SOX Compliance Checklist

- Internal Controls Assessment:

- Financial Reporting Processes:

- Documentation and Record-keeping:

- Risk Assessment:

- IT Controls:

- Segregation of Duties:

- Periodic Testing and Monitoring:

- Designing a Customized SOX Compliance Checklist for Your Organization:

- SOX Compliance Checklist Implementation Strategies

- Best Practices for SOX Compliance Checklist Management

- SearchInform Risk Monitor provides tools for:

- Example of a SOX Compliance Checklist

- Benefits of SearchInform Solutions for SOX Compliance

Achieving compliance with the Sarbanes-Oxley Act (SOX) is not just a legal obligation but a fundamental requirement for maintaining trust and integrity in the financial markets. A robust SOX compliance checklist serves as a roadmap for ensuring that companies accurately report their financial information and maintain transparency in their operations. Whether you're a multinational corporation or a small publicly traded company, understanding the components of a SOX compliance checklist and designing a customized one tailored to your organization's needs is essential. Moreover, effective implementation strategies are crucial for embedding compliance practices into your organization's culture and operations. In this guide, we'll delve into the key components of a SOX compliance checklist, explore how to design one that fits your organization, and discuss strategies for successful implementation.

Here's a breakdown of components for a SOX compliance checklist:

Internal Controls Assessment:

In the realm of regulatory compliance, the assessment of internal controls over financial reporting (ICFR) stands as a cornerstone. It entails a comprehensive examination aimed at gauging the effectiveness and reliability of the mechanisms in place to safeguard the accuracy and integrity of financial information. This evaluation is not merely a procedural formality; rather, it serves as a critical safeguard against potential misstatements that could significantly distort financial statements. By scrutinizing the robustness of internal controls, organizations endeavor to fortify their financial reporting processes, thereby bolstering investor confidence and upholding regulatory standards.

Financial Reporting Processes:

Within the intricate tapestry of financial operations, the review of financial reporting procedures assumes paramount importance. This entails a meticulous examination aimed at ensuring that every aspect of the reporting process adheres to stringent standards of accuracy and transparency. Through this scrutiny, organizations endeavor to validate the integrity of financial data and the reliability of reporting mechanisms. By meticulously dissecting each component of the reporting process, organizations strive to unearth any potential discrepancies or inaccuracies, thus fortifying the foundation upon which informed financial decisions are made.

Documentation and Record-keeping:

At the heart of sound financial governance lies the meticulous maintenance of documentation and records. This encompasses the diligent recording and preservation of financial transactions and processes, ensuring a comprehensive trail of accountability and transparency. In navigating the complex landscape of regulatory compliance, organizations must not only maintain meticulous documentation but also ensure its proper retention in accordance with regulatory requirements. By upholding rigorous standards of record-keeping, organizations mitigate the risk of discrepancies and foster an environment of accountability and trust.

Risk Assessment:

In the ever-evolving landscape of financial operations, risk assessment stands as a linchpin in the pursuit of regulatory compliance. This multifaceted process involves a comprehensive examination aimed at identifying and evaluating potential risks inherent in financial reporting. Armed with this insight, organizations can strategically implement controls designed to mitigate these risks, thereby fortifying the resilience of their financial operations. By proactively addressing potential vulnerabilities, organizations not only safeguard against financial irregularities but also cultivate a culture of proactive risk management.

IT Controls:

In an era dominated by digital transformation, the assessment of IT controls assumes unparalleled significance in the realm of financial governance. This encompasses a meticulous evaluation of the controls governing IT systems that wield a direct impact on financial reporting. From ensuring data integrity and security to safeguarding against unauthorized access, organizations must deploy robust IT controls to fortify the digital infrastructure underpinning financial operations. By subjecting IT controls to rigorous scrutiny, organizations bolster the resilience of their financial systems in the face of evolving cyber threats and technological complexities.

Segregation of Duties:

Within the intricate fabric of financial governance, the segregation of duties emerges as a fundamental safeguard against fraud and errors. This imperative necessitates the delineation of responsibilities to prevent any single individual from wielding unchecked authority over key financial functions. By fostering a system of checks and balances, organizations mitigate the risk of conflicts of interest and ensure the integrity of financial operations. Through the judicious allocation of responsibilities, organizations cultivate an environment of transparency and accountability, thereby fortifying the foundation upon which sound financial governance rests.

