Cybersecurity in Banking: Navigating the Complexities

- Introduction to Cybersecurity in Banking

- Importance of Cybersecurity in the Banking Sector

- Regulatory Frameworks and Compliance Standards

- Common Cyber Threats to Bank Security

- Phishing Attacks

- Malware and Ransomware

- Insider Threats

- Distributed Denial of Service (DDoS) Attacks

- Advanced Persistent Threats (APTs)

- Third-Party Risks

- Strategies for Bank Cybersecurity

- Advanced Technologies

- Employee Education and Training

- Stringent Security Protocols

- Regular Software Updates and Patch Management

- Third-Party Risk Management

- Continuous Monitoring and Threat Intelligence

- Role of AI and Machine Learning in Bank Security

- Real-Time Threat Detection

- Fraud Prevention

- Enhancing Authentication Processes

- Automated Response to Threats

- Data Encryption and Protection

- Predictive Analytics for Risk Management

- Continuous Improvement Through Learning

- Emerging Technologies and Trends in Bank Security

- Blockchain Technology

- Zero Trust Architecture

- Quantum Computing

- Biometric Security

- Artificial Intelligence and Machine Learning

- Cloud Security Solutions

- Advanced Threat Intelligence

- Internet of Things (IoT) Security

- Benefits of SearchInform Solutions for Bank Security

Introduction to Cybersecurity in Banking

In an era where digital transformation is reshaping every industry, the banking sector stands at the forefront of technological innovation. However, with the rise of digital banking comes an increased risk of cyber threats. Cybersecurity in banking is not just a technical necessity but a cornerstone for maintaining trust and ensuring the stability of financial systems. Banks handle sensitive information, from personal customer data to critical financial transactions, making them prime targets for cyberattacks. Therefore, robust cybersecurity measures are imperative to safeguard these assets.

Importance of Cybersecurity in the Banking Sector

The importance of cybersecurity in banking cannot be overstated. Financial institutions are entrusted with the personal and financial information of millions of customers. A breach in cybersecurity can lead to catastrophic financial losses, not only for the bank but also for its customers. Additionally, the reputational damage following a cyberattack can be devastating, eroding customer trust and confidence in the institution. Cybersecurity ensures the protection of sensitive data from unauthorized access and cyber threats such as hacking, phishing, and malware attacks. Effective cybersecurity measures help prevent financial fraud, protect against identity theft, and ensure the integrity of transactions. In essence, cybersecurity is fundamental to the stability and reliability of the banking sector.

Regulatory Frameworks and Compliance Standards

To address the complex challenges of cybersecurity, the banking sector operates under stringent regulatory frameworks and compliance standards. These regulations are designed to ensure that financial institutions implement adequate cybersecurity measures to protect sensitive information and maintain the integrity of financial systems. Key regulatory bodies, such as the Federal Financial Institutions Examination Council (FFIEC) in the United States and the European Central Bank (ECB) in the European Union, set forth guidelines and standards for cybersecurity practices. Regulations like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) mandate specific security measures to protect customer data and payment information.

Compliance with these standards is not optional; it is a legal requirement that banks must adhere to. Regular audits and assessments are conducted to ensure compliance, and failure to meet these standards can result in significant penalties. Additionally, these regulations often require financial institutions to implement robust risk management strategies, conduct regular security assessments, and have incident response plans in place. By adhering to these regulatory frameworks, banks can enhance their cybersecurity posture, mitigate risks, and protect themselves and their customers from potential cyber threats.

Cybersecurity in the banking sector is a multifaceted challenge that demands a proactive and comprehensive approach. The importance of safeguarding sensitive financial information cannot be understated, as the consequences of cyber threats are far-reaching and severe. Regulatory frameworks and compliance standards play a crucial role in guiding banks to implement effective cybersecurity measures. As technology continues to evolve, so too must the strategies and protections in place to defend against cyber threats. Ensuring robust cybersecurity in banking is essential for maintaining trust, protecting financial assets, and securing the future of digital banking.

