Mastering Risk Management: From Identifying Risks to Proactive Solutions

- Introduction to Risk Management Program

- What is a Risk Management Program?

- Why Every Business Needs a Risk Management Program

- Key Components of a Risk Management Framework

- Steps to Develop a Risk Management Program

- Identifying Business Risks: Peeling Back the Layers

- Emerging Risks: The Silent Threats

- Risk Assessment Techniques: Turning the Unknown into the Known

- Predictive Analytics: A Game-Changer

- Risk Mitigation Strategies: Your Arsenal of Defense

- Contingency Planning: Your Backup Playbook

- Adaptation in Action

- Building Resilience: From Reactive to Proactive

- Ready to Reap the Benefits?

- Benefits of an Effective Risk Management Program

- Improved Decision-Making: Clarity in Chaos

- Enhanced Compliance and Security: Stay Ahead of Regulations

- Financial and Operational Stability: Weather Any Storm

- Fostering Innovation Through Managed Risks

- Building Stakeholder Confidence

- From Protection to Possibility

- Challenges in Implementing Risk Management Programs

- Common Barriers: Why Implementation Stumbles

- Lack of Awareness: The Knowledge Gap

- Resource Constraints: The Budget and Personnel Crunch

- Complexity: The Multilayered Maze

- Resistance to Change

- Solutions and Best Practices to Overcome Challenges

- Training and Awareness Campaigns: Knowledge Is Power

- Leveraging Technology: Automation to the Rescue

- Clear Communication: Breaking Down Silos

- Prioritizing Incremental Wins

- Building a Risk-Aware Culture

- From Challenges to Case Studies

- Case Studies and Real-World Examples: Risk Management in Action

- A Financial Firm: Fortifying Cybersecurity and Safeguarding Data

- The Challenge

- The Solution

- The Outcome

- A Manufacturing Company: Building Resilient Supply Chains

- The Challenge

- The Solution

- The Outcome

- A Retail Chain: Protecting Customer Data and Brand Reputation

- The Challenge

- The Solution

- The Outcome

- A Healthcare Organization: Mitigating Operational Risks

- The Challenge

- The Solution

- The Outcome

- A Tech Startup: Navigating Market Uncertainty

- The Challenge

- The Solution

- The Outcome

- Lessons Learned from Failed Risk Management

- Success in Risk, Success in Business

- Future Trends in Risk Management: A Glimpse into What’s Next

- Predictive Analytics in Risk Assessment: From Guesswork to Foresight

- How Predictive Analytics Works

- Real-World Impact

- The Role of Blockchain in Risk Management: The Trust Revolution

- Blockchain in Action

- Real-World Example

- Emerging Threats and Evolving Strategies: Adapting to the Unknown

- Climate Change and Environmental Risks

- The Rise of Cyber Threats

- Socioeconomic Shifts

- The Role of ESG in Risk Management

- Why ESG Matters

- Human-Centered Risk Management

- The Human Factor

- Embracing the Future with Confidence

- How SearchInform Can Help: Turning Challenges Into Opportunities

- A Revolution in Risk Management Solutions

- What Sets SearchInform Apart?

- Key Features and Benefits: Why SearchInform Stands Out

- 1. Comprehensive Monitoring: Catch Risks Before They Strike

- 2. Proactive Alerts: A Heads-Up When It Matters Most

- 3. Customizable Dashboards: Insights That Work for You

- 4. Advanced Data Loss Prevention (DLP): Shielding Your Crown Jewels

- 5. Predictive Risk Analysis: Anticipate the Future

- 6. Seamless Integration: Plug and Play Simplicity

- What Could Happen if You Team with SearchInform

- Retail

- Healthcare

- Finance

- Why SearchInform Is Your Future Partner in Risk Management

- Take Control of Your Risks Today

Introduction to Risk Management Program

Imagine waking up to a crisis that halts operations, drains finances, or damages your brand's reputation overnight. Could your business withstand the blow? If the answer is uncertain, you’re not alone. Many businesses operate without a robust safety net—until it’s too late. This is where a risk management program steps in, acting like a vigilant guardian that doesn’t just fight fires but prevents them from starting. It’s not just a “nice-to-have”; it’s your lifeline in a world full of uncertainties.

What is a Risk Management Program?

At its core, a risk management program is like a roadmap for navigating uncertainties. It systematically identifies, evaluates, and mitigates risks that could derail your business goals. But it’s not just about avoiding disasters. A well-designed program empowers organizations to turn risks into opportunities, enabling them to act decisively and thrive in challenging environments.

