Effective Risk Identification for Businesses

- Introduction to Risk Identification

- Steps in Risk Identification

- Understanding Organizational Objectives and Context

- Identifying Risk Sources: Internal and External

- Emerging and Hidden Risks

- Risk Categorization

- Bridging the Gaps with Cross-Functional Insights

- Methods and Techniques for Risk Identification

- Brainstorming and Workshops: Power in Collaboration

- SWOT Analysis: Unveiling Hidden Insights

- Risk Checklists and Templates: Covering All Bases

- Root Cause Analysis (RCA): Digging Deeper

- Scenario Planning and Stress Testing: Preparing for the Worst

- Emerging Techniques: Leveraging New Approaches

- Amplifying Risk Discovery

- Technological Aids in Risk Identification

- Data-Driven Risk Identification Techniques

- Predictive Analytics and Artificial Intelligence: The Crystal Ball of Risk

- Real-Time Monitoring: Staying Ahead of the Curve

- Scenario Modeling and Digital Twins: Risk Simulation for the Modern Era

- The Role of Blockchain in Risk Management

- Industry-Specific Risk Identification

- Financial Services: A Battlefield of Fraud and Compliance

- Healthcare: Where Patient Safety and Compliance Intersect

- Retail: The Balancing Act of Supply Chains and Cybersecurity

- Manufacturing: Keeping the Machines Running

- Emerging Risk Trends Across Industries

- Common Challenges in Risk Identification

- Incomplete or Inaccurate Data: The Risk of Flying Blind

- Lack of Organizational Buy-In: Building a Culture of Accountability

- Overlooking Emerging Risks: Staying Ahead in a Rapidly Evolving World

- Resistance to Change: Overcoming Legacy Systems and Processes

- Resource Constraints: Doing More with Less

- Navigating Complexity: Managing Interconnected Risks

- Risk Documentation and Reporting

- Best Practices for Risk Registers: Your Risk Management Playbook

- Expanding the Concept: Visual Risk Dashboards

- Integrating Risk Identification into Governance: Building Trust Through Transparency

- New Dimensions: Linking Risks to Strategic Goals

- Communication is Key: Making Risk Reports Accessible

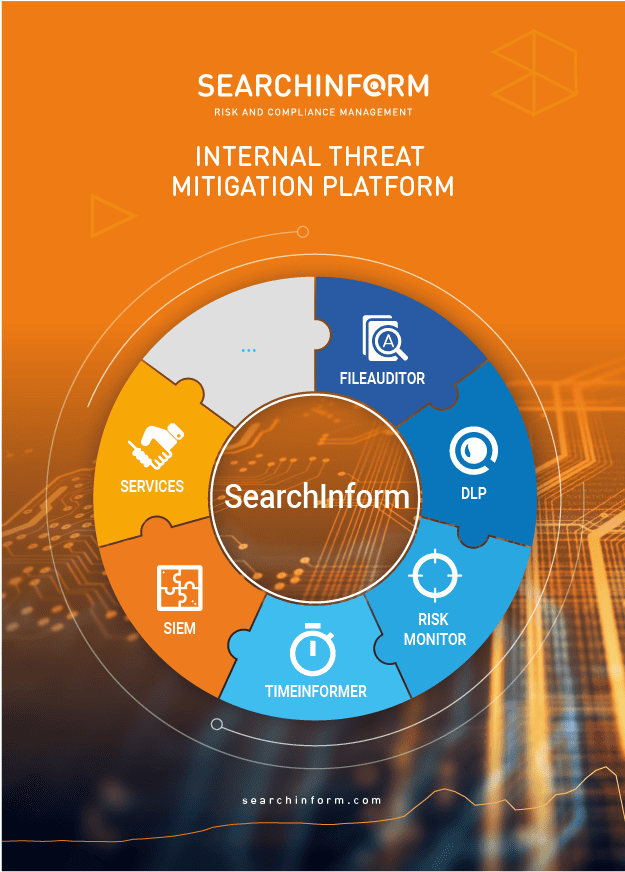

- How SearchInform Identifies and Mitigates Business Risks

- Precision in Risk Identification

- Real-Time Risk Detection: Staying Ahead of Threats

- Advanced Risk Discovery: The Power of Prediction

- Tailored Solutions for Industry-Specific Challenges

- Integration with Governance and Reporting Frameworks

- Your Partner in Resilience and Growth

Introduction to Risk Identification

Imagine you’re steering a ship through foggy waters without a compass or radar. The unseen dangers—hidden rocks, shifting currents, and approaching storms—could spell disaster at any moment. This is what running a business feels like without a solid grasp of risk identification. Just as a captain relies on navigation tools to avoid catastrophe, businesses need a proactive approach to spotting potential threats before they emerge.