Common Cyber Threats to Bank Security

In the digital age, banks face a myriad of cyber threats that can compromise their security and the safety of their customers' information. Understanding these threats is crucial for developing effective cybersecurity strategies. Below are some of the most common cyber threats to banks:

Phishing Attacks

Phishing attacks are among the most prevalent and dangerous cyber threats to banks. These attacks typically involve fraudulent emails or websites designed to trick individuals into revealing sensitive information, such as login credentials or financial details. Cybercriminals often disguise themselves as legitimate entities, such as bank officials or trusted companies, to deceive recipients. Once the information is obtained, it can be used to gain unauthorized access to bank accounts and carry out fraudulent transactions.

Malware and Ransomware

Malware, including ransomware, poses a significant threat to banking security. Malware is malicious software that infiltrates systems to steal data, disrupt operations, or spy on users without their knowledge. Ransomware, a specific type of malware, encrypts the victim’s data and demands a ransom for the decryption key. Banks, being data-rich targets, are particularly vulnerable to such attacks. A successful ransomware attack can paralyze banking operations, compromise customer information, and lead to substantial financial losses.

Insider Threats

Insider threats occur when employees or other individuals with access to a bank's systems and data misuse their privileges, either maliciously or unintentionally. These threats can be particularly challenging to detect and mitigate because insiders have legitimate access to sensitive information. Insider threats can lead to data breaches, financial fraud, and unauthorized access to confidential information, making them a critical area of concern for banks.

Distributed Denial of Service (DDoS) Attacks

Distributed Denial of Service (DDoS) attacks aim to overwhelm a bank’s online services, such as websites and mobile applications, by flooding them with excessive traffic. This can cause significant disruptions, rendering banking services inaccessible to customers. While DDoS attacks do not directly compromise data, they can serve as a diversion for other malicious activities and cause reputational damage due to the unavailability of services.

Advanced Persistent Threats (APTs)

Advanced Persistent Threats (APTs) are prolonged and targeted cyberattacks where an intruder gains access to a network and remains undetected for an extended period. The goal of APTs is often to steal sensitive data rather than cause immediate damage. Banks are prime targets for APTs because of the valuable information they hold. APTs require sophisticated techniques and substantial resources, making them a significant threat from organized crime groups or state-sponsored hackers.

Third-Party Risks

Banks often rely on third-party vendors for various services, such as IT support, cloud services, and payment processing. While these partnerships can enhance efficiency, they also introduce additional cybersecurity risks. Third-party vendors may not have the same level of security controls as the banks themselves, making them potential entry points for cyberattacks. Ensuring that third-party partners adhere to robust security practices is essential to mitigate this risk.

Cyber threats to banks are constantly evolving, becoming more sophisticated and harder to detect. Phishing, malware, insider threats, DDoS attacks, APTs, and third-party risks represent some of the most significant challenges to banking security today. To combat these threats, banks must adopt a proactive and comprehensive cybersecurity strategy, incorporating advanced technologies, employee training, and stringent security protocols. By staying vigilant and continuously updating their defenses, banks can protect themselves and their customers from the ever-present dangers of the cyber world.

Strategies for Bank Cybersecurity

In the rapidly evolving landscape of cyber threats, banks must implement robust and dynamic strategies to safeguard their operations and customer data. A multifaceted approach to cybersecurity is essential, encompassing advanced technologies, employee education, and stringent security protocols. Below are key strategies that banks can employ to enhance their cybersecurity posture.

Advanced Technologies

Implementing cutting-edge technologies is fundamental to effective bank cybersecurity. Banks should invest in artificial intelligence (AI) and machine learning (ML) systems capable of detecting and responding to threats in real-time. These technologies can analyze vast amounts of data to identify unusual patterns and potential security breaches before they cause significant damage. Additionally, employing blockchain technology can enhance the security of transactions, making it more difficult for cybercriminals to alter financial records. By staying at the forefront of technological advancements, banks can better protect themselves against sophisticated cyber threats.

Employee Education and Training

Human error remains one of the most significant vulnerabilities in cybersecurity. Therefore, comprehensive employee education and training programs are vital. Regular training sessions should be conducted to keep staff updated on the latest cybersecurity threats and best practices. This includes phishing awareness training, where employees learn to recognize and avoid malicious emails and links. Additionally, banks should implement policies that require employees to follow secure password practices and report any suspicious activity immediately. By fostering a culture of cybersecurity awareness, banks can significantly reduce the risk of insider threats and human errors.

