Cyber Tax Fraud: Understanding and Preventing It

- Introduction to Cyber Tax Fraud

- Definition of Cyber Tax Fraud

- How Cyber Tax Fraud Differs from Traditional Tax Fraud

- Why Cyber Tax Fraud is on the Rise

- Methods of Cyber Tax Fraud

- Phishing and Social Engineering in Tax Fraud

- Use of Malware in Tax Fraud Schemes

- Identity Theft and Tax Refund Fraud

- Hacking and Exploitation of Tax Software

- Impact of Cyber Tax Fraud

- Financial Losses for Businesses and Individuals

- Legal Consequences and Penalties

- Damage to Reputation and Trust

- Long-term Effects on Business Operations

- Preventive Measures Against Cyber Tax Fraud

- Strengthening Cybersecurity Protocols

- Educating Users About Phishing and Scams

- Securing Tax Filing Software

- Monitoring for Unusual Activity

- Implementing Strong Access Controls

- Partnering with Trusted Tax Filing Platforms

- Regular Audits and Reviews

- Case Studies of Cyber Tax Fraud

- Notable Examples of Cyber Tax Fraud Incidents

- Analysis of the Failures Leading to Fraud

- Lessons Learned from Real-world Cases

- Future Trends in Cyber Tax Fraud

- Emerging Threats in Cyber Tax Fraud

- The Role of Artificial Intelligence in Fraud Detection

- Predictive Analytics and Its Role in Tax Fraud Prevention

- Future-Proofing Against Cyber Tax Fraud

- SearchInform’s Role in Combating Cyber Tax Fraud

- Overview of SearchInform’s Cybersecurity Solutions

- How SearchInform Helps in Monitoring and Detection

- Incident Response with SearchInform Tools

Introduction to Cyber Tax Fraud

With the growing reliance on digital platforms for tax filing, cyber tax fraud has become a significant concern. Cyber tax fraud, often referred to as digital tax fraud, online tax fraud, or internet tax fraud, involves the exploitation of online tax systems for financial gain. These cybercrimes not only harm individual taxpayers but also pose a severe threat to the integrity of government revenue systems worldwide.

Definition of Cyber Tax Fraud

Cyber tax fraud refers to illegal activities where online tax filing platforms are manipulated to deceive tax authorities. This includes altering tax information, filing fraudulent returns, or stealing personal data for financial benefit. Unlike traditional tax fraud, which may rely on falsifying paper documents, cyber tax fraud exploits the vulnerabilities in digital tax systems. Common types of cyber tax fraud include:

- Identity theft for filing fake tax returns and claiming refunds.

- Hacking or phishing schemes to access personal financial information.

- Tampering with digital tax records through online systems.

How Cyber Tax Fraud Differs from Traditional Tax Fraud

While both cyber tax fraud and traditional tax fraud aim to evade taxes or claim unwarranted refunds, the methods differ drastically. Traditional tax fraud typically involves manual manipulation of financial documents, while cyber tax fraud leverages digital tools and technology. Here are some key differences:

- Remote execution: Cyber tax fraud can be committed from anywhere in the world, bypassing physical borders.

- Increased scale and speed: Fraudsters can file numerous fraudulent returns quickly using automated systems.

- Greater anonymity: The digital nature of these crimes allows perpetrators to mask their identities, making it difficult to trace them.

Why Cyber Tax Fraud is on the Rise

Several factors have contributed to the significant increase in cyber tax fraud, particularly in the digital age. These include:

- Increased digital tax filing: As more individuals and businesses move to online platforms for tax filings, opportunities for cyber tax fraud have multiplied.

- Advanced cybercriminal tactics: Fraudsters are using more sophisticated methods, such as malware, ransomware, and phishing attacks, to steal tax-related data.

- Inadequate security measures: Many tax filing systems and users lack sufficient cybersecurity protocols, making them easy targets for fraud.

The shift toward digital tax platforms, combined with increasingly advanced cybercriminal techniques, has made cyber tax fraud an evolving threat that governments and organizations must address urgently.