Risk identification is not just a buzzword; it’s the foundation of every successful risk management framework. By systematically uncovering vulnerabilities and anticipating challenges, businesses can turn obstacles into opportunities and safeguard their future. It’s the ultimate defense mechanism, enabling organizations to navigate the complexities of today's fast-changing landscape.

Why does this matter so much? Because risks don’t just vanish when ignored—they grow. Financial losses, reputational damage, and operational setbacks can compound over time. Early risk detection and effective risk discovery are the keys to staying ahead, ensuring your business thrives no matter what lies ahead.

The journey to mastering risk starts here. But how does risk identification work, and why is it indispensable in today’s world? Let’s uncover the answers and equip your business with the insights it needs to succeed.

Steps in Risk Identification

Risk identification is like piecing together a puzzle to reveal a complete picture of your organization's vulnerabilities and opportunities. Each step builds a clearer understanding of where risks lie and how they might impact your objectives. Let’s dive deeper into these essential steps, uncovering practical insights and real-world examples along the way.

Understanding Organizational Objectives and Context

What drives your business forward? Understanding your organizational goals and the context in which you operate is the starting point for effective risk identification. For instance, a healthcare provider striving to improve patient outcomes will face risks like data breaches, operational inefficiencies, and compliance violations. On the other hand, a retail company may focus on supply chain disruptions or cyberattacks targeting consumer data.

This step is about aligning your risk identification efforts with your strategic priorities. When you know your destination, it’s easier to spot the obstacles that could derail your journey.

Identifying Risk Sources: Internal and External

Risks come from all directions—inside your organization and out. Internal risks might include outdated technology, employee mistakes, or gaps in security protocols. External risks, however, are often unpredictable: economic downturns, natural disasters, regulatory changes, or competitive pressures.

Think of internal risks as the loose screws in a machine and external risks as the unexpected storms that test its durability. Both require attention to ensure smooth operations and long-term resilience.

Emerging and Hidden Risks

Beyond the obvious, businesses today must be vigilant about emerging risks. From technological advancements like AI misuse to hidden vulnerabilities such as third-party supplier risks, being proactive is key. Tools that specialize in risk detection can help uncover these hidden dangers, while risk discovery efforts shine a light on emerging threats before they become critical.

Risk Categorization

To tackle risks effectively, categorize them. Think of it as sorting your laundry: grouping items makes them easier to handle.

- Financial Risks: These could range from fraudulent transactions to market volatility and budget mismanagement.

- Operational Risks: Equipment breakdowns, supply chain hiccups, or inefficient processes fall under this umbrella.

- Strategic Risks: Misaligned goals, poor market positioning, or failure to innovate can derail growth.

- Compliance Risks: Non-adherence to legal or industry standards can result in penalties or damaged reputations.

- Reputational Risks: Negative press, customer dissatisfaction, or ethical missteps can erode trust and loyalty.

Breaking risks into these categories allows you to prioritize and address them strategically, ensuring no stone is left unturned.

Bridging the Gaps with Cross-Functional Insights

Another vital step is involving all relevant departments in the process. Finance might highlight budgetary concerns, while IT can pinpoint cybersecurity vulnerabilities. This cross-functional approach ensures your risk identification process is thorough and inclusive, leaving no gaps for potential issues to slip through.

Identifying risks is just the first step; the real power lies in how you address them. But before we dive into mitigation strategies, let’s explore the techniques and tools that make risk detection more precise and actionable. After all, knowing where to look is only half the battle—knowing how to look makes all the difference.

Methods and Techniques for Risk Identification

Risk identification isn’t just a checklist item—it’s a dynamic process that combines creativity, critical thinking, and collaboration. By using a variety of methods and techniques, organizations can uncover risks hiding in plain sight and anticipate challenges lurking around the corner. Let’s explore some proven approaches that make risk detection and risk discovery more effective and actionable.

Brainstorming and Workshops: Power in Collaboration

When was the last time you gathered your team in a room and asked, “What could go wrong?” Brainstorming sessions and workshops bring together diverse perspectives, encouraging employees to share insights that might not surface in everyday operations.

