Comprehensive Guide to Risk Identification Techniques

- The Importance of Risk Identification

- Traditional Risk Identification Techniques: The Foundation of Risk Management

- Brainstorming: Collaborative Risk Discovery

- Checklists: The Power of Simplicity

- SWOT Analysis: A Strategic Compass

- Interviews and Questionnaires: Mining for Hidden Insights

- Advanced Risk Identification Techniques

- Root Cause Analysis: Finding the Story Behind the Risk

- Delphi Technique: The Wisdom of Many

- Failure Mode and Effects Analysis: Anticipating the Domino Effect

- Event Tree Analysis: Charting the Ripple Effect

- Technology-Driven Risk Identification Techniques: Shaping the Future

- Data Analytics: Decoding Risks Hidden in Numbers

- AI and Machine Learning: The Dynamic Sentinels

- Automated Risk Detection: A New Era of Vigilance

- Blockchain and IoT: The Rising Stars in Risk Management

- Bridging Technology with Tradition

- The Shift to Industry-Specific Risk Identification

- Financial Sector: Navigating Volatility and Compliance

- Manufacturing: Keeping the Supply Chain Intact

- Healthcare: Protecting Patients and Data

- Retail: Staying Ahead in a Competitive Landscape

- Best Practices for Effective Risk Identification

- Blending Techniques for a Broader Perspective

- Regularly Updating Risk Registers

- Integrating Technology with Traditional Methods

- Building a Culture of Continuous Improvement

- Challenges and Solutions in Risk Identification

- The Shadow of Bias in Risk Identification

- Complexity in a Dynamic World

- Resource Constraints: The Tug-of-War

- Turning Challenges into Opportunities

- SearchInform: Redefining Risk Identification

- Tailored Solutions for Comprehensive Risk Coverage

- Advanced Technologies for Smarter Risk Identification

- Industries Transformed by SearchInform

- Why Organizations Trust SearchInform

- Transform Risk into Opportunity

The Importance of Risk Identification

Risk management is a craft as old as human civilization. From ancient navigators charting treacherous seas to modern corporations mitigating cyber threats, the cornerstone of managing uncertainty is understanding it. This brings us to a pivotal question: how do we identify risks before they morph into costly mistakes? The answer lies in mastering risk identification techniques, a blend of art, science, and foresight.

Risk identification isn’t just a preliminary step in risk management; it’s the foundation upon which effective strategies are built. Misjudge a risk, and the entire framework crumbles. Picture a building with a hidden fault line running beneath it. Ignoring the fault line doesn’t make it disappear; it makes the eventual collapse inevitable. Identifying risks upfront allows organizations to allocate resources intelligently, avoid disruptions, and seize opportunities while mitigating threats.

Risk identification, however, isn’t a one-size-fits-all process. Just as navigators of old relied on rudimentary maps before the advent of advanced tools, organizations today employ a mix of methods—both time-tested and cutting-edge—to uncover potential threats. Traditional risk identification techniques, in particular, have long served as the cornerstone of this effort, offering practical and structured approaches to understanding uncertainties. Let’s explore these foundational methods and their enduring relevance in today’s complex risk landscape.

Traditional Risk Identification Techniques: The Foundation of Risk Management

Risk identification techniques are like the bedrock of a building—solid, dependable, and essential for stability. Before the advent of sophisticated analytics or AI-driven tools, businesses relied on traditional methods to navigate uncertainties. Even today, these time-tested techniques remain indispensable, providing clarity and structure in an often chaotic environment.

Brainstorming: Collaborative Risk Discovery

Picture this: a team gathered in a room, ideas flying like sparks. The energy is palpable as participants share insights, question assumptions, and uncover hidden risks. This is the magic of brainstorming. It’s not about hierarchy or rigid structures but about collaboration—an open exchange that brings diverse perspectives to the table.

Take, for example, a product launch at a tech company. A brainstorming session might reveal potential delays from suppliers, legal challenges related to intellectual property, or even consumer adoption hurdles. By identifying these risks early, the team can prepare contingency plans, ensuring the launch goes smoothly.

Brainstorming thrives on variety. Include participants from different departments and encourage wild ideas—sometimes the most unexpected thoughts expose the most significant risks. And don’t forget to document every suggestion; even seemingly minor points can turn into critical insights later.