Methods of Cyber Tax Fraud

Cyber tax fraud is becoming more sophisticated as cybercriminals develop new techniques to exploit vulnerabilities in digital tax systems. These methods range from simple phishing attacks to complex software exploitation. Each method poses unique challenges for both individuals and tax authorities, requiring constant vigilance and advanced cybersecurity measures.

Phishing and Social Engineering in Tax Fraud

One of the most common methods of cyber tax fraud is phishing, where fraudsters deceive individuals into sharing sensitive information, such as Social Security numbers or login credentials, through fake emails or websites. Social engineering, which relies on manipulating human behavior, plays a key role in this process. Taxpayers often receive convincing messages that appear to be from legitimate tax agencies, urging them to click on malicious links or provide confidential details. This method is effective because it preys on trust, making unsuspecting users the gateway to cyber tax fraud.

In many cases, cybercriminals send emails that mimic official tax agencies, alerting recipients of “urgent issues” like overdue taxes or suspicious activity. The moment the victim responds with personal information, the fraudster can file fraudulent tax returns, leading to identity theft and financial loss.

Use of Malware in Tax Fraud Schemes

Malware, malicious software designed to infiltrate and damage systems, is another powerful tool in the arsenal of cyber tax fraudsters. Malware is often introduced to a victim's device through downloads or hidden in seemingly legitimate attachments. Once installed, it can capture keystrokes, steal login credentials, or gain access to sensitive financial information stored on the device.

Cybercriminals use malware to intercept tax-related data as it's entered into online tax systems. By capturing this data, they can gain unauthorized access to digital tax platforms, leading to identity theft, the filing of fraudulent tax returns, and other forms of internet tax fraud. Malware allows fraudsters to operate behind the scenes, undetected, while the taxpayer remains unaware of the breach.

Identity Theft and Tax Refund Fraud

Identity theft is a widespread problem in cyber tax fraud. Fraudsters steal personal details such as Social Security numbers and use them to file fraudulent tax returns, aiming to collect refunds under someone else’s identity. This is often done early in the tax season, before the legitimate taxpayer files their return, allowing criminals to intercept refunds.

The repercussions of this type of digital tax fraud can be severe for victims, as they not only lose money but also face long, complex processes to reclaim their rightful identity and resolve issues with tax authorities. Identity theft remains one of the most damaging forms of cyber tax fraud because it disrupts the financial stability of individuals and the efficiency of tax systems.

Hacking and Exploitation of Tax Software

Hackers increasingly target tax software used by individuals and businesses for filing taxes. By exploiting vulnerabilities in these systems, cybercriminals can access vast amounts of tax-related information. This method of online tax fraud is particularly dangerous because it affects multiple victims at once.

Once inside these systems, hackers can manipulate tax records, change bank account details for refunds, or steal confidential information. The exploitation of tax software demonstrates the increasing sophistication of internet tax fraud, as criminals use advanced hacking techniques to infiltrate secure systems that handle millions of tax filings every year.

Cyber tax fraud is evolving rapidly, and with each new method, the threat to taxpayers and tax authorities grows. Whether through phishing, malware, identity theft, or hacking, fraudsters are continually seeking ways to exploit the digital tax ecosystem for financial gain. These methods underline the importance of robust cybersecurity practices and heightened awareness to prevent falling victim to these schemes.

Impact of Cyber Tax Fraud

The rapid expansion of cyber tax fraud has far-reaching effects, not only on the finances of individuals and businesses but also on their reputations, operations, and legal standing. The implications of digital tax fraud go beyond immediate monetary losses, affecting long-term trust in digital tax systems and creating additional operational burdens. Understanding the consequences of cyber tax fraud is essential for preventing and mitigating its damage.

Financial Losses for Businesses and Individuals

One of the most direct and immediate impacts of cyber tax fraud is financial loss. For individuals, this often takes the form of fraudulent tax refunds or stolen identities used to siphon tax refunds to criminals. For businesses, the stakes can be even higher, with cybercriminals exploiting vulnerabilities in online tax systems to commit large-scale tax evasion or manipulate financial data. The loss of funds not only affects short-term financial stability but also leads to additional costs, such as legal fees, regulatory fines, and recovery expenses.

