The meaning of risk is the possibility of loss. Thus, what risk management entails is the process of identifying, analyzing, assessing, and prioritizing risk. To handle this process, many companies are forced to make considerable expenditures on employee time for manually updating risk registers, undertaking the administrative burden of comparing reports, risk evaluation, and monitoring the effectiveness of controls, since not having an organized system can expose a company to risk including penalties from regulating authorities. With an eye to boost work efficiency, they could stand to greatly benefit from utilizing trusted automated enterprise risk management software to relieve them of this burden and free them to concentrate on generating revenue instead. Risk management software helps recognize threats and address them systematically to minimize and avoid negative outcomes, maximize productivity, and control threats to a company’s assets, such as company financials, private customer information, and confidential corporate data.

Get your risk detection automated!

There are also certain types of clients that pose a particular type of risk to a company. High risk clients identification encompasses particularly those who are unable to fulfill their financial obligations, such as bank customers. In the past, banks have issued loans very freely without employing much in-depth analysis and scrutiny of the loan recipients’ ability to pay. The tides of the economy have forced them, however, to apply more stringent standards that minimize these losses.

Due to the increasing regulation in the insurance industry, a disintegrated value chain, rising competition, and changing demands, risk management software for insurance companies is growing even higher than before in order to help insurance firms adapt to these conditions. Insurance companies have always relied heavily on data and thus systemization and maintaining practices to maintain that all their bases are covered has always been a major focus. Risk management software for small business is another field that is exploding. After answering a simple questionnaire, companies can better prepare themselves to ensure they correspond to rules and regulations in addition to providing for better business continuity, health and safety, incident management, auditing, risk analytics, and corporate governance. All the while, the benefit of these applications with all of their flexibility and convenience is accompanied by risk in software project management. Since software can be accessed from any location, so too can criminals attempt to steal information and money from customers, software developers, and suppliers of goods and services.

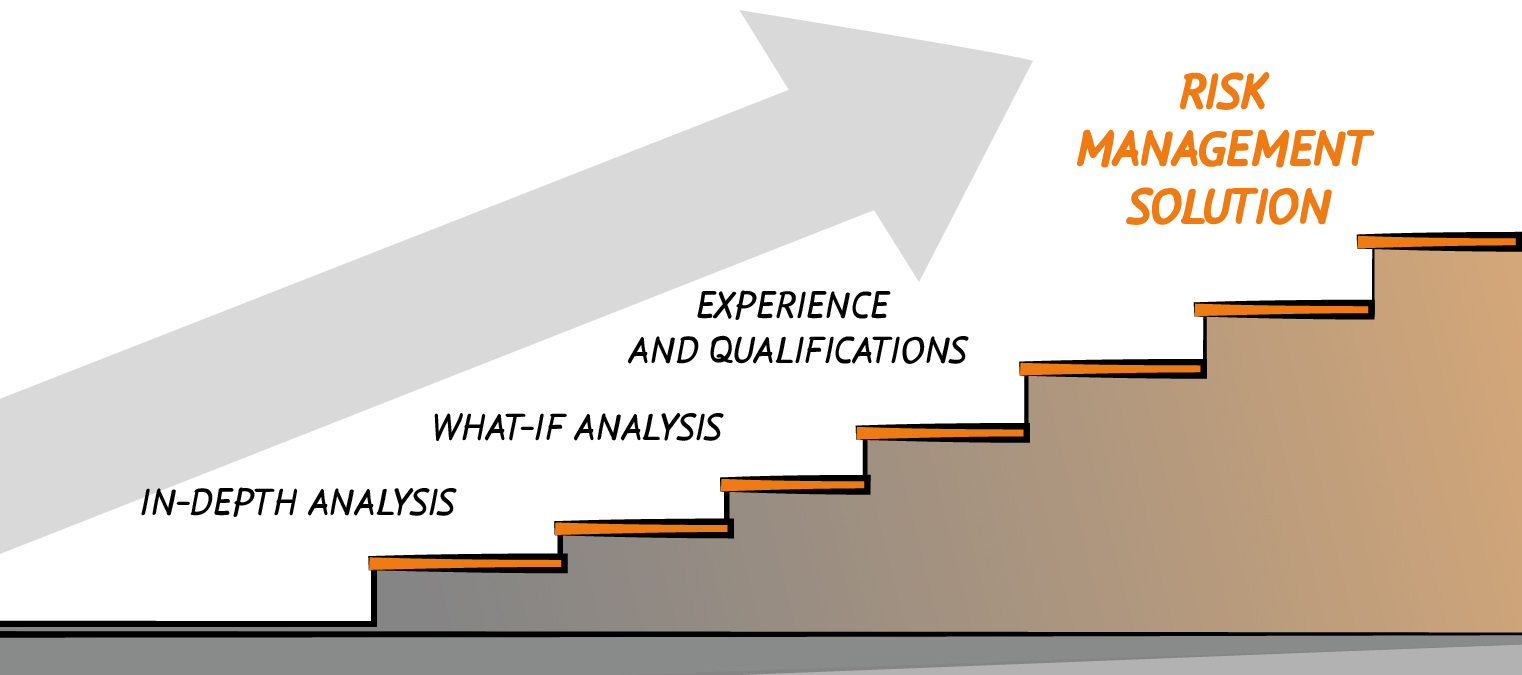

There are various commonly utilized methods for risk identification in the corporate world. A couple of the most common methods include what-if analyses for brainstorming and checklists, often combined and utilized together. Experience and qualifications on the specialist’s part are essential to any benefit this analysis yields. Such a consideration could be made for the location to store medical insurance company’s customers’ medical histories. If a particularly in-depth analysis is required for technological conditions that may cause damage or injury, companies may conduct a hazard and operability study. Each of these methods requires experts who are well-versed in the field as well as the ongoing operations and processes.

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!