Why Every Business Needs a Risk Management Program

Unpredictability is the only constant in today’s business landscape. From sudden cybersecurity breaches to economic downturns, risks can strike from any direction. A risk management program acts as your early warning system, helping you anticipate and neutralize threats before they escalate. Without one, your business is essentially flying blind, leaving you vulnerable to financial losses, legal issues, and reputational damage.

For example:

- A retail chain that identified and addressed supply chain vulnerabilities was able to maintain operations while competitors struggled during a global crisis.

- A tech company used risk assessments to enhance cybersecurity, saving millions by avoiding a costly data breach.

Wouldn’t you want your business to be among those that weather the storm while others falter?

Key Components of a Risk Management Framework

Building a risk management program is like constructing a fortress—it requires strong foundations and vigilant upkeep. Here are the essential pillars:

- Risk Identification: Pinpointing what could go wrong. Think of it as spotting cracks in the wall before they widen.

- Risk Assessment: Determining how likely and impactful those risks are. Are you dealing with a minor inconvenience or a potential catastrophe?

- Risk Mitigation: Crafting strategies to manage and reduce risks. This is your battle plan.

- Monitoring and Reporting: Continuously tracking the risk environment to stay ahead of the curve. Risks evolve, and so should your defenses.

Each of these elements works together to ensure your business remains resilient, no matter what challenges arise.

Now that we’ve uncovered the “why” and “what” of risk management, let’s explore the “how.” In the next section, we’ll break down the actionable steps to develop a risk management program tailored to your organization’s unique challenges. Buckle up—it’s time to put theory into practice!

Steps to Develop a Risk Management Program

Creating a risk management program isn’t just about dodging disasters—it’s about building a fortress of resilience that can withstand uncertainty and thrive under pressure. Here’s a detailed, step-by-step guide to developing a risk management program that doesn’t just work but transforms the way you do business.

Identifying Business Risks: Peeling Back the Layers

Before you can tackle risks, you need to know where they’re hiding. Think of your business like a puzzle, with each piece representing potential vulnerabilities. It’s time to put the picture together.

- Financial Risks: These include market volatility, exchange rate fluctuations, credit risks, and liquidity challenges. For example, imagine a company relying on a single client for most of its revenue—what happens if that client leaves? Diversifying revenue streams can mitigate this risk.

- Operational Risks: These are the hiccups that disrupt your day-to-day operations. Whether it’s supply chain interruptions, IT outages, or even human error, these risks require immediate attention. For instance, a global logistics company might use real-time tracking tools to reduce operational risks.

- Strategic and Reputational Risks: Misaligned objectives, poor strategic decisions, or reputational damage from social media backlash can derail long-term plans. Consider the rise of consumer boycotts following high-profile controversies; businesses without crisis management strategies often falter under the pressure.

Emerging Risks: The Silent Threats

As industries evolve, so do the risks. Cybersecurity threats, climate change-related disruptions, and rapidly changing regulations are just a few examples. Identifying these emerging risks requires a forward-thinking approach, blending expertise with cutting-edge tools like predictive analytics.

Risk Assessment Techniques: Turning the Unknown into the Known

Once you’ve uncovered potential risks, the next step is to assess their severity and likelihood. This process turns gut feelings into actionable insights.

-

Qualitative vs. Quantitative Analysis:

- Qualitative: Think of this as the storytelling side of risk assessment. By engaging experts and brainstorming scenarios, you get a sense of what’s possible. For example, “What’s the fallout if our competitor launches a similar product?”

- Quantitative: This is the data-driven side. It uses historical data, statistical models, and financial calculations to predict impacts. “How much revenue would we lose if a supply chain delay extended delivery by a week?”

-

Tools for Risk Identification:

- SWOT Analysis: Highlight strengths, weaknesses, opportunities, and threats to see the bigger picture.

- Scenario Planning: Test different “what-if” scenarios to anticipate potential outcomes.

- Risk Matrices: Plot risks based on their likelihood and impact to prioritize efforts effectively.

Predictive Analytics: A Game-Changer

Predictive analytics takes traditional risk assessment up a notch. By analyzing trends, market conditions, and internal data, businesses can predict risks before they occur. Imagine being alerted to a potential supplier default three months in advance—this is where technology meets strategy.

Risk Mitigation Strategies: Your Arsenal of Defense

With risks identified and assessed, it’s time to act. Mitigation isn’t about eliminating risks entirely—it’s about making them manageable and preparing for the unexpected.

- Avoidance: The simplest strategy is to steer clear of risks altogether. For example, a business may choose not to expand into a market plagued by political instability.