Moreover, many victims of internet tax fraud face a lengthy and complex process to recover stolen funds. Tax authorities may require thorough investigations, leaving businesses and individuals unable to access refunds or resolve disputes in a timely manner. This financial uncertainty can strain personal and corporate resources, leading to broader financial stress.

Legal Consequences and Penalties

The legal ramifications of cyber tax fraud can be severe for both the perpetrators and the victims, depending on the circumstances. Victims may find themselves entangled in legal disputes as they try to prove their innocence or recover lost funds. In some cases, businesses that fail to implement adequate cybersecurity measures may be held accountable for allowing fraud to occur, facing hefty penalties or even lawsuits from affected customers or stakeholders.

For those caught committing digital tax fraud, the legal penalties can be life-altering. Many countries have stringent laws against tax fraud, and cyber tax crimes are no exception. Cybercriminals may face heavy fines, asset seizure, or even imprisonment. The rise in cyber tax fraud has also prompted governments to intensify their monitoring and enforcement efforts, leading to more frequent audits and investigations.

Damage to Reputation and Trust

In the digital age, trust is one of the most valuable assets a business or individual can hold. Unfortunately, once a cyber tax fraud incident occurs, this trust can be irreparably damaged. For businesses, a breach in tax security can lead to the loss of client confidence, as customers may feel that their sensitive financial information is no longer secure. This can result in decreased business activity, loss of loyal customers, and difficulties attracting new clients.

On a larger scale, repeated incidents of online tax fraud erode trust in the entire digital tax system. Individuals and organizations may become hesitant to use online tax platforms, instead opting for more traditional or expensive tax filing methods, which could reduce the efficiency and convenience that digital tax systems are meant to offer.

Long-term Effects on Business Operations

The long-term operational effects of cyber tax fraud can be significant, especially for businesses. Recovering from a fraud incident often requires internal investigations, audits, and the implementation of new security protocols. These processes divert resources away from core business functions, affecting productivity and growth. In some cases, businesses may also need to overhaul their entire cybersecurity infrastructure, which can be a costly and time-consuming endeavor.

Additionally, businesses found to have inadequate cybersecurity measures in place may face heightened scrutiny from tax authorities and regulatory bodies. This could lead to more frequent audits or stricter compliance requirements, both of which can increase operational complexity and cost.

The repercussions of cyber tax fraud extend far beyond the initial incident, impacting financial stability, legal standing, and long-term operations. The widespread nature of this digital threat highlights the importance of robust cybersecurity measures and ongoing vigilance to safeguard against future attacks.

Preventive Measures Against Cyber Tax Fraud

As the threat of cyber tax fraud continues to grow, it becomes essential for individuals, businesses, and governments to implement robust preventive measures. Digital tax fraud can cause significant financial and reputational damage, but with the right precautions, it is possible to safeguard against these increasingly sophisticated attacks. By combining advanced technologies with user awareness, tax filers can reduce their risk of falling victim to internet tax fraud.

Strengthening Cybersecurity Protocols

At the heart of any effective defense against digital tax fraud is a strong cybersecurity framework. For businesses, this means investing in comprehensive security solutions that protect sensitive tax data from unauthorized access. Firewalls, encryption, and secure access controls are fundamental tools that should be deployed to safeguard online tax platforms.

For individuals, using multi-factor authentication (MFA) is a simple yet highly effective way to add an extra layer of protection. MFA ensures that even if cybercriminals obtain a user’s login credentials, they cannot gain access to the account without the additional verification step. Regularly updating passwords and avoiding the reuse of passwords across multiple platforms also help mitigate the risk of cyber tax fraud.

Educating Users About Phishing and Scams

One of the most common methods of cyber tax fraud is phishing, where fraudsters send deceptive emails to trick users into revealing personal information. Educating both individuals and businesses about how to recognize these scams is a key step in preventing fraud.