For instance, a finance team might highlight budgetary concerns, while the IT department flags potential cybersecurity vulnerabilities. Workshops create a safe space for open dialogue, ensuring that even unconventional risks are considered.

SWOT Analysis: Unveiling Hidden Insights

Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis is a time-tested method for structured risk identification. It’s particularly effective in aligning risks with strategic goals.

Picture this: a growing e-commerce retailer uses SWOT analysis to identify supply chain vulnerabilities (weakness), emerging competitors (threat), automation potential (strength), and international market expansion (opportunity). The insights gained not only guide risk mitigation but also inform strategic decisions.

Risk Checklists and Templates: Covering All Bases

Sometimes, the simplest tools are the most effective. Risk checklists and templates ensure no stone is left unturned. Tailored to specific industries or functions, these tools provide a systematic approach to identifying common and industry-specific risks.

For example, in healthcare, a checklist might include patient data security, compliance with regulations, and operational inefficiencies. Using these templates streamlines the process, making risk identification efficient and comprehensive.

Root Cause Analysis (RCA): Digging Deeper

When risks surface repeatedly, it’s time to ask, “Why?” Root Cause Analysis goes beyond surface-level symptoms to identify the underlying causes of recurring risks.

Imagine a manufacturing company facing frequent equipment failures. RCA might reveal poor maintenance schedules or low-quality parts as the root cause. Addressing these foundational issues prevents similar risks from reoccurring, creating long-term resilience.

Scenario Planning and Stress Testing: Preparing for the Worst

What happens if the worst-case scenario becomes a reality? Scenario planning and stress testing simulate high-impact risks, allowing organizations to evaluate their preparedness.

For instance, a financial institution might test its systems against market crashes or fraud attempts. These simulations provide valuable insights, helping businesses develop robust contingency plans and enhance their risk detection capabilities.

Emerging Techniques: Leveraging New Approaches

- Crowdsourcing Risk Ideas: Why not tap into the collective intelligence of your workforce? Crowdsourcing ideas from employees across all levels and departments can reveal unexpected risks.

- Mind Mapping: This creative tool visually organizes risks, showing connections between risk categories, sources, and impacts. It’s particularly useful in identifying secondary risks often overlooked in traditional approaches.

Amplifying Risk Discovery

Identifying risks is essential, but manual techniques can only go so far in today’s fast-paced environment. Up next, we’ll explore how cutting-edge technologies, such as data-driven tools and AI-powered solutions, elevate risk detection to new heights, making risk discovery not only faster but also smarter. Let’s dive into the future of risk management.

Technological Aids in Risk Identification

In today’s fast-paced world, manual methods of risk identification can only take you so far. Technology is the game-changer, providing tools and techniques that not only speed up the process but also improve precision. From analyzing big data to leveraging artificial intelligence, technology transforms how businesses approach risk detection and risk discovery.

Data-Driven Risk Identification Techniques

They say data is the lifeblood of modern business, but it’s also the key to risk identification. By analyzing trends, anomalies, and historical patterns, businesses can uncover risks that might otherwise remain hidden. For example:

- Transaction Monitoring: In the financial sector, real-time data analysis can identify unusual patterns, signaling potential fraud.

- Supply Chain Analytics: Retailers use data to pinpoint vulnerabilities in their supply chains, such as delays or over-reliance on specific vendors.

Data-driven risk detection enables organizations to act swiftly, preventing small issues from snowballing into crises.

Predictive Analytics and Artificial Intelligence: The Crystal Ball of Risk

Imagine predicting a risk before it even appears on your radar. That’s the power of predictive analytics and artificial intelligence (AI). These tools don’t just look at past data—they anticipate future challenges by identifying patterns that human eyes might miss.

- Machine Learning Models: By analyzing massive datasets, machine learning can flag emerging risks like customer churn, compliance violations, or operational inefficiencies.

- Natural Language Processing (NLP): This AI technology scans emails, contracts, and reports to detect potential risks in communications or agreements.

For instance, predictive models in the healthcare industry might highlight risks related to patient safety, such as medication errors or treatment delays. This proactive approach ensures that mitigation steps can be taken well in advance.

Real-Time Monitoring: Staying Ahead of the Curve

Risk doesn’t wait for quarterly reviews—it evolves constantly. Real-time monitoring systems allow organizations to detect risks as they happen, enabling immediate responses. Examples include:

- Network Monitoring: Detecting cybersecurity threats like unauthorized access or malware in real time.