- Reduction: Mitigate the impact or likelihood of a risk. Enhancing cybersecurity measures or investing in employee training are examples of risk reduction.

- Sharing: Transfer some of the burden to third parties, such as insurers or strategic partners. A small business might purchase liability insurance to handle potential legal claims.

- Acceptance: Acknowledge the risk but prepare for its consequences. For example, startups often accept market volatility while implementing measures to bounce back quickly.

Contingency Planning: Your Backup Playbook

When all else fails, a contingency plan ensures you’re not left scrambling. These plans outline clear steps for managing crises, like backup suppliers for critical materials or predefined communication strategies for PR issues. For instance, companies in hurricane-prone areas often have disaster recovery plans that include securing alternative facilities.

Continuous Monitoring: Staying One Step Ahead

Risks are like waves—they don’t stop coming. Continuous monitoring ensures your risk management program evolves with the times. Regular reviews, audits, and the integration of real-time data can help you stay ahead of the curve. Businesses that adopt a proactive approach to risk monitoring often find themselves better equipped to adapt to sudden changes.

Adaptation in Action

Consider a retail giant that uses IoT devices to monitor inventory levels across stores. By analyzing data trends, they can predict supply chain disruptions and react before shelves run empty.

Building Resilience: From Reactive to Proactive

A well-designed risk management program doesn’t just protect—it empowers. It allows you to turn potential threats into strategic advantages, fostering innovation and agility in an unpredictable world.

Ready to Reap the Benefits?

Now that you know how to build a risk management program, it’s time to discover what it can do for your business. In the next section, we’ll explore the transformative benefits of an effective risk management program—from better decision-making to enhanced compliance and stability. Let’s unlock the rewards of resilience!

Benefits of an Effective Risk Management Program

Imagine navigating a maze with a detailed map versus wandering aimlessly. That’s the difference an effective risk management program makes. It’s not just about dodging dangers—it’s about charting a course to success. Let’s break down how this program transforms risks into opportunities and becomes a powerhouse for growth.

Improved Decision-Making: Clarity in Chaos

Decision-making in business often feels like walking a tightrope. Should you expand into a new market? Invest in emerging technologies? Without clear insights, every move feels like a gamble.

An effective risk management program provides clarity by identifying potential pitfalls and opportunities.

- Real-World Example: A manufacturing company using predictive analytics discovered that a critical supplier was nearing bankruptcy. Armed with this knowledge, they secured alternative suppliers, avoiding production halts.

- The Competitive Edge: With clear data on risks, businesses can act decisively, gaining an edge over competitors stuck in analysis paralysis.

Enhanced Compliance and Security: Stay Ahead of Regulations

Ever-changing regulations can feel like a moving target, especially in industries like healthcare, finance, and energy. Non-compliance isn’t just a slap on the wrist—it can mean hefty fines, legal battles, or damaged reputations.

- Compliance Simplified: A risk management program ensures your policies and processes align with industry standards. By identifying potential compliance gaps early, you save time, money, and stress.

- Cybersecurity Fortified: With rising cyber threats, data breaches can cripple businesses. An effective program identifies vulnerabilities and implements safeguards, ensuring that your sensitive information stays out of the wrong hands.

Financial and Operational Stability: Weather Any Storm

Stability isn’t just about avoiding disaster—it’s about thriving through uncertainty. Whether it’s a market downturn, supply chain disruption, or economic uncertainty, a risk management program builds resilience.

- Protecting Cash Flow: Imagine a retail chain that anticipates seasonal downturns and adjusts inventory accordingly. They maintain profitability while competitors are left with unsold stock.

- Ensuring Operational Continuity: By identifying operational risks, businesses can put contingency plans in place, ensuring minimal disruption even in the face of unexpected challenges.

Fostering Innovation Through Managed Risks

Here’s the surprising truth: risks and innovation go hand in hand. A robust risk management program doesn’t stifle creativity—it encourages it by creating a safety net.

- Encouraging Bold Moves: When you know potential risks are accounted for, you’re free to explore innovative ideas and take calculated risks. For instance, a tech startup launching a disruptive product can rely on their program to mitigate market-entry risks.

- Driving Growth: Businesses that manage risks effectively often lead in their industries because they’re not afraid to push boundaries.

Building Stakeholder Confidence

Confidence isn’t just for internal teams—your stakeholders, investors, and customers need to trust that your business can weather challenges.

- Investor Trust: A strong risk management program signals to investors that you’re not only prepared for uncertainties but also committed to long-term growth.