Checklists: The Power of Simplicity

Ever packed for a trip and forgotten your charger? That’s the kind of mistake checklists are designed to prevent. In the realm of risk management, they ensure nothing essential slips through the cracks.

A hospital preparing for an accreditation audit, for instance, might use a checklist to ensure compliance with safety protocols, data security measures, and staff training requirements. Each item ticked off builds confidence, reducing the likelihood of oversights.

The beauty of checklists lies in their versatility. They can be customized to fit any industry or situation, from ensuring workplace safety to mitigating legal risks in contracts. To maximize their effectiveness, review and update checklists regularly, keeping them aligned with changing circumstances.

SWOT Analysis: A Strategic Compass

SWOT analysis isn’t just a tool; it’s a narrative of an organization’s current standing and future potential. By assessing strengths, weaknesses, opportunities, and threats, it paints a complete picture of the risk landscape.

Imagine a small retail business expanding into e-commerce. A SWOT analysis might highlight its strength in customer loyalty and a weakness in digital marketing expertise. It could reveal opportunities in untapped markets but also warn of threats like fierce online competition. Armed with these insights, the business can strategize effectively, leveraging its strengths while addressing vulnerabilities.

What makes SWOT particularly powerful is its adaptability. It’s equally useful for a multinational corporation planning a merger or a local nonprofit launching a fundraising campaign. This versatility ensures its place as a staple among techniques for identifying risks.

Interviews and Questionnaires: Mining for Hidden Insights

Organizations are treasure troves of knowledge, with employees, stakeholders, and even customers holding valuable insights into potential risks. Interviews and questionnaires serve as tools for extracting this wisdom.

Consider a construction firm embarking on a large-scale project. Interviews with site managers might reveal concerns about equipment reliability, while questionnaires sent to suppliers could highlight delays in the supply chain. Together, these inputs offer a clearer picture of the challenges ahead.

For maximum impact, tailor questions to the audience. For internal teams, focus on operational risks. For external stakeholders, explore market dynamics or logistical challenges. And always analyze responses holistically—patterns often emerge that point to deeper, systemic risks.

While traditional risk identification techniques provide a strong foundation, modern challenges demand more nuanced approaches. Imagine building a bridge; traditional tools lay the groundwork, but advanced machinery is needed to construct its intricate arches. Similarly, advanced techniques take risk identification to the next level, offering precision and depth in an increasingly complex world. Let’s dive into these innovative approaches, exploring how they uncover risks that traditional methods might miss.

Advanced Risk Identification Techniques

Risk identification techniques have evolved alongside the complexities of modern business environments. While traditional methods build a solid foundation, advanced techniques dive deeper, providing sharper tools to dissect and understand risks. These approaches go beyond surface-level observations, uncovering hidden threats and offering strategic insights.

Root Cause Analysis: Finding the Story Behind the Risk

Imagine noticing cracks in the walls of your home. Fixing them without understanding the cause might offer a quick solution, but it won’t prevent new cracks from forming. Root cause analysis operates on a similar principle—it digs deep to uncover the fundamental reasons behind risks rather than addressing only their symptoms.

For instance, a manufacturing company experiencing recurring production delays might initially blame poor supplier performance. However, root cause analysis could reveal that the real issue lies in outdated ordering systems causing miscommunication. By addressing the root of the problem—upgrading their systems—the company can eliminate delays and ensure smoother operations.

Root cause analysis thrives on curiosity and thoroughness. It challenges organizations to ask "why" repeatedly until the source of a problem is identified. It’s a process that demands patience but rewards with clarity, often transforming a reactive mindset into a proactive one.

Delphi Technique: The Wisdom of Many

Have you ever been in a group where everyone’s opinion matters, but the loudest voice often dominates? The Delphi technique eliminates this bias, creating a structured, iterative process where experts anonymously share their insights. This method is like assembling a panel of meteorologists to predict a storm, with each iteration refining the collective understanding.

Take the aerospace industry, for example. When assessing risks in the design of a new aircraft, engineers, safety specialists, and pilots contribute their expertise anonymously. Through multiple rounds of discussion, the group narrows its focus on the most critical risks, ensuring comprehensive coverage.

The beauty of the Delphi technique lies in its structure. By stripping away the influence of hierarchy or groupthink, it ensures that every voice counts, creating a richer, more reliable risk profile.

Failure Mode and Effects Analysis: Anticipating the Domino Effect

FMEA is like playing a high-stakes game of chess where every potential move is analyzed before it’s made. This method systematically evaluates possible failures and their consequences, prioritizing them based on severity and likelihood.