Periodic Testing and Monitoring:

In the dynamic landscape of regulatory compliance, the imperative of periodic testing and monitoring stands as a bulwark against complacency. This entails the systematic evaluation of internal controls and processes to ensure their ongoing effectiveness and compliance with regulatory standards. Through regular testing and monitoring, organizations can swiftly identify and address any emerging issues or deficiencies, thereby preempting potential risks to financial integrity. By instilling a culture of continuous improvement, organizations foster resilience in the face of regulatory scrutiny and evolving market dynamics.

Designing a Customized SOX Compliance Checklist for Your Organization:

Designing a customized SOX compliance checklist for your organization is a strategic endeavor that demands meticulous attention to detail and a deep understanding of your company's unique needs and complexities. Here's a comprehensive guide on how to craft a tailored SOX compliance checklist that aligns with your organization's objectives:

- Assess Organizational Requirements: Begin by conducting a thorough assessment of your organization's structure, operations, and regulatory obligations. Identify key stakeholders involved in financial reporting, IT governance, legal compliance, and other relevant departments. Understand the specific SOX requirements applicable to your industry and company size.

- Gather Input from Key Stakeholders: Engage in collaborative dialogue with relevant departments, including finance, IT, legal, and compliance, to gather insights and perspectives. Solicit feedback on existing processes, controls, and areas of concern. Encourage open communication to ensure that all stakeholders have a voice in the checklist design process.

- Identify Critical Processes and Controls: Based on your assessment and stakeholder input, identify the critical processes and controls that require inclusion in the checklist. This may include internal controls over financial reporting (ICFR), financial reporting procedures, IT controls, documentation and record-keeping practices, risk assessment methodologies, segregation of duties, and periodic testing and monitoring protocols.

- Tailor Checklist Items: Customize generic SOX checklist items to address the specific requirements and nuances of your organization. Ensure that each checklist item is relevant, actionable, and aligned with regulatory guidance. Consider the organizational structure, size, industry, and risk profile when tailoring checklist items.

- Include Additional Controls and Procedures: In addition to modifying existing checklist items, consider including additional controls or procedures as needed based on organizational risks and objectives. This proactive approach helps address potential vulnerabilities and enhances the effectiveness of the compliance framework.

- Ensure Clarity and Accessibility: Design the checklist in a clear and concise format that is easy to understand and navigate. Use plain language and avoid technical jargon to facilitate comprehension across all stakeholders. Ensure that the checklist is accessible to relevant personnel and easily integrated into existing processes and workflows.

- Review and Refinement: Conduct a thorough review of the customized checklist with key stakeholders to solicit feedback and ensure alignment with organizational goals and regulatory requirements. Iterate on the checklist as needed based on feedback and changes in regulatory landscape or organizational dynamics.

- Training and Communication: Provide training and guidance to relevant personnel on the use of the customized checklist. Communicate the importance of SOX compliance and the role of the checklist in achieving compliance objectives. Foster a culture of accountability and continuous improvement through ongoing communication and support.

Designing a customized SOX compliance checklist that effectively addresses the unique needs and complexities of your organization strengthens internal controls, mitigates risks, and ensures regulatory compliance.

SOX Compliance Checklist Implementation Strategies

Implementing a SOX compliance checklist requires strategic planning and effective execution to ensure its successful integration into your organization's operations. Here are some key strategies for implementing a SOX compliance checklist:

- Clear Communication: Clearly communicate the importance of SOX compliance and the rationale behind the checklist implementation to all relevant stakeholders within the organization. Ensure that employees understand their roles and responsibilities in complying with the checklist requirements.

- Training and Education: Provide comprehensive training and education to employees on the use of the SOX compliance checklist, as well as on relevant regulations and compliance procedures. Equip employees with the knowledge and skills necessary to effectively implement and adhere to the checklist requirements.

- Integration with Existing Processes: Integrate the SOX compliance checklist seamlessly into existing business processes and workflows to minimize disruption. Ensure that the checklist complements and enhances, rather than hinders, day-to-day operations.

- Technology Utilization: Leverage technology solutions to streamline and automate compliance processes wherever possible. Implement software tools and systems that facilitate checklist management, monitoring, and reporting, thereby increasing efficiency and accuracy.

- Management Oversight: Establish clear lines of accountability and oversight for SOX compliance within the organization. Ensure that management is actively involved in monitoring compliance efforts, providing support, and addressing any issues or challenges that arise.

- Regular Review and Updates: Conduct regular reviews of the SOX compliance checklist to ensure its relevance and effectiveness. Update the checklist as needed to reflect changes in regulations, organizational processes, or industry standards.

- Periodic Testing and Monitoring: Implement a system for periodic testing and monitoring of compliance with the checklist requirements. Conduct internal audits and assessments to evaluate the effectiveness of controls and identify areas for improvement.

