How to Combat Financial Fraud with Effective Cybersecurity

Introduction to Financial Fraud in the Context of Cybersecurity

Financial fraud has evolved significantly in the digital era, making it a pressing concern for businesses, individuals, and governments alike. With advancements in technology, the complexity and frequency of financial crimes have risen, creating a challenging environment for organizations that are tasked with safeguarding their assets. As a result, cybersecurity has become an indispensable component in the fight against monetary fraud, offering tools and strategies to detect, mitigate, and prevent cyber-enabled financial crimes.

Definition of Financial Fraud

Financial fraud, also known as monetary fraud or financial crime, refers to the deliberate deception carried out for financial gain. This type of fraud can take many forms, including embezzlement, identity theft, money laundering, insider trading, and payment card fraud. In the modern landscape, financial fraud increasingly involves the use of digital platforms, which has given rise to more sophisticated forms of cyber-enabled financial crime.

The scope of financial crime extends across various sectors, impacting corporations, financial institutions, and individual consumers. The perpetrators often exploit weak points in cybersecurity systems, making the integration of financial fraud detection with robust cybersecurity measures critical for any organization.

Overview of Cybersecurity in Financial Contexts

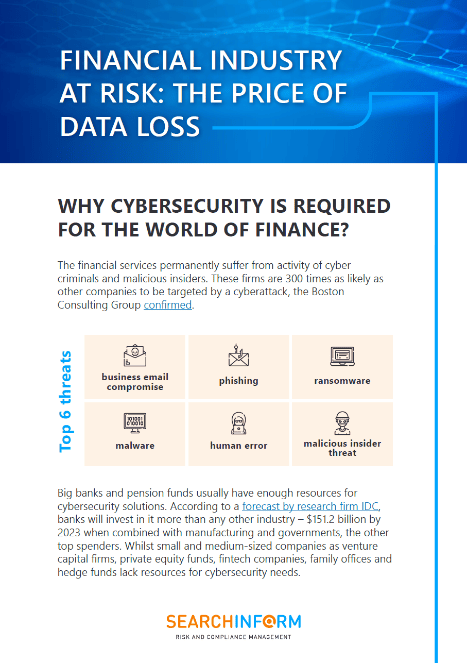

The intersection of financial operations and cybersecurity is where many challenges and solutions arise. In an era where digital transactions dominate, and data is a valuable asset, the role of cybersecurity in preventing financial fraud is paramount. Financial institutions, for instance, are frequent targets of cybercriminals due to the vast amounts of sensitive data they hold. Monetary fraud involving unauthorized access to financial systems, phishing attacks, and ransomware can lead to catastrophic financial losses and damage to reputation.

Cybersecurity in financial contexts involves several layers of protection, including:

- Data encryption: Ensures sensitive financial data is secure both at rest and in transit.

- Multi-factor authentication (MFA): Provides an additional layer of security to prevent unauthorized access.

- Intrusion detection systems (IDS): Monitor financial networks for suspicious activities that could indicate financial crime.

- Advanced monitoring and analytics: Helps to detect anomalies that might suggest the presence of monetary fraud.

Importance of Integrating Cybersecurity with Financial Operations

Integrating cybersecurity into financial operations is no longer optional—it's essential. Financial fraud schemes, whether through phishing, malware, or insider threats, are becoming increasingly sophisticated, and financial institutions that fail to fortify their cybersecurity defenses risk severe consequences.

Here’s why integrating cybersecurity with financial operations is crucial:

- Prevention of financial losses: Strong cybersecurity measures can help prevent monetary fraud, saving organizations from significant financial losses.

- Protection of sensitive data: Financial institutions handle highly sensitive data, from personal identities to payment details, making data protection critical.

- Maintaining customer trust: A robust cybersecurity framework ensures that customers' financial assets and personal information are safe, preserving trust in the institution.

- Regulatory compliance: Many industries are required to adhere to strict regulations around data protection and financial crime prevention, which means integrating cybersecurity is essential to meet these requirements.

The rise of digital financial fraud demands that organizations not only implement but continually evolve their cybersecurity strategies. With cybercriminals using increasingly advanced tactics to exploit weaknesses in financial systems, institutions must employ equally advanced cybersecurity tools to stay ahead.