Stringent Security Protocols

Robust security protocols are the backbone of bank cybersecurity. These protocols should include multi-factor authentication (MFA) to add an extra layer of security for accessing sensitive information and systems. Regular security audits and assessments are crucial to identify and address vulnerabilities. Banks must also comply with regulatory standards such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), which mandate specific security measures to protect customer data. Incident response plans should be in place to ensure a swift and effective response to any security breaches, minimizing damage and restoring operations quickly.

Regular Software Updates and Patch Management

Keeping software and systems updated is a critical component of cybersecurity. Cybercriminals often exploit vulnerabilities in outdated software to gain unauthorized access. Banks must implement a robust patch management process to ensure that all systems and applications are regularly updated with the latest security patches. Automated systems can help manage this process efficiently, reducing the risk of human oversight. By maintaining up-to-date software, banks can close potential security gaps that cyber attackers might exploit.

Third-Party Risk Management

Many banks rely on third-party vendors for various services, from IT support to payment processing. However, these relationships can introduce additional cybersecurity risks. Banks must conduct thorough due diligence when selecting third-party vendors, ensuring they adhere to stringent security standards. Regular audits of third-party partners are essential to verify their security practices and compliance. Contracts should include clauses that mandate security measures and outline the responsibilities of each party in the event of a cyber incident. Effective third-party risk management is crucial to protecting bank security from external vulnerabilities.

Continuous Monitoring and Threat Intelligence

Continuous monitoring of networks and systems is vital for early detection of potential cyber threats. Banks should employ sophisticated monitoring tools that provide real-time alerts for suspicious activities. Additionally, threat intelligence services can offer valuable insights into emerging threats and trends in cybercrime. By integrating threat intelligence into their cybersecurity strategy, banks can proactively adjust their defenses to counter new and evolving threats. Continuous monitoring and threat intelligence help banks stay one step ahead of cybercriminals, ensuring robust protection against potential attacks.

The cybersecurity landscape for banks is complex and constantly changing, requiring a proactive and comprehensive approach. By leveraging advanced technologies, educating employees, implementing stringent security protocols, maintaining updated software, managing third-party risks, and continuously monitoring for threats, banks can significantly enhance their cybersecurity posture. These strategies are essential for protecting sensitive financial information, maintaining customer trust, and ensuring the stability and integrity of banking operations. Through diligent and dynamic cybersecurity practices, banks can effectively safeguard themselves against the ever-present dangers of the cyber world.

Role of AI and Machine Learning in Bank Security

In the ever-evolving domain of cybersecurity, artificial intelligence (AI) and machine learning (ML) have emerged as pivotal tools, especially for banks. These advanced technologies offer a proactive and dynamic approach to identifying and mitigating cyber threats, ensuring the protection of sensitive financial data and maintaining the trust of customers. Below, we delve into the various ways AI and ML enhance bank security.

Real-Time Threat Detection

One of the most significant advantages of AI and ML in bank security is their ability to detect threats in real-time. Traditional security systems often rely on predefined rules and patterns, which can be limiting when faced with novel or sophisticated cyberattacks. AI and ML, however, can analyze vast amounts of data and recognize anomalies that may indicate a security breach. By continuously learning from new data, these technologies can adapt to emerging threats, providing banks with a robust defense mechanism that evolves over time.

Fraud Prevention

Fraud prevention is a critical aspect of bank security where AI and ML excel. These technologies can scrutinize transactional data for patterns that are indicative of fraudulent activity. For instance, AI can flag transactions that deviate from a customer’s typical behavior, such as unusual spending locations or abnormal purchase amounts. Machine learning models can also predict potential fraud by analyzing historical data and identifying trends that precede fraudulent transactions. This predictive capability enables banks to take preventive measures before fraud occurs, significantly reducing financial losses.

Enhancing Authentication Processes

AI and ML are revolutionizing authentication processes in banking, making them more secure and user-friendly. Biometric authentication methods, such as facial recognition, voice recognition, and fingerprint scanning, leverage AI to accurately verify user identities. These methods are not only more secure than traditional passwords but also offer a seamless user experience. Additionally, AI can enhance multi-factor authentication (MFA) by assessing the risk level of login attempts and dynamically adjusting the authentication requirements. This ensures that high-risk attempts are met with stricter verification, bolstering security without inconveniencing legitimate users.