- Customer Loyalty: Customers are drawn to businesses they trust. A company that transparently manages risks, like product recalls or data breaches, builds stronger relationships with its audience.

From Protection to Possibility

A great risk management program does more than shield your business—it propels it forward. But implementing one isn’t always straightforward. In the next section, we’ll dive into the challenges businesses face when rolling out these programs and explore best practices to overcome them. Let’s tackle the hurdles head-on!

Challenges in Implementing Risk Management Programs

Developing a risk management program sounds like a no-brainer, but putting it into practice? That’s where the real battle begins. Businesses often stumble at the implementation stage, facing barriers that can make the entire process feel overwhelming. But here’s the good news: every challenge is an opportunity in disguise. Let’s uncover these hurdles and how to leap over them with finesse.

Common Barriers: Why Implementation Stumbles

Even the best-laid plans can hit roadblocks. Here are the most common challenges organizations face when implementing risk management programs:

Lack of Awareness: The Knowledge Gap

You can’t manage what you don’t understand. Many employees and even decision-makers fail to grasp the importance of risk management or see it as a bureaucratic exercise. This lack of buy-in often results in half-hearted efforts.

- Impact: Without awareness, risk management feels like an “add-on” rather than a core business function.

- Real-World Example: A small tech startup suffered a major data breach because employees didn’t follow cybersecurity protocols—they weren’t even aware they existed!

Resource Constraints: The Budget and Personnel Crunch

Let’s face it—risk management programs require time, money, and expertise. For smaller businesses or those operating on tight margins, dedicating resources to this initiative can seem like a luxury they can’t afford.

- Impact: Underfunded programs lead to gaps in risk identification and mitigation.

- Real-World Example: A manufacturing company with limited IT resources struggled to update its aging systems, leaving it vulnerable to ransomware attacks.

Complexity: The Multilayered Maze

Risk management often involves juggling multiple departments, each with its unique set of challenges and priorities. Coordinating efforts across finance, operations, IT, and HR can feel like herding cats.

- Impact: Siloed efforts and misaligned goals can cause important risks to slip through the cracks.

- Real-World Example: A retail chain faced massive inventory losses because their procurement and logistics teams didn’t align on risk mitigation strategies.

Resistance to Change

One of the less obvious but equally significant barriers is resistance from within. Employees and even leadership teams can be hesitant to embrace new systems, seeing them as disruptive or unnecessary.

- Impact: Resistance leads to delays in implementation, incomplete adoption, or outright rejection of risk management initiatives.

- Real-World Example: A financial institution’s employees resisted a new fraud detection tool, citing complexity, until tailored training sessions eased the transition.

Solutions and Best Practices to Overcome Challenges

The hurdles may be high, but they’re not insurmountable. With the right strategies, your organization can implement a risk management program that thrives.

Training and Awareness Campaigns: Knowledge Is Power

Educating your team is the foundation of a successful program. Awareness campaigns, workshops, and real-world examples help employees and stakeholders understand the program's value.

- Best Practice: Share stories of businesses that avoided disasters thanks to risk management.

- Pro Tip: Use relatable scenarios to demonstrate the impact of unmanaged risks on everyday operations.

Leveraging Technology: Automation to the Rescue

Modern challenges require modern solutions. Automated tools simplify complex tasks, from real-time risk monitoring to predictive analytics.

- Best Practice: Start small by implementing tools that address specific pain points, like cybersecurity or compliance, and scale up as needed.

- Pro Tip: Choose user-friendly platforms to encourage adoption and minimize resistance.

Clear Communication: Breaking Down Silos

Collaboration is the secret ingredient to successful risk management. Encourage open communication across departments to align goals and share insights.

- Best Practice: Appoint a dedicated risk management coordinator to streamline efforts.

- Pro Tip: Use cross-functional workshops to identify interdepartmental risks and solutions.

Prioritizing Incremental Wins

Rome wasn’t built in a day, and neither is a perfect risk management program. Focus on achieving small, impactful wins that build momentum and showcase the program’s value.

- Best Practice: Tackle the most pressing risks first, such as compliance issues or cybersecurity vulnerabilities.

- Pro Tip: Celebrate these early successes to foster buy-in from skeptics.

Building a Risk-Aware Culture

Risk management isn’t just a process—it’s a mindset. By embedding risk awareness into your company culture, you create an environment where employees actively identify and mitigate risks.

- Best Practice: Integrate risk management into onboarding, performance reviews, and decision-making processes.

- Pro Tip: Recognize and reward employees who contribute to risk mitigation efforts.