Taxpayers should be cautious of unsolicited emails or phone calls claiming to be from tax authorities. Official tax bodies rarely request sensitive information through these channels, and any unexpected requests should be treated with suspicion. Encouraging users to verify the legitimacy of such communications before responding can significantly reduce the chances of falling victim to online tax fraud.

Securing Tax Filing Software

For businesses that rely on digital platforms to manage tax filings, keeping software up to date is critical in preventing cyber tax fraud. Many cybercriminals exploit vulnerabilities in outdated software, allowing them to access sensitive tax data or manipulate digital tax records. Ensuring that tax software is regularly updated with the latest security patches can close these gaps, making it harder for hackers to breach systems.

In addition to software updates, using tax platforms that are certified and recognized for their security standards can also reduce risk. Businesses should ensure that their digital tax filing solutions comply with industry security regulations and employ encryption to protect transmitted data.

Monitoring for Unusual Activity

Monitoring for unusual behavior can help detect cyber tax fraud in its early stages, preventing further damage. For individuals, this means regularly checking bank statements and tax filings to ensure there are no unauthorized transactions or filings. Any suspicious activity should be reported immediately to the relevant tax authorities.

Businesses can take a more proactive approach by implementing real-time monitoring tools that track network activity and flag potential security breaches. These systems can provide alerts when unusual behavior is detected, allowing for a quicker response to any online tax fraud attempts.

Implementing Strong Access Controls

Limiting access to sensitive tax information is another effective strategy in preventing internet tax fraud. Businesses should ensure that only authorized personnel have access to tax-related systems and data. Role-based access controls can help restrict who can view, edit, or submit tax filings, reducing the likelihood of internal threats.

For individuals, protecting personal devices that are used for online tax filings is equally important. Using encrypted devices, enabling security features like biometric authentication, and avoiding public Wi-Fi when accessing tax platforms can further reduce vulnerability to cyber tax fraud.

Partnering with Trusted Tax Filing Platforms

Another preventive measure against cyber tax fraud is partnering with well-established, secure tax filing platforms. Trusted providers offer enhanced security features that minimize the risk of digital tax fraud, such as encryption, secure cloud storage, and continuous monitoring of potential threats. By choosing a reliable platform with a strong security track record, both individuals and businesses can better protect themselves from online tax fraud.

Regular Audits and Reviews

Regularly auditing tax processes can uncover potential vulnerabilities that might be exploited by cybercriminals. For businesses, conducting periodic reviews of internal controls, tax filing procedures, and cybersecurity measures can identify weaknesses before they are exploited. This process also helps ensure compliance with industry standards and governmental regulations, further reducing the risk of cyber tax fraud.

Implementing a combination of these preventive measures is crucial in the fight against cyber tax fraud. From educating users to strengthening technical defenses, taking a proactive approach helps mitigate the risks posed by digital tax fraud and ensures that personal and financial data remains secure.

Case Studies of Cyber Tax Fraud

Real-world examples of cyber tax fraud illustrate the evolving tactics used by criminals and highlight the vulnerabilities within digital tax systems. These case studies serve as powerful reminders of the importance of robust cybersecurity measures. By examining these incidents, we can uncover the failures that led to fraud and the lessons that businesses and individuals should adopt to protect themselves from future threats.

Notable Examples of Cyber Tax Fraud Incidents

- The 2015 IRS Data Breach: One of the most high-profile cyber tax fraud incidents occurred in 2015 when the Internal Revenue Service (IRS) fell victim to a significant data breach. Cybercriminals used stolen personal information to exploit the IRS’s "Get Transcript" feature, which allowed taxpayers to access their past tax filings. The breach affected approximately 700,000 taxpayers, with the criminals using the stolen data to file fraudulent tax returns and claim refunds. This digital tax fraud case revealed severe weaknesses in the IRS’s online authentication process, leading to massive financial losses and personal data exposure.

- Intuit TurboTax Fraud Scheme: In 2014, Intuit, the company behind TurboTax, faced allegations that its platform was used by cybercriminals to file fraudulent tax returns. Cyber fraudsters used stolen personal information to create false accounts on TurboTax and file fraudulent tax returns, successfully claiming millions in refunds. This form of online tax fraud underscored the growing threat of identity theft and the need for stronger security measures on tax filing platforms. Intuit responded by tightening its security protocols, but the case served as a warning to the tax industry as a whole.