In the automotive industry, for example, FMEA might uncover that a single faulty brake component could cascade into catastrophic accidents, legal liabilities, and reputational damage. With this foresight, manufacturers can re-engineer the component, preventing failure before it ever occurs.

FMEA stands out for its ability to quantify risks. It doesn’t just identify what could go wrong; it helps organizations rank risks, ensuring resources are allocated to the most pressing issues.

Event Tree Analysis: Charting the Ripple Effect

Picture a small pebble dropped into a calm pond, the ripples expanding outward. Event tree analysis works similarly, mapping how one event can trigger a series of outcomes, both positive and negative.

A financial institution might use this technique to evaluate how a single cybersecurity breach could lead to data loss, customer attrition, legal penalties, and reputational damage. By visualizing the sequence of risks, the organization can prepare layered defenses to intercept threats at every stage.

What makes event tree analysis particularly compelling is its storytelling power. It allows decision-makers to see not just the immediate impact of a risk but its broader implications, fostering a more comprehensive approach to mitigation.

Advanced risk identification techniques shine in their precision, but even these methods have their limitations in the face of massive datasets and rapid technological advancements. This is where technology-driven approaches come into play, enhancing human effort with the power of machines. Just as an artist’s skill is amplified by superior tools, the next generation of techniques for identifying risks leans heavily on artificial intelligence, machine learning, and predictive analytics. These innovations don’t just identify risks; they anticipate them, enabling organizations to act before threats materialize. Let’s delve into how these groundbreaking technologies are redefining the landscape of risk management.

Technology-Driven Risk Identification Techniques: Shaping the Future

The world is no longer constrained by the limits of manual processes. In an age dominated by data and speed, technology-driven risk identification techniques have become game-changers. These approaches are not just tools; they are transformative allies, reshaping how organizations understand and mitigate risks. With machine precision and human ingenuity combined, they deliver insights that were once unimaginable.

Data Analytics: Decoding Risks Hidden in Numbers

Think of data as the lifeblood of modern organizations, pumping through every transaction, interaction, and operation. But without analytics, this lifeblood remains a murky stream of unorganized information. Enter predictive data analytics—a powerful magnifying glass that reveals hidden patterns and trends, often long before risks materialize.

Imagine a retail giant grappling with supply chain inefficiencies during peak holiday seasons. By analyzing years of sales data, weather patterns, and supplier performance, predictive analytics can pinpoint periods of likely disruption. This foresight allows managers to stock strategically and coordinate alternative suppliers in advance, avoiding costly shortages.

Data analytics is not just about crunching numbers; it’s about telling a story. Every dip, spike, or plateau in a graph can signify an emerging risk or opportunity. With proper analysis, these numbers become actionable insights, enabling proactive decisions instead of reactive firefighting.

AI and Machine Learning: The Dynamic Sentinels

Artificial intelligence doesn’t just mimic human intelligence—it surpasses it in speed, scale, and precision. Machine learning, a subset of AI, thrives on its ability to learn and adapt, continuously refining itself with each new piece of data. In risk identification, this adaptability is crucial.

Take the financial industry, where fraud detection often feels like an arms race against increasingly sophisticated schemes. AI systems can scan millions of transactions in real time, flagging suspicious activity based on patterns that would elude even the most vigilant analyst. For instance, when a banking customer in New York suddenly makes a high-value purchase in Tokyo, the system not only identifies this as unusual but also cross-references historical behavior to assess the likelihood of fraud.

The magic of AI lies in its evolution. Unlike static tools, it improves with every anomaly detected and every false alarm dismissed. This learning process ensures that the techniques for identifying risks remain relevant, even as the threats themselves evolve.

Automated Risk Detection: A New Era of Vigilance

Automation is the hallmark of modern efficiency, bringing tireless monitoring capabilities to risk management. Automated tools are like sentinels, scanning the horizon for potential threats and acting before issues escalate.

Imagine an organization managing sensitive customer data. Automated systems monitor user behavior in real time, identifying unauthorized access or unusual download patterns. For instance, if an employee suddenly transfers a large volume of data outside the network, the system can raise an alert, allowing for immediate investigation and action.

This proactive approach transforms how organizations handle risks. Instead of waiting for an incident to escalate, automation empowers teams to intercept and neutralize threats at the earliest stage, enhancing overall resilience.