- Continuous Improvement: Foster a culture of continuous improvement by soliciting feedback from stakeholders and actively seeking opportunities to enhance the effectiveness and efficiency of the SOX compliance checklist. Encourage innovation and collaboration in developing solutions to compliance challenges.

Implementing these strategies enables organizations to effectively integrate a SOX compliance checklist into their operations, strengthen internal controls, and ensure ongoing compliance with regulatory requirements.

Best Practices for SOX Compliance Checklist Management

Effective management of a SOX compliance checklist is crucial for ensuring regulatory adherence and maintaining robust financial governance. Here are some best practices for managing a SOX compliance checklist:

- Centralized Management: Establish a centralized system or platform for managing the SOX compliance checklist. This allows for easy access, monitoring, and updating of checklist items by relevant stakeholders.

- Clear Ownership and Accountability: Assign clear ownership and accountability for managing the SOX compliance checklist. Designate a compliance officer or team responsible for overseeing checklist implementation, monitoring, and reporting.

- Regular Review and Updates: Conduct regular reviews of the SOX compliance checklist to ensure its relevance and effectiveness. Update checklist items as needed to reflect changes in regulations, organizational processes, or industry standards.

- Documented Procedures: Document procedures for checklist management, including guidelines for adding, modifying, or removing checklist items. Ensure that all changes to the checklist are properly documented and approved.

- Training and Communication: Provide training and guidance to relevant personnel on the use of the SOX compliance checklist and associated procedures. Communicate updates and changes to the checklist in a timely manner to ensure awareness and compliance.

- Risk-Based Approach: Adopt a risk-based approach to checklist management, prioritizing high-risk areas and allocating resources accordingly. Focus on critical controls and processes that have the greatest impact on financial reporting integrity.

- Automated Tools and Technologies: Leverage automated tools and technologies to streamline checklist management processes. Implement software solutions that facilitate checklist tracking, monitoring, and reporting, reducing manual effort and enhancing efficiency.

- Regular Monitoring and Reporting: Establish a system for regular monitoring of checklist implementation and compliance. Generate reports to track progress, identify issues or deficiencies, and communicate findings to management and relevant stakeholders.

- External Validation: Consider engaging external auditors or consultants to provide independent validation of checklist implementation and compliance. External assessments can offer valuable insights and assurance regarding the effectiveness of internal controls.

- Continuous Improvement: Foster a culture of continuous improvement by soliciting feedback from stakeholders and actively seeking opportunities to enhance checklist management processes. Encourage innovation and collaboration in identifying and implementing best practices.

By adhering to these best practices, organizations can effectively manage their SOX compliance checklist, strengthen internal controls, and ensure ongoing compliance with regulatory requirements.

Example of a SOX Compliance Checklist

Here's an example of a simplified SOX compliance checklist covering key areas:

- Internal Controls Assessment:

- Are internal controls over financial reporting (ICFR) documented and regularly reviewed?

- Is there a process in place to detect and prevent material misstatements in financial statements?

- Are controls adequately designed and effectively implemented?

- Financial Reporting Processes:

- Are financial reporting procedures documented and consistently followed?

- Is financial data accurate, complete, and transparent?

- Are reporting mechanisms reliable and secure?

- Documentation and Record-keeping:

- Are financial transactions and processes properly documented?

- Are records retained for the required period as per regulatory requirements?

- Is there a system in place for the secure storage and retrieval of financial records?

- Risk Assessment:

- Has a comprehensive risk assessment been conducted to identify potential risks related to financial reporting?

- Have controls been implemented to mitigate identified risks?

- Is there ongoing monitoring and reassessment of risks and controls?

- IT Controls:

- Are IT controls over systems impacting financial reporting adequately assessed and documented?

- Is there assurance of data integrity, security, and availability?

- Are controls in place to prevent unauthorized access to financial data?

- Segregation of Duties:

- Are responsibilities appropriately divided to prevent fraud and errors?

- Are conflicts of interest mitigated by separating key financial duties?

- Is there oversight to ensure compliance with segregation of duties policies?

- Periodic Testing and Monitoring:

- Are internal controls regularly tested to ensure effectiveness?

- Is there a process in place to monitor compliance with SOX requirements?

- Are findings from testing and monitoring activities documented and addressed promptly?

This example provides a basic framework for a SOX compliance checklist. Depending on the organization's size, industry, and specific requirements, additional checklist items and details may be necessary. It's essential to customize the checklist to fit the organization's unique needs while ensuring alignment with regulatory standards.