By combining cybersecurity and financial operations, businesses can build a stronger defense against the growing threat of financial crime. This proactive approach helps minimize the risks associated with financial fraud and ensures that both corporate and customer assets are well-protected.

Types of Financial Fraud in Cybersecurity

As the financial sector continues to embrace digital transformation, it also faces an escalating number of cyber threats. Financial fraud, or monetary fraud, has taken on new forms, leveraging sophisticated cyber techniques to exploit vulnerabilities in financial systems. Understanding the key types of financial crime in the cybersecurity landscape is crucial for institutions to stay one step ahead of fraudsters.

Phishing and Social Engineering

Phishing attacks, often paired with social engineering tactics, are among the most prevalent forms of financial fraud in the digital age. Cybercriminals target individuals or employees within financial institutions, tricking them into disclosing sensitive information such as login credentials or payment details. These attacks can appear as legitimate emails, messages, or websites designed to mimic real financial services, deceiving victims into surrendering their data.

Social engineering goes beyond simple deception—it manipulates human psychology. Fraudsters exploit emotions like urgency or fear, prompting individuals to act impulsively, whether it’s transferring funds or granting unauthorized access to financial systems. Once financial criminals have this information, they can perpetrate a wide range of financial crimes, from unauthorized transactions to full-scale identity theft.

Ransomware Attacks Targeting Financial Data

Ransomware has emerged as one of the most devastating cyber threats to financial institutions. In a ransomware attack, hackers gain access to critical financial systems or sensitive data, encrypt it, and demand a ransom to restore access. The consequences of such monetary fraud can be far-reaching, leading to financial loss, operational disruption, and significant reputational damage.

Financial institutions are prime targets for ransomware due to the high value of the data they store, including personal identities, credit card details, and transaction histories. Once encrypted, this data becomes useless to the organization, leaving them vulnerable to large-scale financial crime. Even worse, paying the ransom doesn’t always guarantee that data will be restored or that attackers won’t return for another attempt.

Insider Threats in Financial Institutions

While external cyberattacks make headlines, insider threats represent a significant form of financial crime within financial institutions. Insiders—employees, contractors, or partners—who have legitimate access to financial data can misuse their position for personal gain. This type of monetary fraud can be particularly hard to detect, as insiders often know how to bypass security protocols.

Insider threats may involve anything from unauthorized transfers and data manipulation to leaking sensitive information. Whether driven by financial pressure, personal grievances, or external coercion, insider threats pose a serious risk to any financial institution. Cybersecurity measures such as monitoring user behavior, implementing strong access controls, and ensuring regular audits are crucial in mitigating these risks.

Payment Fraud and Cybersecurity Challenges

Payment fraud is a broad category of financial fraud that affects both individuals and businesses. From unauthorized credit card transactions to wire transfer fraud, cybercriminals are constantly devising new methods to exploit weaknesses in payment systems. The rise of digital payments has introduced new opportunities for monetary fraud, with tactics ranging from phishing attacks on customers to malware targeting point-of-sale systems.

One of the main cybersecurity challenges in preventing payment fraud is the speed and scale of modern digital transactions. With millions of transactions occurring every second, detecting financial crime in real-time can be difficult. Cybersecurity solutions like machine learning and artificial intelligence are increasingly being used to identify and block suspicious activities before they can result in financial loss.

In addition, payment fraud also highlights the importance of educating customers and employees about recognizing and reporting fraudulent activity. Financial institutions must continually adapt their security measures to address emerging threats, ensuring that digital payment systems remain safe and trustworthy.

Identity Theft and Account Takeover

Identity theft is one of the most damaging forms of financial crime, where cybercriminals steal personal or financial information to impersonate someone else and gain access to their financial accounts. Once a fraudster has access to this information, they can commit monetary fraud by opening credit lines, draining bank accounts, or making unauthorized purchases.

Account takeover fraud is a specific subset of identity theft, where the criminal gains access to a person’s existing financial accounts, such as bank or credit card accounts, and takes control. They may change account information, transfer funds, or make large purchases without the victim’s knowledge.