- IoT Sensors: In manufacturing, IoT devices monitor equipment performance, flagging potential failures before they occur.

With these tools, businesses can shift from reactive to proactive risk management, minimizing disruptions and maximizing resilience.

Scenario Modeling and Digital Twins: Risk Simulation for the Modern Era

What if you could test your risk response strategies in a virtual environment before implementing them in the real world? That’s where scenario modeling and digital twins come into play.

- Scenario Modeling: Simulates potential crises, such as market crashes or supply chain disruptions, allowing organizations to assess their preparedness.

- Digital Twins: Digital replicas of physical systems or processes help businesses experiment with risk mitigation strategies in a controlled, virtual space.

These tools bring risk discovery to life, offering actionable insights that make a tangible difference.

The Role of Blockchain in Risk Management

Blockchain isn’t just for cryptocurrency—it’s a powerful tool for risk detection and prevention. Its transparent, immutable ledger ensures accountability and reduces risks in areas like:

- Supply Chain Integrity: Tracking goods from origin to destination to prevent counterfeiting or fraud.

- Smart Contracts: Automating agreements to ensure compliance and reduce legal risks.

Technology has revolutionized how risks are identified and managed across industries. But each sector has unique challenges, from compliance in healthcare to fraud detection in financial services. Next, we’ll explore how risk identification tools are tailored to meet the demands of specific industries, ensuring no stone is left unturned in the quest for resilience.

Industry-Specific Risk Identification

Every industry has its unique set of risks, shaped by its environment, operations, and customer base. Tailoring risk identification, risk detection, and risk discovery to specific sectors ensures businesses address challenges with precision and efficiency. Let’s dive into how different industries tackle their most pressing vulnerabilities.

Financial Services: A Battlefield of Fraud and Compliance

The financial services sector operates in a high-stakes environment where fraud and regulatory risks dominate the landscape. Whether it’s suspicious transactions, money laundering, or insider trading, effective risk detection can make or break an institution’s credibility.

- Fraud Detection: Monitoring real-time transactions helps identify anomalies, such as unusual spending patterns or unauthorized access. For example, AI-powered systems can flag potential credit card fraud within seconds.

- Regulatory Compliance: With constantly changing regulations, compliance risks are always looming. Risk discovery tools help financial institutions stay updated and ensure adherence to legal frameworks, avoiding hefty fines and reputational damage.

By leveraging advanced analytics and automation, financial firms can not only detect risks but also mitigate them proactively, safeguarding their stability and trust.

Healthcare: Where Patient Safety and Compliance Intersect

In healthcare, lives are quite literally on the line. Risks such as patient data breaches, compliance violations, and operational inefficiencies demand a robust approach to risk identification.

- Patient Data Protection: With electronic health records becoming the norm, cybersecurity is critical. Risk detection systems can pinpoint vulnerabilities in data storage and transfer, preventing breaches that could compromise patient trust.

- Regulatory Adherence: Healthcare providers must comply with strict regulations like HIPAA. Risk discovery tools help ensure that policies are followed, minimizing legal and financial repercussions.

- Operational Readiness: Identifying risks in operational workflows, such as delays in patient care or equipment failures, ensures seamless service delivery.

By addressing these risks head-on, healthcare organizations can enhance both patient outcomes and institutional reputation.

Retail: The Balancing Act of Supply Chains and Cybersecurity

Retailers face a dual challenge: managing complex supply chains while protecting consumer data in an increasingly digital world. Effective risk identification ensures both aspects are addressed without compromise.

- Supply Chain Vulnerabilities: From delayed shipments to inventory mismanagement, retail operations hinge on smooth supply chains. Advanced analytics can flag bottlenecks or over-reliance on single vendors.

- Consumer Data Risks: With the rise of e-commerce, protecting customer data is non-negotiable. Risk detection tools identify weak points in cybersecurity, ensuring sensitive information remains secure.

Retailers who invest in comprehensive risk management not only protect their bottom line but also build consumer trust, a valuable asset in today’s competitive market.

Manufacturing: Keeping the Machines Running

Manufacturing thrives on precision and efficiency, but risks such as equipment failures, workplace hazards, and supply chain disruptions can throw a wrench in the works.

- Operational Risks: Sensors and IoT devices monitor machinery in real time, identifying issues before they escalate. Predictive maintenance tools further reduce downtime by anticipating failures.