Blockchain and IoT: The Rising Stars in Risk Management

Technology’s role in risk identification doesn’t stop at AI or analytics. Emerging technologies like blockchain and the Internet of Things (IoT) are carving out their niches in this space.

Blockchain, with its decentralized and immutable nature, is a boon for industries like finance and supply chain management. It offers a transparent ledger where every transaction is traceable and tamper-proof. For instance, a pharmaceutical company using blockchain can verify the authenticity of its drugs, reducing the risk of counterfeit products entering the supply chain.

IoT, on the other hand, connects physical assets to digital networks, enabling real-time monitoring. Think of a logistics company tracking its fleet using IoT sensors. These devices not only provide location data but also monitor vehicle conditions, flagging maintenance risks before they turn into breakdowns.

Bridging Technology with Tradition

The rise of technology-driven risk identification techniques doesn’t render traditional methods obsolete. Instead, the two approaches complement each other, creating a comprehensive toolkit for organizations. For example, data analytics can validate insights from brainstorming sessions, while AI can enhance root cause analysis by providing deeper correlations.

This integration is not merely a recommendation—it’s a necessity. In a world where risks evolve as quickly as technologies, relying solely on one approach is like navigating a stormy sea with half a map. Organizations that combine human intuition with technological precision position themselves to thrive amid uncertainty.

As technology reshapes risk identification, one size no longer fits all. Every industry operates in its unique ecosystem, with distinct challenges and vulnerabilities. A financial institution grappling with market volatility faces entirely different threats than a healthcare provider safeguarding patient data or a manufacturing firm managing supply chain disruptions.

This evolution demands a deeper focus on tailoring techniques for identifying risks to industry-specific needs. By understanding the nuances of each sector, organizations can move beyond generic approaches, crafting strategies that address their most pressing concerns with precision. Let’s delve into how different industries are navigating their distinct risk landscapes and what lessons can be drawn from their approaches.

The Shift to Industry-Specific Risk Identification

Risk is never a one-size-fits-all concept. Each industry operates like a unique ecosystem, shaped by its own dynamics, regulations, and vulnerabilities. While general risk identification techniques lay the groundwork, they can lack the nuance required to address the complexities of specific sectors. It’s like trying to map the terrain of a dense rainforest with tools designed for an open desert—effective, but not sufficient.

Industry-specific techniques for identifying risks go beyond generalizations, diving into the details that make each sector distinct. They consider the unique interplay of market forces, regulatory demands, and operational intricacies. To truly understand the power of these techniques, let’s step into the shoes of businesses across different industries and see how they navigate their challenges.