In the age of cybercrime, stolen data from identity theft often circulates on the dark web, where it’s sold to other criminals looking to perpetrate further financial fraud.

Fraudulent Wire Transfers

Wire transfer fraud involves cybercriminals tricking individuals or companies into sending large sums of money to fraudulent accounts. This type of financial crime often targets businesses, where attackers impersonate executives, partners, or trusted contacts, requesting immediate payments under false pretenses. Business Email Compromise (BEC) is one of the most common methods used in wire transfer fraud.

Cybercriminals might also infiltrate email accounts and manipulate communications between buyers and sellers, redirecting legitimate payments into their own accounts. The rapid nature of wire transfers makes recovery difficult once the fraud has been committed, which is why it’s a preferred method for large-scale financial crime.

Money Laundering in Digital Platforms

Money laundering involves disguising the origins of illegally obtained funds, often by passing them through a complex sequence of banking transfers or commercial transactions. In today’s world, criminals are using digital platforms and cryptocurrencies to move and obscure illicit funds, which adds a cybersecurity challenge to traditional anti-money laundering efforts.

Cybercriminals use various techniques like creating fake businesses, using cryptocurrency exchanges, or exploiting digital payment systems to launder stolen funds. Financial institutions need to have strong anti-money laundering (AML) programs integrated with advanced cybersecurity measures to detect suspicious transactions and stop money laundering before it escalates.

Synthetic Identity Fraud

Synthetic identity fraud is an emerging type of monetary fraud in which criminals combine real and fake information to create a completely new identity. For example, they may use a legitimate Social Security number but pair it with a fabricated name, address, and other personal details. This identity can then be used to apply for loans, credit cards, and other financial services.

Because synthetic identities appear legitimate to financial institutions, they are often difficult to detect. This type of financial fraud is growing rapidly, particularly in the credit and lending sectors, and poses a significant threat to financial institutions that rely on automated approval systems.

Investment Scams and Ponzi Schemes

Investment fraud is another type of financial crime, often facilitated by cyber means. Fraudsters use online platforms, emails, or social media to lure individuals into fraudulent investment opportunities, promising high returns with little risk. Ponzi schemes, pyramid schemes, and fake cryptocurrency investment platforms are common examples of this.

The anonymity of online transactions makes it easier for criminals to create fake investment platforms, tricking individuals into handing over large sums of money with no intention of returning any profit. The rise of digital currencies like Bitcoin has also fueled new types of investment fraud, as many people lack the technical knowledge to spot these scams.

Card-Not-Present (CNP) Fraud

Card-Not-Present fraud occurs when a cybercriminal uses stolen credit or debit card information to make online or telephone purchases without physically presenting the card. This type of financial fraud is growing rapidly as e-commerce continues to expand, providing a lucrative target for fraudsters.

Cybercriminals typically steal card details through phishing attacks, malware, or data breaches and use this information to make unauthorized purchases. Due to the rise in online shopping, CNP fraud represents one of the most common forms of financial crime globally.

Financial fraud in the digital age is multifaceted and constantly evolving, requiring financial institutions to stay vigilant and proactive. By understanding the various forms of financial crime and strengthening cybersecurity measures, businesses can protect themselves against these sophisticated threats and maintain the integrity of their operations.

The Impact of Financial Fraud on Organizations

In today’s interconnected world, financial fraud has far-reaching consequences for organizations, touching every aspect of business operations. From direct financial losses to long-lasting reputational damage, the impact of monetary fraud can be devastating if not properly managed. Cybercriminals are increasingly targeting companies of all sizes, using sophisticated techniques to breach security systems and steal valuable assets. Let’s explore the various ways in which financial fraud affects organizations and why a robust cybersecurity strategy is crucial for survival in the digital age.

Financial Losses Due to Cyber Fraud

One of the most immediate and tangible impacts of financial fraud is the direct financial loss that organizations suffer. Cyber fraudsters use various methods such as phishing attacks, ransomware, and insider threats to siphon off funds, manipulate financial records, or divert payments into fraudulent accounts. According to recent studies, companies worldwide lose billions of dollars annually to monetary fraud, and the numbers continue to rise as cybercriminals refine their tactics.