- South Africa SARS Data Leak: In 2017, the South African Revenue Service (SARS) experienced a cyber tax fraud incident when hackers infiltrated its systems and leaked sensitive taxpayer data online. The stolen information was later used for fraudulent tax activities. This case not only illustrated the global reach of cyber tax fraud but also demonstrated how poor data management and insufficient cybersecurity infrastructure can lead to widespread fraud and public distrust in tax systems.

Analysis of the Failures Leading to Fraud

Each of these incidents had common threads that contributed to their failure to prevent cyber tax fraud. A primary issue in many cases was the failure to adequately secure taxpayer data, often due to outdated systems, weak encryption, or insufficient authentication measures. In the case of the IRS breach, a simple flaw in the verification process allowed hackers to repeatedly access taxpayer accounts without detection.

Another significant failure was the lack of early detection. In most of these cases, the fraudulent activity had been occurring for months, or even years, before it was discovered. This highlights the importance of continuous monitoring and real-time detection tools that can identify suspicious activities in digital tax platforms before they escalate.

Lastly, many organizations underestimated the sophisticated nature of cybercriminals. In both the IRS and TurboTax cases, the fraudsters employed advanced tactics, including social engineering and identity theft, to bypass security systems. This oversight points to the need for tax platforms to anticipate the evolving strategies used in internet tax fraud and proactively enhance their defenses.

Lessons Learned from Real-world Cases

The lessons from these cyber tax fraud cases are clear: prevention requires both robust technical measures and user awareness. Based on the failures observed in these incidents, here are some key takeaways:

- Strengthen Authentication Processes: Multi-factor authentication (MFA) should be mandatory for accessing any online tax platform. As seen in the IRS case, weak verification systems are a gateway for fraudsters.

- Implement Continuous Monitoring: Real-time monitoring tools that flag unusual behavior, such as multiple login attempts or suspicious tax return submissions, are crucial in preventing digital tax fraud from escalating.

- Educate Users on Cybersecurity: Awareness campaigns that educate taxpayers about the risks of phishing, identity theft, and other tactics used in cyber tax fraud can significantly reduce the chances of falling victim to these schemes.

- Upgrade Legacy Systems: Many tax platforms still rely on outdated technology, leaving them vulnerable to modern cyber threats. Investing in the latest cybersecurity tools, encryption methods, and software updates is essential in defending against online tax fraud.

These case studies serve as a stark reminder that cyber tax fraud is a growing threat that requires ongoing vigilance. By learning from the mistakes of the past, tax authorities and individuals can better protect themselves from the ever-evolving tactics of cybercriminals.

Future Trends in Cyber Tax Fraud

As technology evolves, so do the tactics employed by cybercriminals. Cyber tax fraud is becoming increasingly sophisticated, with new threats emerging every year. As more tax systems and processes move online, the future of digital tax fraud promises to be both complex and dangerous. To stay ahead of these threats, tax authorities and businesses must understand the upcoming trends and leverage cutting-edge technology to detect and prevent online tax fraud.

Emerging Threats in Cyber Tax Fraud

The landscape of cyber tax fraud is continuously shifting as cybercriminals adapt to new defenses. One of the emerging threats is ransomware attacks targeted at tax authorities and financial institutions. These attacks not only disrupt operations but can also lead to the theft of sensitive taxpayer data, which is then sold on the dark web or used to file fraudulent tax returns.

Another growing concern is the increased use of synthetic identities to commit internet tax fraud. Fraudsters combine real and fabricated personal information to create new identities that evade detection. These synthetic identities are then used to file fraudulent tax returns and claim refunds, making detection incredibly difficult for tax authorities.

Moreover, the rise of cryptocurrency introduces new challenges. The anonymity offered by digital currencies makes it easier for fraudsters to conceal illicit gains from tax fraud. This evolving space requires tax agencies to develop new frameworks to track and monitor transactions associated with cryptocurrency-related tax evasion.