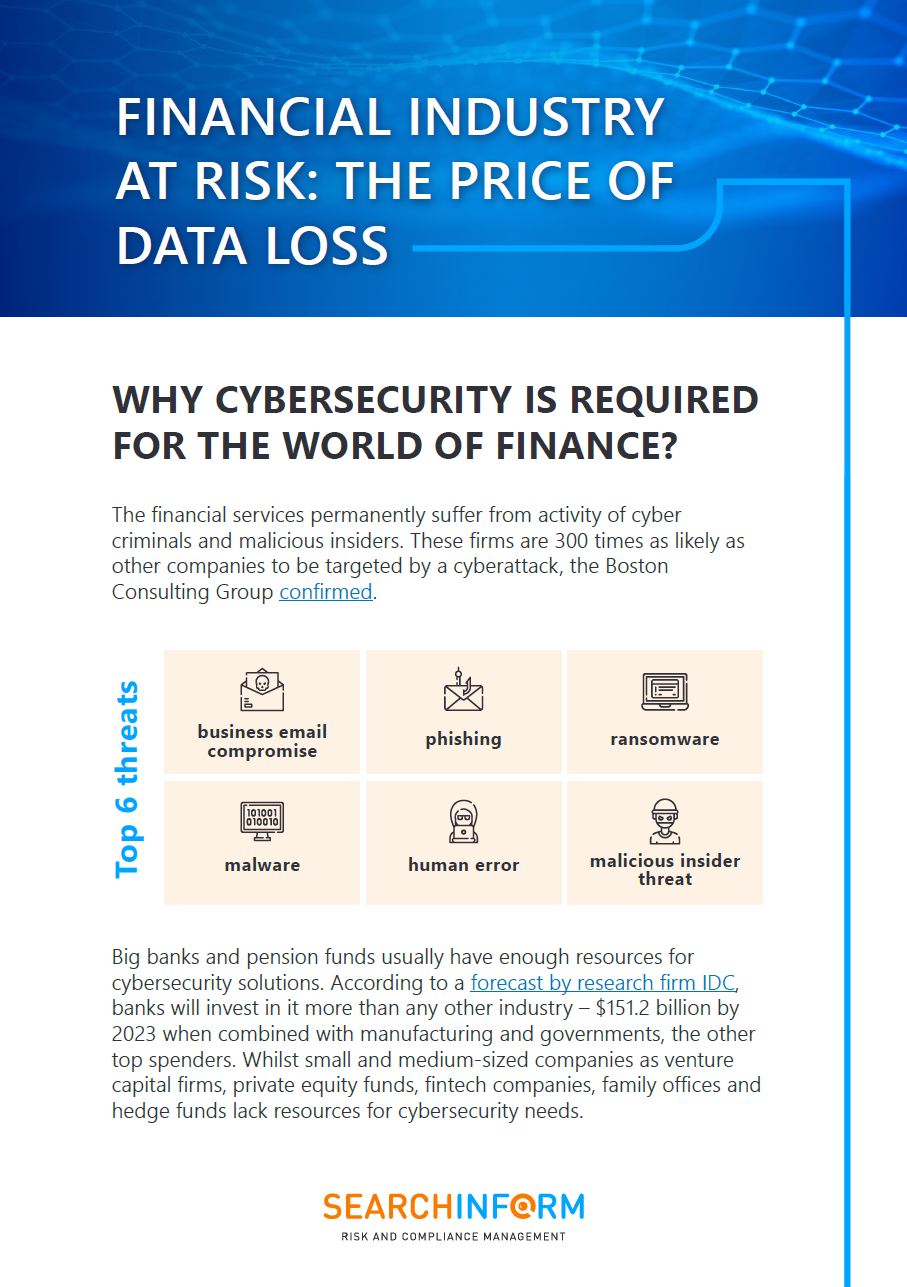

Financial Sector: Navigating Volatility and Compliance

The financial world is like a high-stakes poker game where market trends, regulatory changes, and technological advancements are constantly reshuffling the deck. Risk identification techniques in this sector must balance precision and agility, identifying threats before they escalate into crises.

Take the 2008 global financial crisis—a stark reminder of what happens when risks are underestimated or overlooked. Today, financial institutions rely on predictive models and stress testing to simulate scenarios like economic downturns or credit defaults. These tools allow banks to assess the domino effect of risks, ensuring that they have the liquidity and resilience to weather turbulence.

Yet, numbers alone don’t tell the whole story. Compliance risks loom large, with evolving regulations like anti-money laundering laws and data protection mandates. To address these, banks often employ advanced monitoring systems that flag unusual transactions or detect discrepancies in financial reporting. Here, the fusion of traditional oversight and cutting-edge analytics is vital, ensuring no stone is left unturned.

Manufacturing: Keeping the Supply Chain Intact

Manufacturing is a symphony of precision, where even a minor disruption can throw the entire orchestra offbeat. Imagine an automotive plant where a single faulty component halts the assembly line, delaying production and costing millions. In this sector, risk identification techniques are all about foresight and resilience.

One of the most significant risks manufacturers face is supply chain instability. Natural disasters, geopolitical tensions, or even supplier bankruptcies can cause ripples across the production process. Manufacturers combat this by mapping their supply chains in intricate detail, identifying weak links and building contingency plans. For instance, a manufacturer may diversify its supplier base or maintain buffer inventories to mitigate disruptions.

Operational risks, too, demand attention. Predictive maintenance, powered by IoT sensors, is increasingly used to monitor equipment performance and predict failures before they occur. These proactive measures not only minimize downtime but also ensure worker safety, which is a critical concern in high-risk environments like factories.

Healthcare: Protecting Patients and Data

In healthcare, the stakes are profoundly human. Here, risk identification isn’t just about financial or operational stability—it’s about saving lives and safeguarding trust. Hospitals, clinics, and pharmaceutical companies operate in an environment fraught with privacy challenges, regulatory oversight, and the critical need for patient safety.