Automated Response to Threats

The speed at which cyber threats evolve necessitates an equally rapid response. AI and ML can automate responses to detected threats, minimizing the time between detection and mitigation. For example, if an AI system identifies a potential breach, it can automatically initiate actions such as isolating affected systems, notifying security personnel, and starting forensic investigations. This immediate response is crucial in limiting the damage caused by cyberattacks and ensuring swift recovery.

Data Encryption and Protection

Protecting sensitive data is paramount for banks, and AI plays a significant role in enhancing data encryption and protection. AI algorithms can manage encryption keys, ensuring they are used and stored securely. Moreover, AI can monitor encrypted data flows and detect any irregularities that may indicate a breach attempt. By continuously analyzing and securing data, AI helps maintain the integrity and confidentiality of financial information.

Predictive Analytics for Risk Management

Risk management in banking benefits immensely from the predictive capabilities of AI and ML. These technologies can analyze a wide range of data sources, from market trends to geopolitical events, to predict potential risks that may impact bank security. For instance, AI can forecast the likelihood of cyberattacks during periods of heightened political tension or economic instability. By providing banks with actionable insights, AI and ML enable proactive risk management, allowing banks to strengthen their defenses ahead of potential threats.

Continuous Improvement Through Learning

A distinguishing feature of AI and ML is their ability to learn and improve over time. Machine learning models can be trained on new data, continuously refining their accuracy and effectiveness. This continuous improvement is crucial in the ever-changing landscape of cybersecurity, where new threats and attack vectors are constantly emerging. By leveraging AI and ML, banks can ensure that their security measures are always up-to-date and capable of addressing the latest cyber threats.

AI and machine learning are transforming the field of bank security, providing advanced tools for real-time threat detection, fraud prevention, enhanced authentication, automated threat response, data protection, and predictive analytics. These technologies offer a dynamic and proactive approach to cybersecurity, enabling banks to stay ahead of evolving threats and protect their critical assets. By integrating AI and ML into their security strategies, banks can enhance their defenses, maintain customer trust, and ensure the stability and integrity of their operations in the digital age.

Emerging Technologies and Trends in Bank Security

The cybersecurity landscape is continuously evolving, driven by the emergence of new technologies and the ever-increasing sophistication of cyber threats. For banks, staying ahead of these changes is critical to safeguarding their systems and protecting customer data. Below are some of the most promising emerging technologies and trends in bank security that are shaping the future of cybersecurity.

Blockchain Technology

Blockchain technology is gaining traction in the banking sector for its potential to enhance security and transparency. By creating an immutable ledger of transactions, blockchain ensures that data cannot be altered or tampered with, providing a higher level of security. This technology is particularly useful for securing payment systems, verifying identities, and reducing fraud. Moreover, blockchain's decentralized nature means that there is no single point of failure, making it more resilient against cyberattacks. Banks are increasingly exploring blockchain to secure transactions, streamline processes, and build trust with their customers.

Zero Trust Architecture

The traditional security model, which relied on perimeter defenses, is being replaced by the zero trust architecture (ZTA) approach. Zero trust assumes that threats could come from both inside and outside the network, and therefore, no entity—whether internal or external—should be trusted by default. Instead, continuous verification of every device, user, and network connection is required. This model significantly enhances security by ensuring that access to sensitive data is strictly controlled and monitored. Implementing ZTA involves robust identity verification, micro-segmentation of networks, and real-time monitoring of all activities.

Quantum Computing

Quantum computing, while still in its early stages, poses both challenges and opportunities for bank security. On one hand, quantum computers have the potential to break current encryption methods, which could compromise data security. On the other hand, quantum technology also offers advanced encryption techniques, such as quantum key distribution (QKD), which can provide unprecedented levels of security. Banks are beginning to invest in quantum-resistant encryption algorithms to prepare for the future when quantum computers become more prevalent. This proactive approach is essential to safeguard against potential quantum threats.