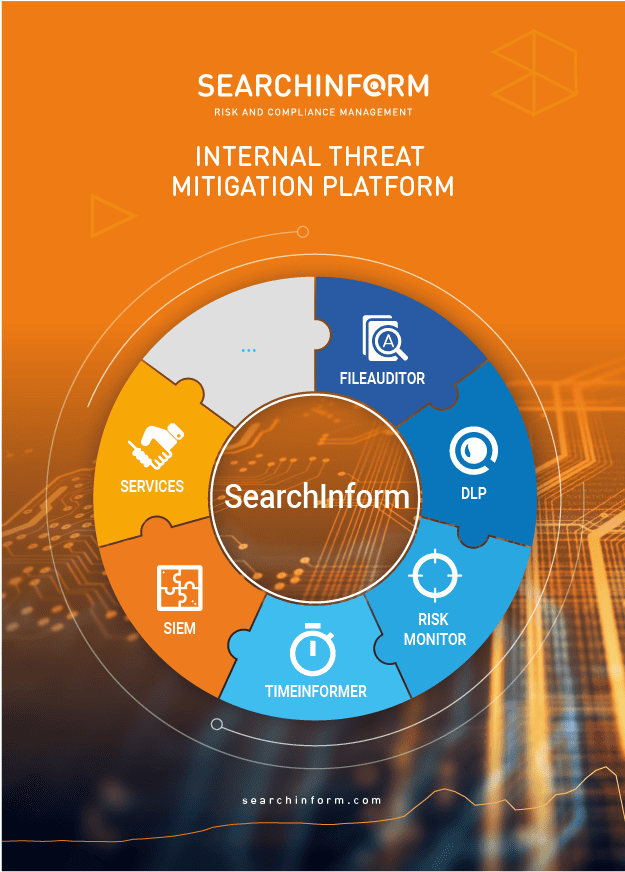

Benefits of SearchInform Solutions for SOX Compliance

SearchInform offers comprehensive solutions for SOX compliance that provide numerous benefits to organizations. Here are some of the key benefits:

Advanced Data Discovery: SearchInform solutions offer advanced data discovery capabilities, allowing organizations to quickly and accurately identify sensitive financial information, such as transaction records, financial statements, and audit trails. This facilitates compliance with SOX requirements related to data accuracy, completeness, and transparency.

Real-time Monitoring: SearchInform solutions enable real-time monitoring of critical financial systems and processes, including ERP systems, databases, and file repositories. This proactive monitoring helps organizations detect and respond to potential compliance issues promptly, reducing the risk of financial misstatements and fraud.

User Activity Monitoring: SearchInform solutions provide visibility into user activity across IT systems, allowing organizations to monitor employee behavior and detect suspicious or unauthorized activities. This helps prevent unauthorized access to financial data and ensures compliance with SOX requirements related to segregation of duties and access controls.

Automated Reporting: SearchInform solutions automate the generation of compliance reports, including audit trails, access logs, and compliance status summaries. This streamlines the reporting process and ensures that organizations have accurate and up-to-date documentation to demonstrate compliance with SOX requirements during audits and regulatory inspections.

Policy Enforcement: SearchInform solutions enable organizations to enforce compliance policies and procedures across the organization, ensuring consistent adherence to SOX requirements. This includes automated enforcement of data retention policies, encryption standards, and access control policies to protect sensitive financial information from unauthorized access or disclosure.

Incident Response and Investigation: SearchInform solutions facilitate incident response and investigation activities in the event of a compliance violation or security incident. They provide forensic capabilities to analyze security incidents, track user activity, and identify the root cause of compliance breaches, helping organizations mitigate risks and prevent future incidents.

Integration with Existing Systems: SearchInform solutions seamlessly integrate with existing IT systems and infrastructure, including ERP systems, SIEM solutions, and security tools. This minimizes disruption to business operations and allows organizations to leverage their existing investments in technology while enhancing SOX compliance capabilities.

Scalability and Flexibility: SearchInform solutions are scalable and adaptable to meet the evolving needs of organizations of all sizes and industries. Whether deploying on-premises or in the cloud, organizations can scale their compliance efforts as their business grows and adapt the solutions to address changing regulatory requirements and industry trends.

SearchInform solutions offer organizations a comprehensive and effective approach to achieving SOX compliance, helping them protect sensitive financial information, mitigate risks, and maintain trust and transparency in their financial reporting processes.

Ready to elevate your SOX compliance efforts with confidence? Discover how SearchInform solutions can streamline your compliance processes, mitigate risks, and ensure regulatory adherence. Contact us today for a personalized demonstration.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!