The rise of digital health records has brought immense benefits but also new risks. Data breaches in healthcare can compromise patient information, leading to identity theft and eroding public trust. Techniques for identifying risks in this space often center around cybersecurity, employing tools that monitor for vulnerabilities in networks and systems. For example, an AI-driven system might flag unusual access patterns in a hospital’s database, allowing administrators to intervene before sensitive data is compromised.

Operational risks also loom large. A hospital might use root cause analysis to understand why medication errors occur, identifying systemic issues like understaffing or poorly designed workflows. By addressing these root causes, healthcare providers can ensure safer patient outcomes and more efficient operations.

Retail: Staying Ahead in a Competitive Landscape

Retail operates at the intersection of fast-changing consumer behavior and complex logistics. Risks in this sector range from inventory mismanagement to fraud. For example, an e-commerce platform might use predictive analytics to identify patterns of return fraud, where customers exploit loopholes in the returns process.

Supply chain disruptions, much like in manufacturing, are a constant concern. Retailers rely on risk mapping to visualize their networks, identifying potential choke points and diversifying suppliers where needed. Cyber risks are another growing threat, especially with the rise of online shopping. Retailers invest heavily in cybersecurity measures, using these to monitor for phishing attacks or unauthorized access attempts that could jeopardize customer data.

As industries evolve, so do their risk landscapes. The most effective organizations understand that combining industry-specific insights with general risk identification techniques creates a powerful framework for managing uncertainty. But even with the best tools and strategies, challenges remain. Bias, complexity, and the ever-changing nature of risks demand continuous refinement.

How can organizations ensure their techniques are as adaptive as the threats they face? By integrating best practices that combine human intuition with technological precision. Let’s explore how this integration creates a holistic approach to risk management, ensuring that no risk, big or small, goes unnoticed.

Best Practices for Effective Risk Identification

Risk identification is not a one-time task or a static checklist—it’s a living, breathing process that evolves as threats emerge and industries transform. Mastering the art of identifying risks requires not only the right tools and techniques but also the ability to adapt and think critically in the face of uncertainty. Organizations that excel in this domain embrace a mix of innovation, diligence, and collaboration, crafting strategies that are both dynamic and resilient.

Blending Techniques for a Broader Perspective

Imagine viewing the world through a single lens. While it offers clarity, it limits your perspective. This is why organizations must adopt a multifaceted approach, combining traditional methods with advanced and technology-driven techniques for identifying risks. By doing so, they create a 360-degree view of potential threats.

For example, a multinational retailer preparing for a major holiday season might begin with brainstorming sessions to uncover obvious risks, like inventory shortages or website crashes. However, they wouldn’t stop there. Predictive analytics could provide deeper insights, highlighting supply chain vulnerabilities or unexpected spikes in consumer demand. Together, these methods create a cohesive and comprehensive understanding of risks that no single technique could achieve on its own.

The key lies in balance. Traditional techniques like interviews or checklists offer foundational insights, while advanced approaches like AI or event tree analysis uncover subtleties and connections that might otherwise go unnoticed. This combination ensures that organizations aren’t just reacting to risks—they’re anticipating and mitigating them.

Regularly Updating Risk Registers

Risk registers are the navigational charts of an organization’s risk management journey. But like any map, they need to be updated regularly to remain relevant. Outdated risk registers are not only ineffective but can give a false sense of security, leading to complacency.

Consider a technology company in the fast-paced world of software development. Six months ago, their primary concern might have been compliance with a new data privacy regulation. Today, a newly discovered vulnerability in widely used software might pose a more significant threat. Regularly revisiting and updating the risk register ensures that emerging risks are prioritized while outdated or resolved risks are removed.

Updating a risk register isn’t just about listing new risks. It’s about reassessing existing ones, understanding how they’ve evolved, and determining if mitigation strategies remain effective. This dynamic approach transforms the risk register from a static document into a living, actionable resource.

Integrating Technology with Traditional Methods

In today’s interconnected world, technology isn’t just an add-on—it’s an integral part of effective risk identification techniques. But this doesn’t mean abandoning traditional methods; rather, it means amplifying them.

For example, a healthcare organization might rely on interviews with frontline staff to understand operational risks, such as delays in patient care. Pairing these insights with AI-driven systems that monitor workflow bottlenecks in real-time creates a powerful synergy. The human element provides context and nuance, while technology adds speed and precision.

Integration also means making technology accessible and actionable. Advanced tools like machine learning or predictive analytics can seem daunting, but their power lies in simplifying complex data into actionable insights. Organizations that effectively combine these tools with traditional methods gain a significant edge, turning raw data into a roadmap for proactive risk management.