From Challenges to Case Studies

Overcoming challenges is the first step toward creating a risk-resilient organization. But what does success look like? In the next section, we’ll explore real-world case studies of businesses that implemented risk management programs and reaped the rewards. Let’s see how theory transforms into action!

Case Studies and Real-World Examples: Risk Management in Action

What separates businesses that thrive in the face of uncertainty from those that crumble? The answer often lies in how effectively they manage risks. Let’s dive into real-world examples where businesses transformed potential disasters into opportunities for growth, showcasing the true power of a well-executed risk management program.

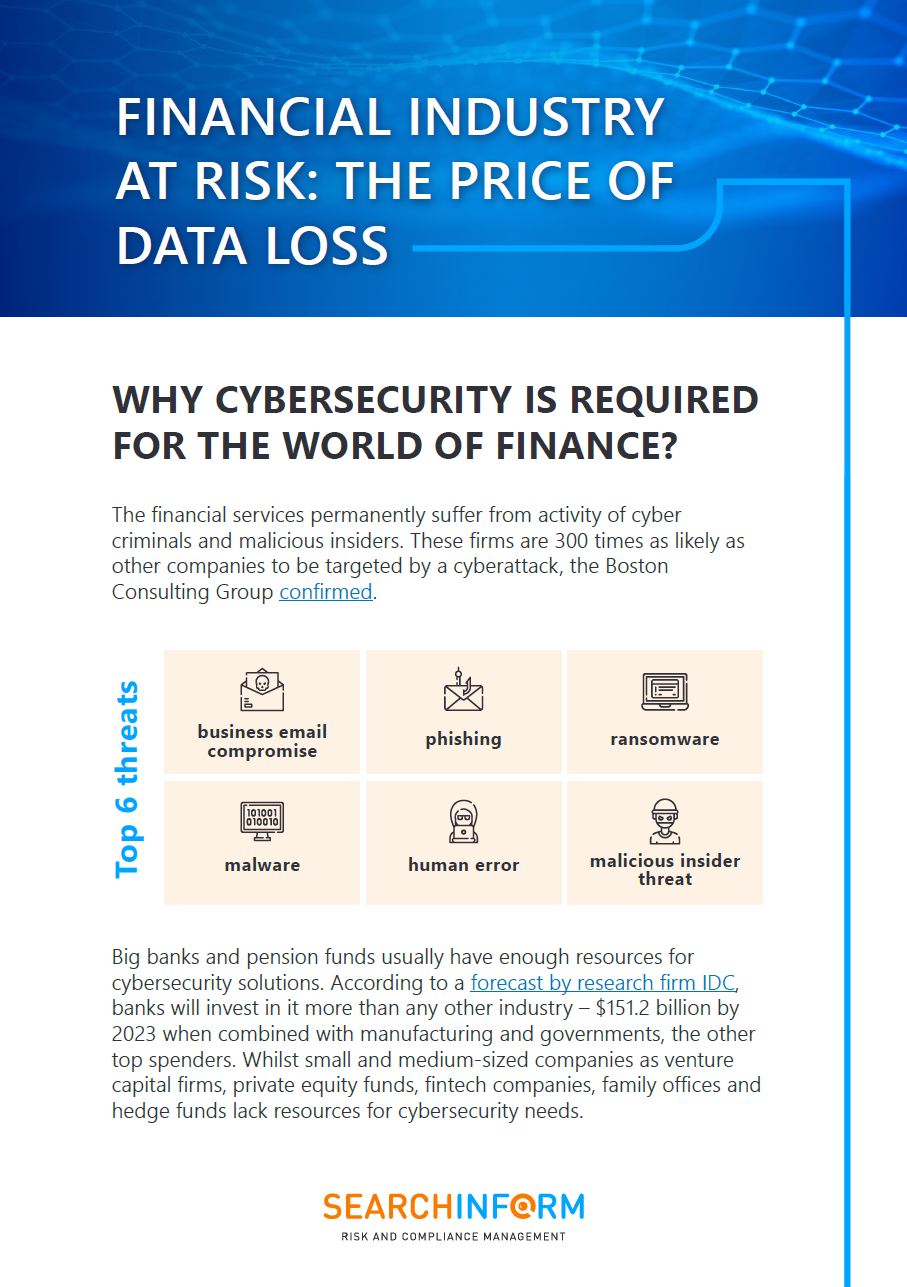

A Financial Firm: Fortifying Cybersecurity and Safeguarding Data

Cyberattacks are a growing menace, especially for financial institutions handling sensitive customer data. One global financial firm faced a spike in attempted data breaches targeting their network. Without robust defenses, they were at risk of massive financial and reputational losses.