- Workplace Safety: Risk detection systems analyze workplace conditions, flagging potential hazards to ensure employee safety and compliance with regulations.

- Supply Chain Continuity: Manufacturing often depends on raw materials sourced globally. Risk discovery tools track geopolitical and economic factors, ensuring uninterrupted production.

With these measures, manufacturers can maintain seamless operations while reducing costs and risks.

Emerging Risk Trends Across Industries

While each industry has unique challenges, some emerging risks cut across sectors:

- Climate-Related Risks: From natural disasters disrupting supply chains to stricter environmental regulations, climate concerns are reshaping risk identification practices.

- Cybersecurity Risks: With digital transformation sweeping all industries, cyber threats are a universal concern. Tools for risk detection and discovery play a pivotal role in mitigating these challenges.

- Third-Party Risks: As businesses increasingly rely on vendors and partners, risks stemming from third-party failures have become more prominent. Comprehensive risk assessment ensures that partnerships remain secure and efficient.

While industries tackle risks with sector-specific strategies, the process is not without its hurdles. Up next, we’ll explore common challenges in risk identification and how businesses can navigate them effectively. Let’s uncover the obstacles and the solutions that keep businesses resilient.

Common Challenges in Risk Identification

Risk identification is a critical process, but it’s not without its hurdles. These challenges often stem from organizational inefficiencies, rapidly changing environments, and human oversight. Tackling them head-on requires a combination of strategy, technology, and culture. Let’s explore these barriers in greater detail and uncover actionable solutions to overcome them.

Incomplete or Inaccurate Data: The Risk of Flying Blind

Data is the foundation of effective risk detection and risk discovery. However, incomplete or inaccurate data can skew the entire process, leaving critical risks undetected.

- The Challenge: Data silos, outdated systems, and manual entry errors often result in missing or misleading information.

- The Solution: Investing in integrated data systems and automated validation processes ensures data accuracy. Businesses should also establish regular audits to clean and update their datasets.

For example, a retail company relying on outdated customer data might fail to identify cybersecurity risks, leaving sensitive information exposed. With accurate, real-time data, such risks can be spotted and addressed immediately.

from different sources:

Lack of Organizational Buy-In: Building a Culture of Accountability

Risk identification requires collective effort, but without organizational buy-in, even the best strategies can falter.

- The Challenge: Employees might view risk management as a burden, while leadership may underestimate its value. This lack of engagement results in blind spots across the organization.

- The Solution: Foster a culture of accountability by embedding risk management into everyday operations. Regular training, clear communication about the importance of risk detection, and leadership-driven initiatives can encourage widespread participation.

A financial institution, for instance, might involve all departments in regular risk workshops, ensuring a comprehensive and collaborative approach to identifying and mitigating threats.

Overlooking Emerging Risks: Staying Ahead in a Rapidly Evolving World

In today’s fast-paced environment, yesterday’s risks may no longer be relevant, and new challenges can emerge almost overnight.

- The Challenge: Organizations often focus on traditional risks, neglecting emerging threats such as AI misuse, geopolitical tensions, or climate-related disruptions.

- The Solution: Implement tools that monitor global trends, regulatory changes, and technological advancements. Encourage forward-thinking practices, such as scenario planning and stress testing, to prepare for the unknown.

For example, in the manufacturing industry, failing to consider the impact of climate change could lead to supply chain disruptions from extreme weather. Proactively identifying these risks ensures long-term resilience.

Resistance to Change: Overcoming Legacy Systems and Processes

Some organizations cling to outdated methods, reluctant to embrace new tools and technologies for risk detection.

- The Challenge: Legacy systems and processes may lack the flexibility needed to adapt to modern challenges. This resistance creates vulnerabilities and slows down risk discovery efforts.

- The Solution: Gradually integrate new technologies, starting with pilot projects that demonstrate their value. Highlight success stories to gain support and build momentum for broader adoption.

For instance, a healthcare provider might implement predictive analytics in one department, showcasing its effectiveness before expanding the system organization-wide.

Resource Constraints: Doing More with Less

Risk identification often takes a back seat when resources are stretched thin.

- The Challenge: Limited budgets, time, and personnel can hinder comprehensive risk detection and risk discovery efforts.

- The Solution: Prioritize risks based on potential impact and likelihood. Leverage technology to automate repetitive tasks, freeing up resources for strategic initiatives.