These financial crimes not only result in lost revenue but also incur additional costs associated with investigating the breach, implementing corrective measures, and compensating affected parties. For smaller businesses, a single instance of financial fraud could be catastrophic, leading to insolvency or even bankruptcy. Large corporations may survive the immediate financial hit but often face longer-term consequences that affect their overall financial health.

Reputational Damage from Security Breaches

While financial losses are often quantifiable, the reputational damage caused by financial fraud can be much more difficult to repair. When a security breach occurs, particularly one that involves financial crime, an organization’s credibility and trustworthiness are immediately called into question. Customers, partners, and investors may lose confidence in the company’s ability to protect sensitive information, leading to a decline in business relationships and revenue.

A tarnished reputation can take years to rebuild, and in some cases, the damage is permanent. Many organizations affected by major security breaches face a significant drop in customer retention rates, as consumers turn to competitors with better cybersecurity practices. For financial institutions, in particular, the loss of trust resulting from financial fraud can severely undermine their market position and long-term viability.

Legal and Regulatory Consequences

In addition to financial and reputational damage, organizations that fall victim to financial fraud often face legal and regulatory consequences. Governments and regulatory bodies around the world have implemented strict laws and regulations designed to protect consumers and financial systems from monetary fraud. When a breach occurs, affected organizations may be subject to investigations, fines, and lawsuits, which further strain their resources.

For instance, failure to comply with data protection laws such as the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States can result in substantial penalties. Beyond financial fines, these legal consequences can also lead to long-lasting operational disruptions, requiring companies to overhaul their security practices and enhance compliance measures to prevent future incidents.

Case Studies of Major Financial Frauds

Enron Scandal (2001)

One of the most infamous cases of financial fraud is the collapse of Enron, a massive energy company that engaged in widespread accounting fraud to hide billions in debt from shareholders. Executives at Enron manipulated financial statements to present the company as highly profitable, deceiving investors and regulators. The company’s fraudulent activities went undetected for years, culminating in its bankruptcy in 2001. This monetary fraud led to significant financial losses for investors, widespread job losses, and the dissolution of Arthur Andersen, one of the world’s largest auditing firms at the time.

The Enron scandal also highlighted the lack of corporate governance and oversight in financial reporting, prompting legislative changes such as the Sarbanes-Oxley Act, which introduced stricter regulations to prevent financial crime in the corporate world.

Bernie Madoff’s Ponzi Scheme (2008)

Bernie Madoff orchestrated one of the largest and most infamous Ponzi schemes in history, defrauding investors out of approximately $65 billion. Madoff promised high returns on investments, attracting thousands of investors, including individuals, charities, and institutional funds. However, rather than generating real profits, Madoff used new investors’ money to pay off earlier investors, creating the illusion of a profitable venture. The scheme unraveled in 2008 during the financial crisis when Madoff could no longer maintain the fraud, leading to his arrest.

The Madoff case underscores the risks of unchecked financial fraud in investment management and highlights the need for strong regulatory oversight to protect investors from falling victim to similar schemes.

Société Générale (2008)

In another notable case of financial fraud, French banking giant Société Générale fell victim to a rogue trader named Jérôme Kerviel, who conducted unauthorized trades that resulted in massive financial losses for the bank. Kerviel’s fraudulent trading activity led to a staggering $7 billion in losses, making it one of the largest fraud-related losses in banking history. Kerviel had exploited weaknesses in the bank’s risk management systems, carrying out speculative trades beyond authorized limits.

This incident revealed vulnerabilities in internal controls and risk management frameworks within financial institutions, prompting banks worldwide to tighten their oversight of trading activities and implement stronger cybersecurity measures.

Parmalat Scandal (2003)

Parmalat, an Italian dairy company, became the center of one of Europe’s biggest financial scandals when it was revealed that the company had falsified financial records to conceal a $14 billion hole in its balance sheet. The financial fraud involved creating fictitious accounts and inflating profits over several years, deceiving investors and regulators. When the fraud came to light in 2003, Parmalat filed for bankruptcy, and its executives were charged with a range of financial crimes.

The Parmalat case led to widespread reforms in Italy’s corporate governance and accounting practices, highlighting the importance of transparency and accountability in financial reporting to prevent monetary fraud on such a massive scale.