Biometric Security

Biometric security is becoming increasingly popular in banking for its ability to provide strong and user-friendly authentication. Techniques such as fingerprint scanning, facial recognition, and voice recognition offer high levels of security by ensuring that only authorized individuals can access sensitive information. Unlike traditional passwords, biometric data is difficult to forge or steal, making it a more secure option. Additionally, biometric systems can be integrated with other security measures, such as multi-factor authentication (MFA), to further enhance protection.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) continue to play a pivotal role in enhancing bank security. These technologies enable banks to detect and respond to threats in real-time by analyzing vast amounts of data for unusual patterns and anomalies. AI-driven systems can identify emerging threats faster than traditional methods, allowing for quicker and more effective responses. Furthermore, AI and ML can be used to automate routine security tasks, such as monitoring network traffic and managing access controls, freeing up human resources to focus on more complex security challenges.

Cloud Security Solutions

As banks increasingly migrate their operations to the cloud, robust cloud security solutions are essential. Cloud providers offer advanced security features, such as encryption, identity and access management, and continuous monitoring, which can help protect sensitive data. Additionally, cloud-based security services provide scalability and flexibility, allowing banks to quickly adapt to changing security needs. Banks must ensure that they implement best practices for cloud security, including selecting reputable providers, conducting regular audits, and maintaining stringent access controls.

Advanced Threat Intelligence

Advanced threat intelligence is a crucial component of modern bank security strategies. By gathering and analyzing data from various sources, threat intelligence systems can provide actionable insights into potential cyber threats. This information helps banks anticipate and prepare for attacks, improving their ability to defend against them. Threat intelligence platforms can monitor the dark web, track the activities of cybercriminal groups, and identify vulnerabilities in real-time, enabling banks to stay one step ahead of attackers.

and perform with SearchInform DLP:

Internet of Things (IoT) Security

The proliferation of Internet of Things (IoT) devices in banking introduces new security challenges. These devices, ranging from smart ATMs to connected security cameras, can be potential entry points for cyberattacks if not properly secured. Banks need to implement robust IoT security measures, including strong encryption, regular firmware updates, and network segmentation, to protect against these threats. Ensuring that IoT devices adhere to security best practices is essential for maintaining the overall security of banking operations.

The integration of emerging technologies and trends is reshaping the landscape of bank security, providing new tools and strategies to combat evolving cyber threats. From blockchain and zero trust architecture to quantum computing and biometric security, these innovations offer significant enhancements to the protection of financial institutions. By embracing these technologies and staying vigilant to new trends, banks can strengthen their defenses, protect sensitive information, and ensure the trust and safety of their customers in an increasingly digital world.

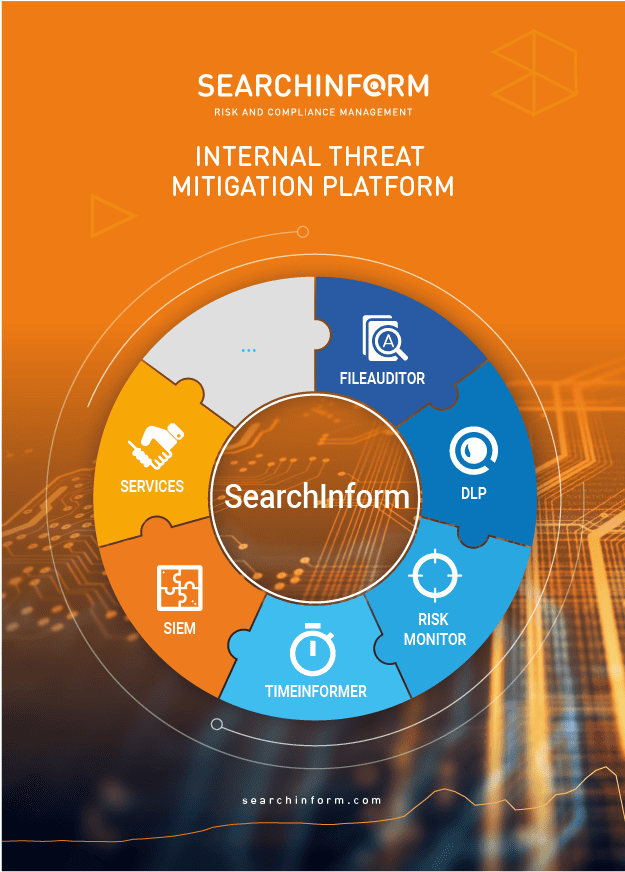

Benefits of SearchInform Solutions for Bank Security

In the realm of bank security, leveraging advanced solutions is paramount to protect sensitive financial information and ensure compliance with regulatory standards. SearchInform Solutions offers a comprehensive suite of tools designed to enhance security measures for banks. Below are the key benefits of integrating SearchInform Solutions into bank security strategies.