The Role of Artificial Intelligence in Fraud Detection

Artificial intelligence (AI) is quickly becoming a cornerstone in the fight against cyber tax fraud. AI systems are capable of analyzing vast amounts of data in real time, identifying patterns, and detecting anomalies that may indicate fraudulent activity. These intelligent systems can analyze tax filings, detect irregularities, and flag suspicious behavior more quickly and accurately than human auditors.

By leveraging machine learning algorithms, AI can continuously improve its fraud detection capabilities. For example, AI can learn from past cases of digital tax fraud and use this knowledge to identify similar patterns in future filings. This adaptive nature allows AI to stay ahead of evolving cyber fraud tactics.

AI also offers the benefit of automated monitoring, which can operate around the clock to safeguard digital tax systems from fraud attempts. This constant vigilance is critical in a world where cyber tax fraudsters are continuously looking for new vulnerabilities to exploit.

Predictive Analytics and Its Role in Tax Fraud Prevention

In addition to AI, predictive analytics is playing a vital role in tax fraud prevention. Predictive analytics uses historical data, combined with advanced algorithms, to predict future outcomes and identify potential risks. For tax authorities, this means being able to anticipate and prevent tax fraud before it occurs.

Predictive analytics can be used to analyze previous instances of online tax fraud, identifying the factors that led to successful fraud attempts. By recognizing these patterns, tax authorities can take preemptive action, such as flagging high-risk filings for further review or deploying additional security measures for vulnerable taxpayer groups.

Moreover, predictive analytics allows businesses to better forecast fraud risk during peak filing seasons when cyber tax fraud is more likely to occur. This enables organizations to allocate resources more effectively, ensuring that fraud detection systems are robust enough to handle increased threats during critical periods.

Future-Proofing Against Cyber Tax Fraud

As the future of internet tax fraud becomes more complex, staying ahead of cybercriminals will require continuous innovation. The combination of AI, predictive analytics, and emerging technologies like blockchain holds significant promise in securing digital tax systems. These tools will not only enhance fraud detection but also reduce the window of opportunity for fraudsters to exploit weaknesses.

To future-proof against these threats, tax authorities and businesses must invest in cutting-edge cybersecurity technologies, while also educating users on the risks associated with cyber tax fraud. As these threats evolve, so too must the strategies to combat them, ensuring the integrity of the global tax system.

SearchInform’s Role in Combating Cyber Tax Fraud

In an era where cyber tax fraud continues to grow in scale and complexity, robust cybersecurity solutions are essential for organizations and tax authorities alike. SearchInform has emerged as a key player in the fight against cyber tax fraud, offering a suite of cybersecurity tools designed to detect, prevent, and respond to these sophisticated threats. With its focus on real-time monitoring, incident response, and threat detection, SearchInform helps secure digital tax systems from malicious actors seeking to exploit vulnerabilities for financial gain.