These case studies provide a sobering look at the catastrophic consequences of financial fraud. They also serve as a reminder of the critical role that robust cybersecurity, regulatory compliance, and internal controls play in mitigating the risks associated with financial crime in today’s complex financial environment.

The next sections will dive deeper into how organizations can protect themselves from these devastating impacts and the role cybersecurity plays in mitigating financial fraud across industries.

Cybersecurity Measures to Prevent Financial Fraud

In the battle against financial fraud, cybersecurity plays a pivotal role in safeguarding sensitive financial information and preventing monetary fraud. With financial crime becoming increasingly sophisticated, organizations must adopt a robust set of cybersecurity measures to protect themselves and their customers. Let’s explore the key strategies that can help prevent financial fraud in today’s digital age.

Implementing Multi-Factor Authentication

Multi-factor authentication (MFA) is one of the most effective tools in preventing unauthorized access to sensitive financial systems. By requiring multiple forms of verification—such as something the user knows (password), something the user has (a device or token), and something the user is (biometric data)—MFA adds an extra layer of security beyond traditional passwords.

Financial institutions can significantly reduce the risk of financial fraud by implementing MFA across their platforms. Whether customers are accessing online banking services or making transactions, this additional step helps verify identities and prevent monetary fraud caused by stolen credentials. Moreover, MFA is essential for internal security within organizations, ensuring that employees only have access to the systems they need, which minimizes the risk of insider threats leading to financial crime.

Data Encryption and Secure Transaction Protocols

Data encryption is a cornerstone of modern cybersecurity, especially when it comes to preventing financial fraud. Encryption ensures that sensitive financial data, whether at rest or in transit, is protected from unauthorized access by converting it into a code that can only be deciphered with a specific key. Financial institutions and online payment platforms use advanced encryption protocols, such as SSL (Secure Socket Layer) and TLS (Transport Layer Security), to secure transactions and protect customer information from being intercepted by cybercriminals.

In addition to encryption, secure transaction protocols like tokenization provide an extra layer of protection by replacing sensitive financial information (such as credit card numbers) with randomly generated tokens. These tokens are meaningless to anyone who intercepts them, making it harder for cybercriminals to perpetrate monetary fraud during online transactions. Implementing these encryption and security protocols ensures that financial crime remains difficult for attackers to execute.

Real-time Fraud Detection and Monitoring Systems

Given the speed and complexity of financial transactions today, organizations must be able to detect and respond to suspicious activities in real time. Real-time fraud detection systems use advanced algorithms to monitor and analyze transactions, flagging unusual behavior that could indicate financial crime. These systems are crucial in industries where large volumes of digital payments occur, such as e-commerce and banking.

For example, if a customer typically makes small purchases but suddenly attempts to transfer a large sum of money to an unknown account, the system may flag this activity as suspicious and initiate an investigation. By monitoring transaction patterns and identifying potential red flags, real-time monitoring helps prevent financial fraud before it escalates.

Furthermore, these systems enable financial institutions to take immediate action, such as freezing accounts or blocking transactions, to prevent further damage once an anomaly is detected. As financial criminals continue to evolve their methods, real-time monitoring has become an indispensable tool in combating monetary fraud.

The Role of AI and Machine Learning in Detecting Fraud

Artificial intelligence (AI) and machine learning are revolutionizing the way financial institutions detect and prevent financial fraud. These technologies can analyze vast amounts of transaction data to identify patterns, anomalies, and trends that may indicate fraudulent activity. Unlike traditional rule-based systems, which rely on predefined criteria to detect financial crime, AI and machine learning algorithms learn from historical data to improve their detection capabilities over time.

By leveraging machine learning models, financial institutions can automatically flag high-risk transactions for further investigation, while minimizing false positives that may disrupt legitimate activities. AI-powered systems can also detect new types of monetary fraud that might otherwise go unnoticed by conventional fraud detection systems. For instance, AI algorithms can analyze not just the financial transaction itself, but also external factors like device usage, geolocation, and behavioral patterns to determine whether an activity is likely to be fraudulent.