The Challenge

The company lacked a centralized system to monitor and prevent data leaks. Employees unintentionally exposed sensitive data, and hackers exploited these vulnerabilities.

The Solution

By implementing a data loss prevention (DLP) solution, the firm gained real-time visibility into data flow across its network. Predictive algorithms flagged unusual activities, and automated alerts allowed the security team to respond swiftly.

The Outcome

The firm reduced cybersecurity breaches by 60% within the first year, protecting not only its assets but also its clients’ trust.

Takeaway: Proactive risk management tools can turn a company from a cyberattack target into a fortress of security.

A Manufacturing Company: Building Resilient Supply Chains

In the manufacturing world, supply chain disruptions can halt production lines and result in substantial losses. One multinational manufacturing firm discovered this the hard way when a key supplier unexpectedly went out of business.

The Challenge

With no contingency plan in place, production delays loomed. The firm risked losing millions in contracts and damaging relationships with customers.

The Solution

The company adopted predictive analytics to assess supplier health and identify risks early. They diversified their supplier base, ensuring that no single partner was critical to operations.

The Outcome

Despite the supplier setback, the firm maintained uninterrupted production and even secured new contracts by showcasing its robust risk management processes.

Takeaway: A diversified and data-informed approach to risk management keeps operations running smoothly, even in turbulent times.

A Retail Chain: Protecting Customer Data and Brand Reputation

Retailers are increasingly under threat from cyberattacks targeting customer payment information. A regional retail chain faced a potential nightmare when hackers attempted to breach its point-of-sale (POS) system.

The Challenge

The company lacked end-to-end encryption for customer transactions, leaving payment data vulnerable.

The Solution

By deploying a risk management program focused on cybersecurity, including POS encryption and employee training, the chain significantly reduced vulnerabilities.

The Outcome

No customer data was compromised during the breach attempt, and the company strengthened customer loyalty by demonstrating its commitment to security.

Takeaway: Proactively addressing cybersecurity risks protects not only your customers but also your brand's reputation.

A Healthcare Organization: Mitigating Operational Risks

Healthcare providers are under immense pressure to maintain uninterrupted services. One major hospital network faced a ransomware attack that threatened patient care and access to critical medical records.

The Challenge

The hospital’s IT infrastructure was not adequately prepared to counter sophisticated ransomware attacks.

The Solution

The organization implemented a multi-layered risk management strategy, including frequent data backups, employee awareness training, and advanced threat detection systems.

The Outcome

When ransomware hit, the hospital quickly restored operations from backups and avoided paying the ransom, minimizing downtime and ensuring patient safety.

Takeaway: A strong risk management framework in healthcare isn’t optional—it’s a lifesaver.

A Tech Startup: Navigating Market Uncertainty

Startups face unique risks, from market volatility to resource constraints. One tech startup developing a niche product had to pivot quickly when their target market became saturated with competitors.

The Challenge

Without the resources to compete with larger players, the startup faced potential collapse.

The Solution

The company used scenario planning to explore alternative markets and adapt its product for a different audience. By leveraging their risk management program, they shifted their focus to a less saturated niche.

The Outcome

The startup not only survived but thrived, doubling its market share in a previously untapped sector.

Takeaway: Risk management fosters agility, allowing businesses to adapt quickly to changing circumstances.

Lessons Learned from Failed Risk Management

While success stories inspire, failures can teach invaluable lessons. Here are a few examples of companies that faced major setbacks due to ineffective risk management:

- A Retail Giant: Ignored cybersecurity warnings and faced a breach that exposed millions of customer records, leading to lawsuits and lost revenue.

- A Construction Firm: Overlooked compliance risks and incurred massive fines when regulators discovered violations.

- A Financial Institution: Relied on outdated risk models and suffered significant losses during an economic downturn.

Key Lesson: Ignoring risks doesn’t make them disappear. Effective risk management isn’t a luxury—it’s a necessity.

Success in Risk, Success in Business

These stories highlight a universal truth: proactive risk management isn’t just about avoiding pitfalls—it’s about unlocking potential. But the landscape of risks is constantly changing. In the next section, we’ll explore the future of risk management, including cutting-edge trends like predictive analytics and blockchain. Let’s take a peek into what lies ahead!

Future Trends in Risk Management: A Glimpse into What’s Next

The world is changing faster than ever, and with it, the nature of risks. Traditional approaches to risk management are no longer enough to keep up. Businesses need cutting-edge tools, innovative strategies, and forward-thinking solutions to stay ahead. So, what does the future of risk management look like? Let’s dive into the trends shaping the landscape of tomorrow.