Building a Culture of Continuous Improvement

At its core, risk identification is about vigilance. Threats evolve, industries change, and no two days are the same. Organizations that treat risk management as a one-time task inevitably fall behind. The solution? Fostering a culture of continuous improvement, where identifying risks becomes a shared responsibility and an ongoing priority.

This culture begins at the top. Leadership must champion risk management initiatives, ensuring that teams have the resources, training, and support they need. Transparency is equally critical. Employees at all levels should feel empowered to voice concerns or report potential risks without fear of reprisal.

Take the example of an airline company. Pilots, mechanics, and ground staff all hold unique perspectives on operational risks. Encouraging open communication between these groups can lead to the identification of critical issues, like maintenance shortcuts or scheduling inefficiencies, before they escalate into safety concerns.

Continuous improvement also requires organizations to stay informed about external trends. Whether it’s new regulatory requirements, advancements in technology, or shifts in consumer behavior, staying ahead of the curve ensures that risk identification techniques remain relevant and effective.

Even with the best practices in place, risk identification isn’t without its challenges. Biases, resource constraints, and the sheer complexity of modern business environments can all hinder efforts. Yet, these challenges also present opportunities. Organizations that confront these obstacles head-on, embracing innovation and collaboration, are better equipped to navigate the unknown.

As we move forward, the question isn’t just how risks will be identified but how organizations will adapt to an ever-changing landscape. What new tools, perspectives, and strategies will redefine the art of identifying risks? Let’s explore how these emerging trends and challenges shape the future of risk management.

Challenges and Solutions in Risk Identification

Risk identification techniques, no matter how advanced, are not immune to obstacles. Like a traveler navigating unfamiliar terrain, organizations often find themselves hampered by unforeseen hurdles—biases, blind spots, resource constraints, and the unpredictability of an ever-evolving business landscape. Overcoming these challenges is less about avoiding them and more about transforming them into stepping stones toward better strategies.

The Shadow of Bias in Risk Identification

Imagine looking through a fogged-up windshield while driving. You can make out shapes and movements, but the clarity needed to navigate safely is missing. Bias in risk identification works the same way—it clouds judgment, distorts priorities, and can lead to an overemphasis on some risks while completely ignoring others.

For example, confirmation bias, where decision-makers seek out information that aligns with their preconceived notions, can lead to critical oversights. A technology firm might focus solely on cybersecurity risks while downplaying operational issues like outdated hardware or workforce fatigue. Similarly, anchoring bias—the tendency to rely too heavily on initial information—might cause an organization to underestimate evolving threats, such as the subtle but growing impact of regulatory changes.

Countering bias requires a conscious effort. Teams need to embrace diversity—not just in terms of demographics but in perspectives and expertise. A construction project might include engineers, environmental scientists, and local community representatives when assessing risks. This multi-dimensional approach ensures a broader, more accurate understanding of potential challenges.

Complexity in a Dynamic World

The modern business environment is like a fast-moving river, with currents shifting rapidly and unpredictably. Traditional risk identification techniques, though valuable, often struggle to keep pace with the sheer complexity and velocity of these changes.

Consider the supply chain chaos triggered by the COVID-19 pandemic. Businesses across the globe grappled with delayed shipments, skyrocketing freight costs, and fluctuating consumer demand—all risks that, while not entirely unforeseen, became magnified in unprecedented ways. Organizations that relied solely on static risk registers found themselves ill-prepared, while those with dynamic, adaptable strategies fared better.

The lesson? Risk identification must evolve in tandem with the world it seeks to protect against. Real-time monitoring tools, predictive analytics, and scenario planning are no longer luxuries—they’re necessities. For instance, a global logistics company might use advanced data models to simulate how a port closure in one region could ripple across their network, enabling them to preemptively adjust routes and schedules.

Resource Constraints: The Tug-of-War

Another challenge lies in resource allocation. Risk identification, for all its importance, is often squeezed between competing priorities. Smaller organizations, in particular, might struggle to justify investments in sophisticated techniques for identifying risks, especially when immediate concerns like cash flow or customer acquisition loom large.

and perform with SearchInform DLP:

However, resource constraints can also spark creativity. Take the example of a local nonprofit managing disaster relief efforts. Without the budget for advanced tools, they relied on community networks to identify risks, gathering insights from local leaders, volunteers, and even social media. This grassroots approach, while unconventional, provided a real-time, ground-level view of potential obstacles, from logistical bottlenecks to emerging health concerns.