Moreover, AI can play a key role in reducing the time it takes to investigate and resolve fraud cases. Instead of manual processes, AI-driven tools can automate many aspects of the investigation, providing faster responses to emerging financial crimes and limiting the potential damage caused by the fraudsters.

The implementation of AI and machine learning in financial security represents a significant advancement in the fight against financial fraud, making it harder for cybercriminals to bypass detection systems and perpetrate their schemes.

As financial fraud becomes more sophisticated, it’s clear that organizations need to stay ahead of the curve by employing the most advanced cybersecurity measures. From multi-factor authentication to AI-powered fraud detection, these strategies are essential in ensuring that financial systems remain secure and resilient in the face of ever-evolving threats.

Best Practices for Mitigating Financial Fraud Risks

The increasing sophistication of financial fraud has made it essential for organizations to adopt best practices that can effectively mitigate risks. While implementing advanced cybersecurity measures is crucial, these efforts must be complemented by proactive strategies across the entire organization. Here, we explore some of the most effective practices to protect against financial crime and reduce the threat of monetary fraud.

Employee Training and Awareness Programs

The human element is often the weakest link in an organization’s defense against financial fraud. Phishing scams, social engineering, and insider threats are all methods that exploit employees’ lack of knowledge or vigilance. That’s why employee training and awareness programs are a fundamental part of mitigating financial crime risks.

Organizations must regularly educate their workforce on the latest cybersecurity threats and how to recognize suspicious activities that could lead to monetary fraud. For instance, teaching employees how to identify phishing emails, avoid sharing sensitive financial information, and follow secure transaction protocols can significantly reduce the likelihood of successful fraud attempts.

Awareness programs should also include training on safe online behavior, password hygiene, and the importance of multi-factor authentication (MFA) in securing accounts. By empowering employees with the right knowledge and tools, organizations can transform them into the first line of defense against financial fraud.

Regular Security Audits and Vulnerability Assessments

Another essential practice in preventing financial fraud is conducting regular security audits and vulnerability assessments. Cybercriminals are constantly finding new ways to exploit vulnerabilities within financial systems, and these weaknesses can go unnoticed if left unchecked. Through comprehensive audits, organizations can identify gaps in their security protocols, detect weaknesses in their systems, and take corrective actions before monetary fraud occurs.

Vulnerability assessments allow organizations to simulate potential financial crime scenarios, testing their systems against real-world threats. By doing so, they can pinpoint vulnerabilities in both hardware and software, ensuring that cybersecurity defenses are always up-to-date. Regular audits and assessments also help companies stay compliant with industry regulations, which often require strict security measures to protect financial data.

Collaboration between IT and Financial Departments

Effective communication and collaboration between IT and financial departments are critical in mitigating financial fraud risks. Often, the IT team is responsible for implementing technical security measures, while financial teams handle sensitive transactions and customer data. When these two departments operate in silos, there’s a risk that critical cybersecurity vulnerabilities may be overlooked.

By fostering collaboration between IT and financial departments, organizations can create a unified approach to combating financial crime. Financial teams can provide valuable insights into transactional patterns, potential fraud indicators, and the specific financial systems most at risk. In turn, IT professionals can ensure that cybersecurity measures are tailored to protect those systems and address the specific challenges posed by monetary fraud.

Joint training sessions, regular communication, and collaborative fraud prevention strategies can go a long way in fortifying an organization’s defenses against financial crime.

Continuous Improvement of Cybersecurity Frameworks

Financial fraud is constantly evolving, and so too must an organization’s approach to cybersecurity. What worked a year ago may no longer be effective in the face of emerging threats. That’s why continuous improvement of cybersecurity frameworks is essential for staying ahead of monetary fraud.

Organizations should adopt an agile approach to cybersecurity, continuously updating and enhancing their frameworks to address new risks. This includes regularly reviewing and improving encryption standards, access controls, incident response protocols, and fraud detection systems. By staying proactive, organizations can better defend against sophisticated financial crime tactics that exploit outdated security measures.

Moreover, it’s important to invest in ongoing research and development, exploring new technologies such as artificial intelligence (AI), machine learning, and blockchain to enhance fraud prevention efforts. Staying at the forefront of cybersecurity innovation can give organizations the edge they need to outpace financial criminals and protect their assets.