Predictive Analytics in Risk Assessment: From Guesswork to Foresight

Imagine being able to foresee risks before they strike—like having a crystal ball for your business. Thanks to predictive analytics, this isn’t science fiction anymore; it’s reality.

How Predictive Analytics Works

By analyzing historical data and spotting patterns, machine learning and AI can predict potential risks with astonishing accuracy. For example:

- Supply Chain Risks: Predictive models can identify weak links in supply chains before they fail.

- Financial Threats: AI can spot market trends and anomalies, helping businesses adjust strategies proactively.

Real-World Impact

A logistics company used predictive analytics to anticipate port delays caused by weather patterns. By rerouting shipments in advance, they saved millions in operational costs.

Why It Matters: Predictive analytics transforms risk management from reactive to proactive, giving businesses a competitive edge.

The Role of Blockchain in Risk Management: The Trust Revolution

Blockchain technology isn’t just for cryptocurrency—it’s revolutionizing how businesses manage risks, especially in areas requiring transparency and trust.

Blockchain in Action

- Supply Chain Integrity: Blockchain ensures every step of the supply chain is transparent, reducing fraud and inefficiencies.

- Financial Security: Smart contracts automatically execute transactions when conditions are met, reducing human error and fraud risks.

- Data Protection: Blockchain’s decentralized nature makes it nearly impossible for hackers to tamper with data.

Real-World Example

A global food supplier implemented blockchain to track product origins, reducing the risk of contamination and fraud. When a recall was necessary, the company pinpointed the issue within hours instead of weeks, saving both costs and reputation.

Why It Matters: Blockchain’s ability to enhance transparency and security makes it a cornerstone for future risk management strategies.

Emerging Threats and Evolving Strategies: Adapting to the Unknown

The future of risk management isn’t just about adopting new tools—it’s about preparing for risks we haven’t even imagined yet.

Climate Change and Environmental Risks

Natural disasters are becoming more frequent and severe, threatening businesses across industries. Companies must integrate climate risk management into their strategies, from assessing flood risks to reducing carbon footprints.

The Rise of Cyber Threats

Cyberattacks are evolving, targeting not just data but entire operational systems. Businesses need advanced threat detection systems, regular audits, and employee training to stay secure.

Socioeconomic Shifts

Global pandemics, political instability, and economic fluctuations are reshaping the risk landscape. Organizations need flexible strategies to navigate these uncertainties, such as scenario planning and diversification.

Real-World Example

A pharmaceutical company mitigated supply chain risks during the COVID-19 pandemic by diversifying its manufacturing locations, ensuring steady production despite regional lockdowns.

The Role of ESG in Risk Management

Environmental, Social, and Governance (ESG) factors are becoming critical components of risk management.

- Environmental Risks: Climate-friendly operations reduce regulatory risks and enhance brand reputation.

- Social Risks: Addressing employee well-being and customer trust minimizes reputational damage.

- Governance Risks: Strong governance practices ensure compliance and ethical decision-making.

Why ESG Matters

Investors, customers, and regulators are paying closer attention to ESG performance. Companies integrating ESG into their risk management programs not only mitigate risks but also unlock new growth opportunities.

Human-Centered Risk Management

In the future, risk management will focus more on people—employees, customers, and stakeholders.

The Human Factor

- Employee Training: Empowering employees with risk awareness reduces human errors.

- Customer Trust: Transparent communication during crises builds stronger customer loyalty.

- Stakeholder Engagement: Collaborating with stakeholders fosters a collective approach to risk mitigation.

Real-World Example

A telecom company reduced phishing attacks by implementing gamified cybersecurity training for employees, making risk management engaging and effective.

Embracing the Future with Confidence

The future of risk management is dynamic, tech-driven, and people-focused. But no matter how advanced the tools, businesses need the right partner to navigate this evolving landscape. In the next section, we’ll explore how SearchInform’s solutions are helping businesses stay ahead of the curve. Let’s take a closer look at the tools transforming risk into opportunity!

How SearchInform Can Help: Turning Challenges Into Opportunities

Managing risks is no longer just about avoiding disasters—it’s about creating opportunities for growth and innovation. SearchInform takes the complexity out of risk management with cutting-edge solutions tailored to the modern business landscape. Whether it’s protecting data, anticipating threats, or enhancing compliance, SearchInform equips you with the tools to stay ahead.