A small nonprofit, for example, could use free or low-cost risk management tools to identify compliance risks, ensuring they remain aligned with regulatory standards without overburdening their staff.

Navigating Complexity: Managing Interconnected Risks

Modern businesses face interconnected risks that don’t fit neatly into traditional categories.

- The Challenge: Overlapping risks—such as a cyberattack causing reputational damage—require a holistic approach that considers their ripple effects.

- The Solution: Adopt an integrated risk management framework that evaluates how risks influence one another. Tools like mind mapping can help visualize these connections, ensuring no link is overlooked.

A retail chain, for example, might use this approach to connect risks from supply chain delays to potential customer dissatisfaction, enabling a comprehensive mitigation strategy.

Challenges in risk identification may seem daunting, but they also present an opportunity to innovate, adapt, and strengthen your organization’s resilience. Up next, we’ll explore best practices for documenting and reporting risks, ensuring your efforts are actionable and aligned with broader business goals. Let’s turn these insights into impactful strategies!

Risk Documentation and Reporting

Risk identification is only the beginning of the journey. What truly solidifies its value is how effectively risks are documented and reported. Clear, detailed, and actionable documentation transforms raw data into a strategic asset, enabling businesses to turn insights into impact. Let’s explore how to ensure your risk documentation and reporting processes are as sharp and dynamic as the risks they address.

Best Practices for Risk Registers: Your Risk Management Playbook

Think of a risk register as your go-to guide for navigating the unpredictable. It’s a centralized record of risks, their details, and your game plan to tackle them.

-

Key Components of an Effective Risk Register:

- Nature of the Risk: Clearly define what the risk is and how it might affect the organization.

- Source of the Risk: Identify whether it stems from internal factors, such as employee errors, or external ones, like market volatility.

- Impact Assessment: Quantify the potential damage to financial stability, operations, or reputation.

- Likelihood of Occurrence: Use qualitative or quantitative metrics to gauge the probability of the risk happening.

- Mitigation Strategies: Detail specific actions to reduce, transfer, or eliminate the risk.

For example, a risk register for a retail company might include "data breaches from third-party vendors," with mitigation strategies such as regular vendor audits and cybersecurity training.

- Dynamic Updates: A risk register is not a static document. Regularly revisit and revise it as new risks are discovered or old ones evolve.

Expanding the Concept: Visual Risk Dashboards

Why stop at text-based risk registers? Visual dashboards can provide an at-a-glance overview of critical risks, offering real-time updates and simplifying communication with stakeholders. Dashboards help track risk detection progress and ensure risk discovery efforts remain on course.

Integrating Risk Identification into Governance: Building Trust Through Transparency

Risk documentation doesn’t just benefit internal teams; it’s a cornerstone of governance and compliance. Embedding risk identification into governance processes demonstrates accountability and builds trust with stakeholders.

- Regular Stakeholder Reporting: Develop a clear, concise format for risk reports tailored to stakeholders’ interests. Highlight key risks, mitigation progress, and upcoming priorities.

- Compliance Alignment: Ensure risk reporting adheres to industry regulations and standards. This not only avoids penalties but also positions your organization as a responsible leader in its field.

- Audit Readiness: Comprehensive risk documentation simplifies audits, whether they’re internal evaluations or external reviews by regulatory bodies.

For instance, a healthcare provider can use documented risk identification insights to showcase how patient safety risks are managed, fostering trust among regulators and patients alike.

New Dimensions: Linking Risks to Strategic Goals

One powerful way to elevate risk reporting is by linking identified risks to organizational objectives. This approach ensures risk management is not just a defensive strategy but also a driver of success.

- Connecting Risks to KPIs: Tie risks to specific key performance indicators (KPIs) to measure their impact on organizational success. For example, a delay in manufacturing operations might directly influence on-time delivery rates.

- Highlighting Opportunities in Risks: Risk discovery often reveals not just threats but also opportunities for innovation or growth. Document these insights to ensure a balanced, forward-looking approach.

Communication is Key: Making Risk Reports Accessible

Technical jargon can alienate stakeholders who aren’t risk management experts. To maximize the impact of your reporting:

- Use clear language and avoid overly technical terms.

- Include visual aids like graphs, heatmaps, or infographics to illustrate key points.

- Tailor the depth of detail based on the audience—executives may need high-level summaries, while operational teams might require in-depth analysis.