By implementing these best practices, organizations can build a strong foundation for preventing financial fraud. Whether through employee awareness programs, security audits, cross-department collaboration, or continuously evolving cybersecurity frameworks, the fight against financial crime requires a multifaceted and proactive approach.

Future Trends in Financial Fraud and Cybersecurity

The landscape of financial fraud is continuously evolving, with criminals developing more sophisticated methods to exploit vulnerabilities. In parallel, cybersecurity technologies are advancing at a rapid pace to combat these emerging threats. As financial crime becomes more intricate, the future will demand stronger, smarter, and more adaptive solutions to mitigate risks. Let’s explore the emerging trends in financial fraud and the technological advancements shaping the future of cybersecurity.

Emerging Threats in Financial Fraud

As digital transformation accelerates, new avenues for financial crime are opening up, giving rise to a variety of sophisticated attack vectors. Cybercriminals are continually finding innovative ways to exploit weaknesses in financial systems, making it crucial for organizations to anticipate and prepare for these emerging threats.

One of the key threats on the horizon is deepfake technology. Deepfakes are AI-generated audio or video manipulations that can convincingly mimic real individuals, making it easier for fraudsters to impersonate company executives or customers. Imagine a scenario where a deepfake video of a CEO is used to authorize large financial transactions, leading to significant monetary fraud before the deception is even detected.

Cryptocurrency fraud is another growing concern. As digital currencies gain traction, cybercriminals are increasingly targeting cryptocurrency exchanges and wallets, exploiting the relative anonymity these platforms offer. Cryptocurrency-related financial fraud can involve hacking, phishing attacks, or fraudulent initial coin offerings (ICOs), and the regulatory landscape surrounding these currencies remains in flux.

Additionally, ransomware attacks are becoming more aggressive, with attackers demanding larger sums and targeting high-value financial data. Financial institutions and businesses with vast amounts of sensitive data are particularly vulnerable, and the consequences of falling victim to such attacks can be severe—ranging from financial losses to reputational damage.

The Evolution of Cybersecurity Technologies

As financial fraud evolves, so too must the technologies that defend against it. The future of cybersecurity is characterized by intelligent, data-driven solutions that adapt to the changing tactics of financial criminals.

One of the most promising developments is the increased integration of artificial intelligence (AI) and machine learning in fraud detection. These technologies allow systems to analyze vast amounts of financial data in real-time, identifying subtle patterns and anomalies that may indicate fraudulent activity. Machine learning algorithms can improve over time, becoming more adept at identifying new forms of financial fraud that traditional rule-based systems might miss.

Another trend is the growing reliance on blockchain technology to combat financial crime. Blockchain’s decentralized and immutable ledger offers a transparent way to track transactions, making it harder for fraudsters to tamper with financial records. In the future, blockchain could play a significant role in securing transactions, especially in areas like cross-border payments and supply chain finance.

Behavioral biometrics is also gaining traction as a way to authenticate users based on their unique behavior patterns, such as typing speed, mouse movements, or how they interact with devices. By continuously monitoring these behaviors, financial institutions can detect and prevent unauthorized access to accounts, significantly reducing the risk of monetary fraud.

Predictions for Financial Fraud Prevention in the Next Decade

Looking ahead, the future of financial fraud prevention will be shaped by a combination of cutting-edge technologies, regulatory shifts, and global collaboration. As financial crime becomes more complex, organizations must be agile and forward-thinking in their approach to cybersecurity.

One major prediction is that cybersecurity will become even more automated. With financial fraud happening at an unprecedented speed, manual processes for detecting and responding to threats will no longer be feasible. Instead, AI-driven systems will play a larger role in automating fraud detection, incident response, and even the decision-making process for freezing accounts or blocking transactions in real-time.

Collaboration between governments, regulatory bodies, and private organizations is also expected to intensify. As financial crime crosses borders, it will become essential for institutions to share information and best practices in a unified effort to combat global monetary fraud. New regulations aimed at standardizing security protocols for financial data, particularly in the realm of cryptocurrency, will likely emerge to close regulatory loopholes.