A Revolution in Risk Management Solutions

SearchInform doesn’t just provide tools; it delivers a comprehensive framework for navigating risks. With intuitive platforms and forward-thinking features, SearchInform transforms risk management from a reactive chore into a proactive strategy.

What Sets SearchInform Apart?

- All-in-One Coverage: Address every type of risk, from operational disruptions to insider threats.

- Scalable and Adaptable: Designed to fit businesses of all sizes and industries.

- Actionable Insights: Turn data into decisions with real-time analytics and alerts.

Key Features and Benefits: Why SearchInform Stands Out

Let’s dive into how SearchInform can transform your risk management approach with powerful features and tools.

1. Comprehensive Monitoring: Catch Risks Before They Strike

What if your business could identify risks as they arise, giving you the time to act decisively? SearchInform’s real-time monitoring tools provide a 360-degree view of your organization’s risk landscape, ensuring no vulnerability goes unnoticed.

- Hypothetical Scenario: Imagine you run a retail chain and notice unusual login attempts across multiple locations. With SearchInform, you’d get an instant alert, allowing you to lock down systems before a potential breach occurs.

The Benefit? Real-time oversight that keeps your operations secure and smooth.

2. Proactive Alerts: A Heads-Up When It Matters Most

What if you had a system that could predict risks before they turned into full-blown crises? SearchInform’s proactive alerts use advanced analytics to notify you of unusual patterns or behaviors, giving you a crucial advantage.

- Hypothetical Scenario: Picture an energy company receiving an alert about irregular employee behavior, hinting at a potential insider threat. By acting immediately, the company could prevent sensitive data from leaking.

The Benefit? Stay one step ahead of threats and protect your assets.

3. Customizable Dashboards: Insights That Work for You

What if you could filter out the noise and focus only on the most critical risks? SearchInform’s customizable dashboards let you prioritize information and make decisions faster.

- Hypothetical Scenario: Say you’re a CFO preparing for an audit. Your dashboard highlights compliance metrics, allowing you to address gaps efficiently before the auditors arrive.

The Benefit? Streamlined decision-making powered by tailored insights.

4. Advanced Data Loss Prevention (DLP): Shielding Your Crown Jewels

What if your most valuable data was always protected, no matter what? SearchInform’s DLP tools secure sensitive information from leaks, breaches, or unauthorized access.

- Hypothetical Scenario: Imagine being a healthcare provider safeguarding patient records. A suspicious email attachment is flagged and quarantined before it can compromise your system.

The Benefit? A rock-solid defense for your business-critical data.

5. Predictive Risk Analysis: Anticipate the Future

What if you could see risks coming months in advance? With predictive analytics, SearchInform uses historical data and AI to foresee potential issues and offer actionable insights.

- Hypothetical Scenario: You’re a logistics company preparing for holiday season demand. Predictive analytics reveal potential delays at key ports, allowing you to reroute shipments and maintain customer satisfaction.

The Benefit? The confidence to prepare for tomorrow, today.

6. Seamless Integration: Plug and Play Simplicity

What if implementing a new risk management system didn’t disrupt your current operations? SearchInform’s tools integrate seamlessly into your existing infrastructure, minimizing downtime and maximizing efficiency.

- Hypothetical Scenario: You’re an IT manager deploying SearchInform alongside your legacy systems. Within days, your team is using the platform without missing a beat.

The Benefit? Enhanced capabilities without the growing pains.

What Could Happen if You Team with SearchInform

Retail

What if your retail chain detected a data breach before it impacted customer trust? With SearchInform’s monitoring and alerts, you could swiftly address vulnerabilities, saving millions in potential recovery costs.

Healthcare

What if your hospital avoided a ransomware attack and ensured uninterrupted patient care? By implementing SearchInform’s DLP and predictive analytics, you’d protect sensitive records and maintain operational continuity.

Finance

What if your financial institution identified fraudulent activity before it spiraled out of control? SearchInform’s tools could flag unusual transactions, safeguarding both assets and reputation.

Why SearchInform Is Your Future Partner in Risk Management

The risks of tomorrow demand the tools of the future. SearchInform combines advanced technology with user-friendly design, empowering businesses to:

- Protect critical assets: Safeguard your most valuable data and systems.

- Enhance compliance: Stay ahead of evolving regulations.

- Boost decision-making: Gain clarity and confidence with actionable insights.

Take Control of Your Risks Today

Why let risks dictate your future when you can take control now? With SearchInform by your side, you’ll transform risk management into a strategic advantage, protecting your business and unlocking new opportunities.

Your move? Contact us today and discover how our solutions can empower your business to thrive in an unpredictable world. Don’t just manage risks—master them.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!