Comprehensive Data Leakage Prevention: One of the primary benefits of SearchInform solutions is its robust data leakage prevention (DLP) capabilities. Banks handle vast amounts of sensitive data, including personal customer information, financial records, and confidential business data. SearchInform DLP monitors all data flows within the bank’s network, ensuring that sensitive information does not leave the organization without authorization. By preventing data leaks, banks can safeguard their assets, maintain customer trust, and avoid potential financial and reputational damage.

Enhanced Insider Threat Detection: Insider threats pose a significant risk to bank security, as employees or other insiders with legitimate access to systems can misuse their privileges. SearchInform solutions excel in detecting and mitigating insider threats. The system continuously monitors user activities, identifying any abnormal behavior that may indicate malicious intent or negligence. By analyzing patterns and anomalies, SearchInform can alert security teams to potential insider threats in real-time, allowing for swift and decisive action to mitigate risks.

Comprehensive Monitoring and Reporting: SearchInform solutions provides comprehensive monitoring and reporting tools that are essential for maintaining security oversight. Our tools offer real-time monitoring of all network activities, ensuring that any suspicious behavior is immediately detected and reported. The detailed reporting features allow banks to generate insights into security incidents, user behavior, and compliance status. This level of visibility is crucial for making informed decisions, conducting thorough investigations, and ensuring adherence to regulatory requirements.

Regulatory Compliance Support: Compliance with regulatory standards is a critical aspect of bank security. SearchInform solutions help banks meet these requirements by offering features specifically designed to support regulatory compliance. The system ensures that all data handling processes align with standards such as GDPR, PCI DSS, and other relevant regulations. By automating compliance checks and providing detailed audit trails, SearchInform reduces the burden of manual compliance efforts and minimizes the risk of non-compliance penalties.

Advanced Threat Detection: The ability to detect advanced threats is another significant advantage of SearchInform solutions. Cyber threats are becoming increasingly sophisticated, requiring equally advanced detection mechanisms. SearchInform employs a combination of machine learning algorithms and behavior analysis to identify potential threats that traditional security measures might miss. This proactive approach enables banks to stay ahead of emerging threats, ensuring a higher level of protection for their systems and data.

Data Encryption and Protection: SearchInform solutions also enhance data encryption and protection measures. By implementing robust encryption protocols, the system ensures that sensitive data remains secure both in transit and at rest. This level of protection is crucial for preventing unauthorized access and maintaining the integrity and confidentiality of financial information. Additionally, SearchInform's data protection features include secure storage solutions and access controls, further safeguarding sensitive information from cyber threats.

Scalable and Customizable Solutions: Banks of all sizes can benefit from the scalability and customization offered by SearchInform solutions. Whether a small regional bank or a large multinational institution, the solutions can be tailored to meet specific security needs and scale with the organization’s growth. Customizable features allow banks to configure the system according to their unique security policies and operational requirements, ensuring optimal protection without compromising on functionality.

Cost-Effective Security Management: Implementing SearchInform solutions can lead to cost savings in security management. By automating many security processes, including monitoring, threat detection, and compliance checks, banks can reduce the need for extensive manual oversight and the associated labor costs. Additionally, the prevention of data breaches and insider threats helps avoid the significant financial losses and penalties that can arise from security incidents. This cost-effective approach enables banks to maintain high security standards while managing their resources efficiently.

SearchInform solutions offer a comprehensive suite of tools that significantly enhance bank security. From preventing data leaks and detecting insider threats to ensuring regulatory compliance and protecting data through advanced encryption, these solutions provide robust defenses against a wide range of cyber threats. The scalability, customization, and cost-effectiveness of SearchInform solutions make them an ideal choice for banks seeking to strengthen their security posture and protect their valuable assets in an increasingly complex cyber landscape.

Contact us today to learn more about how SearchInform solutions can benefit your bank and schedule a personalized consultation with our security experts. Together, we can develop a tailored security strategy that meets your specific needs and ensures the safety of your financial operations.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!