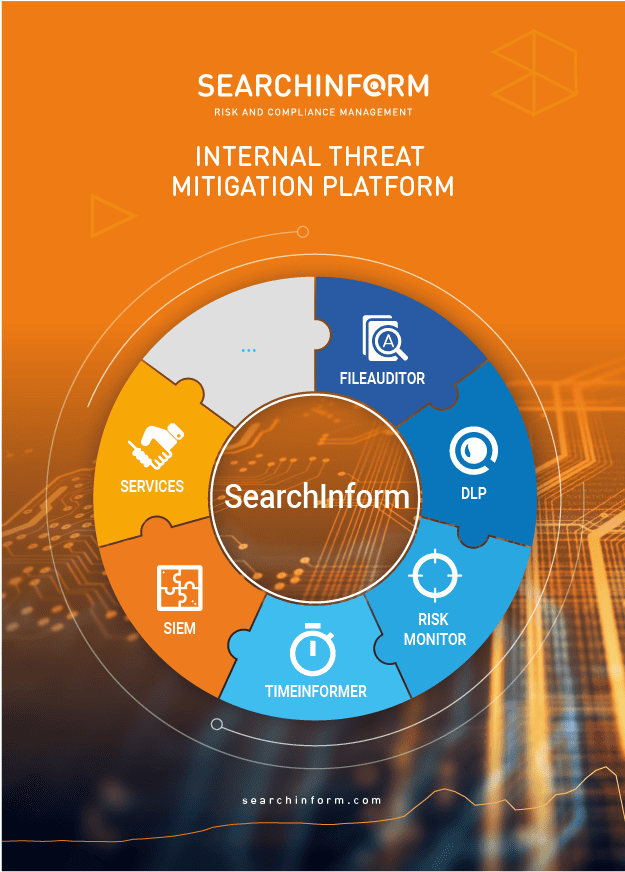

Overview of SearchInform’s Cybersecurity Solutions

SearchInform provides comprehensive cybersecurity solutions that address various aspects of data security, monitoring, and fraud prevention. From its Data Loss Prevention (DLP) tools to its Security Information and Event Management (SIEM) systems, the company’s offerings are designed to help organizations stay ahead of cyber tax fraud threats.

- Data Loss Prevention (DLP): SearchInform’s DLP solution safeguards sensitive tax-related data by monitoring and controlling how it is accessed and shared. This is crucial for preventing data breaches that could lead to online tax fraud, as DLP ensures that only authorized personnel can handle tax data.

- SIEM Systems: SearchInform’s SIEM system collects and analyzes security data from various sources, offering real-time threat detection and incident response. It enables tax authorities and organizations to identify suspicious activities that may indicate cyber tax fraud attempts, ensuring quick action before the situation escalates.

- User Activity Monitoring (UAM): SearchInform’s UAM tool tracks employee behavior and data access patterns, helping identify potential insider threats or malicious activities that could compromise tax data. By monitoring how users interact with sensitive information, organizations can reduce the risk of internal cyber tax fraud incidents.

How SearchInform Helps in Monitoring and Detection

Monitoring and detecting threats before they cause damage is a critical component of any cybersecurity strategy, and SearchInform excels in this area. Our advanced monitoring tools provide organizations with the ability to oversee all aspects of their digital tax environment, from employee interactions to external threats.

SearchInform’s real-time data monitoring capabilities ensure that any unauthorized access or transfer of tax data is flagged immediately. This proactive approach to monitoring allows organizations to stop digital tax fraud before it begins, minimizing the risk of data breaches or identity theft.

Additionally, SearchInform’s solutions integrate with other systems to deliver comprehensive threat detection. By continuously analyzing data logs, user behavior, and system anomalies, the platform can detect irregularities that might signal an attempt at cyber tax fraud. Whether it’s unusual access to tax systems, repeated failed login attempts, or suspicious changes to tax records, SearchInform’s detection tools provide an early warning system against potential fraud.

Incident Response with SearchInform Tools

Quick and effective incident response is crucial when dealing with cyber tax fraud, and SearchInform’s tools are designed to facilitate immediate action. Once a threat is detected, SearchInform enables organizations to swiftly investigate and mitigate the impact of the breach.

SearchInform’s incident response solutions offer clear insights into the nature of the breach, allowing organizations to isolate affected systems, identify compromised data, and take corrective actions. This is particularly important in cases of internet tax fraud, where rapid response can prevent further damage and limit financial losses.

The platform also provides detailed audit trails and reporting, ensuring that every action taken during an incident is documented. These audit logs are invaluable for compliance and post-incident investigations, helping organizations meet regulatory requirements and prevent future instances of cyber tax fraud.

In conclusion, SearchInform plays a vital role in combating cyber tax fraud by providing organizations with the tools they need to secure their tax data, detect threats, and respond to incidents efficiently. Our solutions offer a multi-layered approach to protecting against digital tax fraud, making it an essential partner for businesses and tax authorities aiming to safeguard their financial systems.

By choosing SearchInform, you’re taking a crucial step in safeguarding your organization against cyber tax fraud. With our comprehensive cybersecurity solutions, you can confidently protect your tax data, detect potential threats in real-time, and respond swiftly to incidents before they escalate. Let’s work together to secure your digital environment and keep your financial systems safe.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!