Another key trend is the adoption of quantum computing in cybersecurity. While still in its early stages, quantum computing holds the potential to revolutionize encryption methods. Financial institutions may need to adopt quantum-resistant encryption to protect against future attacks that could break through current security protocols.

As the next decade unfolds, organizations that proactively invest in these emerging technologies and adapt to the changing financial fraud landscape will be better equipped to safeguard their assets and protect their customers from the ever-growing threat of financial crime.

How SearchInform Solutions Address Financial Fraud

In a world where financial crime is becoming increasingly sophisticated, organizations need robust, comprehensive solutions to detect, prevent, and respond to monetary fraud. SearchInform has developed an array of tools designed specifically to combat financial fraud by integrating advanced technology, real-time monitoring, and proactive security measures. By focusing on incident management, data security, and regulatory compliance, SearchInform offers businesses the protection they need in an ever-evolving threat landscape.

Overview of SearchInform’s Fraud Detection Tools

SearchInform’s suite of fraud detection tools provides organizations with powerful capabilities to identify and mitigate financial fraud. These tools are built to monitor various aspects of organizational activity, helping detect anomalies and suspicious behavior before they escalate into full-scale financial crime.

One of the key components of SearchInform’s solution is behavioral analysis. By tracking patterns in employee behavior and system interactions, SearchInform can detect unusual activities that may signal potential financial fraud. For example, if an employee suddenly starts accessing sensitive financial records outside of normal working hours or transfers large sums of money without proper authorization, the system flags this as suspicious behavior, allowing for immediate investigation.

Another tool in SearchInform’s arsenal is content monitoring. This feature scans communications across email, chat, and file transfers for red flags that could indicate financial crime. The system looks for keywords, file movements, and abnormal communication patterns that could signal insider threats or external phishing attempts targeting monetary fraud. This holistic approach ensures that every potential vulnerability is covered, reducing the risk of financial fraud slipping through the cracks.

Incident Management and Response with SearchInform

Financial crime doesn’t just involve detection—it requires fast and effective incident management to minimize damage. SearchInform’s incident management tools empower organizations to respond quickly and decisively when a financial fraud attempt is identified.

One standout feature is the automated alert system. When potential financial fraud is detected, SearchInform immediately sends out alerts to the relevant stakeholders. These alerts contain detailed information on the suspicious activity, helping security teams swiftly assess the situation and take action. Whether it’s freezing accounts, blocking access to critical systems, or conducting further investigation, the automated response helps prevent monetary fraud from progressing.

Additionally, SearchInform’s forensic capabilities allow organizations to conduct thorough investigations post-incident. By analyzing detailed logs and reports, companies can trace the origin of the financial crime, determine the methods used, and take steps to prevent similar incidents in the future. This capability is crucial in not only stopping current financial fraud but also in preventing future attempts.

Enhancing Data Security and Compliance

One of the most significant challenges in combating financial fraud is ensuring that data remains secure while adhering to ever-tightening regulatory standards. SearchInform’s solutions excel in both areas, offering advanced data security tools that protect sensitive financial information while ensuring compliance with industry regulations.

SearchInform leverages data loss prevention (DLP) technology to safeguard financial data from unauthorized access or leakage. By monitoring how data is accessed, shared, and moved within an organization, the DLP system prevents sensitive financial information from being misused or falling into the wrong hands. This is particularly important when it comes to monetary fraud, as cybercriminals often target financial data in order to carry out their schemes.

In addition to securing data, SearchInform helps organizations meet regulatory compliance requirements. Financial institutions, for example, must comply with strict laws such as the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS). SearchInform’s solutions come equipped with compliance monitoring tools that track and ensure adherence to these standards. This helps organizations avoid hefty fines and reputational damage while keeping their defenses against financial crime robust.

In conclusion, SearchInform provides an all-encompassing approach to preventing and managing financial fraud. With a combination of real-time monitoring, advanced fraud detection, incident response, and data security solutions, businesses can effectively safeguard themselves against the rising threat of financial crime.

Take proactive steps to secure your organization against financial fraud by implementing advanced solutions that protect your assets and data. Strengthen your defenses today and stay ahead of evolving threats with tools that offer comprehensive detection, prevention, and response capabilities.

Full-featured software with no restrictions

on users or functionality

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!