Risk documentation and reporting are not endpoints—they’re the foundation for proactive and effective solutions. This is where SearchInform steps in, transforming your insights into actionable strategies. With tools designed for precision risk identification, real-time risk detection, and comprehensive risk discovery, SearchInform empowers businesses to address challenges head-on and turn potential threats into opportunities. Let’s explore how SearchInform can enhance your approach to risk management and drive your organization toward greater resilience and success!

How SearchInform Identifies and Mitigates Business Risks

In a world where risks evolve faster than ever, businesses need more than just reactive measures—they need solutions that proactively identify, detect, and mitigate threats. This is where SearchInform becomes a game-changer. With its comprehensive suite of tools and technologies, SearchInform transforms the complexities of risk identification into actionable strategies that safeguard businesses and propel them forward.

Precision in Risk Identification

SearchInform begins with a deep dive into your organization’s unique risk landscape. By leveraging advanced analytics and real-time data processing, it uncovers vulnerabilities that might otherwise remain hidden. Whether it’s detecting potential data leaks, spotting unusual employee behavior, or flagging compliance gaps, SearchInform ensures that no threat goes unnoticed.

For example, in financial services, SearchInform’s tools can identify patterns of fraudulent activity by analyzing vast amounts of transaction data. In retail, the same technology might detect supply chain vulnerabilities or cybersecurity risks in e-commerce platforms. This precision transforms risk identification into a competitive advantage.

Real-Time Risk Detection: Staying Ahead of Threats

The ability to detect risks in real-time is a cornerstone of effective risk management, and SearchInform excels in this domain. Its solutions monitor critical systems, data flows, and user activities continuously, providing instant alerts when anomalies or threats are detected.

- Data Leak Prevention: SearchInform’s DLP solutions track sensitive information movement, preventing unauthorized access or sharing.

- Employee Activity Monitoring: By analyzing employee behavior, the system can detect potential insider threats or breaches of policy.

- Compliance Monitoring: Real-time tracking ensures that your organization adheres to ever-changing regulations, reducing the risk of penalties or reputational damage.

These tools not only detect risks as they emerge but also provide actionable insights for swift resolution, ensuring your business remains agile and protected.

Advanced Risk Discovery: The Power of Prediction

SearchInform goes beyond identifying current risks; it anticipates future threats through predictive analytics and machine learning. By analyzing historical data and patterns, its tools forecast potential vulnerabilities, enabling businesses to address issues before they arise.

Imagine predicting a compliance violation months in advance or identifying a supply chain disruption before it affects operations. With SearchInform, risk discovery becomes a forward-looking exercise, allowing you to turn insights into proactive strategies that build resilience.

Tailored Solutions for Industry-Specific Challenges

Every industry faces its own unique set of risks, and SearchInform’s tools are designed to adapt. Whether it’s preventing healthcare data breaches, ensuring compliance in financial services, or enhancing operational security in manufacturing, SearchInform provides targeted solutions that align with your business’s needs.

- Financial Services: Tools for fraud detection, regulatory compliance, and transaction monitoring.

- Healthcare: Solutions to safeguard patient data, ensure HIPAA compliance, and mitigate operational risks.

- Retail: Cybersecurity measures for consumer data protection and supply chain risk management.

- Manufacturing: IoT-integrated tools for equipment monitoring and workplace safety.

This tailored approach ensures that your organization can focus on its goals while SearchInform handles the intricacies of risk management.

Integration with Governance and Reporting Frameworks

Risk management isn’t just about detection—it’s also about communication and accountability. SearchInform seamlessly integrates with governance and compliance frameworks, making it easier to document, report, and address risks.

- Comprehensive Risk Dashboards: Visualize your organization’s risk landscape with real-time updates and insights.

- Automated Reporting: Generate detailed reports for stakeholders, ensuring transparency and compliance.

- Audit Preparedness: Simplify audit processes with organized and accessible documentation of identified risks and mitigation actions.

These capabilities not only strengthen internal operations but also build trust with stakeholders, partners, and regulators.

Your Partner in Resilience and Growth

With SearchInform, risk management evolves from a defensive tactic to a strategic advantage. Its solutions don’t just protect your business—they empower it to adapt, innovate, and thrive in an ever-changing landscape.

Now is the time to take control of your risks and turn them into opportunities. Discover how SearchInform’s cutting-edge tools can transform your risk management strategy, safeguard your assets, and drive your success. Let SearchInform lead the way to a more secure and resilient future.

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!