Turning Challenges into Opportunities

Every challenge in risk identification carries the seed of opportunity. Biases, for instance, highlight the need for broader collaboration and more transparent decision-making. Complexity pushes organizations to innovate, while resource constraints encourage ingenuity and prioritization.

One particularly inspiring case comes from the renewable energy sector. A wind farm project in a remote region faced significant risks—unpredictable weather patterns, logistical hurdles, and local regulatory uncertainties. Initially overwhelmed, the team adopted a layered approach: they combined traditional brainstorming sessions with predictive weather models, engaged local stakeholders for regulatory insights, and used low-cost IoT devices to monitor on-site conditions in real time. The result was not just a successful project but a blueprint for handling similarly complex challenges in the future.

While challenges in risk identification may feel daunting, they also underscore an essential truth: adaptability is the ultimate skill. Organizations that thrive in uncertain times aren’t those that avoid risks but those that embrace their inevitability and develop tools to address them effectively.

The question, then, isn’t whether challenges will arise—they always will. The real question is how organizations can build systems, technologies, and cultures that transform risks into opportunities for growth. This is where specialized solutions, such as those offered by SearchInform, come into play. With advanced tools and a focus on precision, SearchInform enhances the effectiveness of risk identification techniques, equipping organizations to face threats with confidence and foresight. Let’s explore how SearchInform helps redefine the future of risk management.

SearchInform: Redefining Risk Identification

Navigating the complex landscape of risks in today’s world requires more than traditional methods or generic tools. It demands precision, adaptability, and a deep understanding of the unique challenges each organization faces. This is where SearchInform steps in—a trusted partner in transforming risk identification techniques from reactive measures into proactive strategies. By leveraging innovative technologies and industry expertise, SearchInform empowers organizations to detect, assess, and address risks with unparalleled efficiency.

Tailored Solutions for Comprehensive Risk Coverage

SearchInform doesn’t offer a one-size-fits-all approach; it provides a suite of tools designed to adapt to the specific needs of businesses across various industries. Whether your organization is managing data security, compliance, or operational risks, SearchInform’s solutions are built to ensure no threat goes unnoticed.

Here’s how SearchInform stands out:

- Automated Threat Detection: SearchInform’s tools continuously monitor your organization’s environment, identifying risks in real-time. From insider threats to external cyberattacks, these solutions offer a vigilant eye on potential vulnerabilities.

- Data-Centric Focus: With data breaches and leaks becoming increasingly sophisticated, SearchInform prioritizes data protection. Its solutions are engineered to spot unusual access patterns, unauthorized file transfers, and other red flags that indicate risks to sensitive information.

- Integration with Business Processes: Unlike tools that disrupt workflows, SearchInform seamlessly integrates into your existing systems. This ensures that risk identification becomes a natural part of your operations rather than an added burden.

- Customizable Alerts and Reporting: Tailored alerts provide actionable insights, helping decision-makers respond swiftly. Detailed reports allow teams to track risk trends over time, ensuring a more informed approach to mitigation.

Advanced Technologies for Smarter Risk Identification

SearchInform’s platform leverages cutting-edge technologies that elevate risk identification techniques to a new level of accuracy and foresight:

- Behavioral Analytics: By monitoring user behavior, SearchInform can detect anomalies that signal potential risks. For example, if an employee suddenly accesses files outside their usual scope of work, the system flags it as suspicious, enabling timely intervention.

- Predictive Analytics: SearchInform doesn’t just identify existing risks; it anticipates emerging ones. Predictive models analyze trends and scenarios, providing organizations with the foresight to act before risks escalate.

Industries Transformed by SearchInform

One of SearchInform’s greatest strengths is its versatility. Its solutions are tailored to address the distinct challenges of various industries:

- Financial Services: From detecting fraudulent activities to ensuring regulatory compliance, SearchInform helps financial institutions manage volatility with precision.

- Healthcare: Patient data security and operational continuity are critical in healthcare. SearchInform’s tools safeguard sensitive information and streamline risk management processes.

- Retail: With the rise of e-commerce, SearchInform provides retailers with tools to combat fraud, protect customer data, and manage logistics risks effectively.

Why Organizations Trust SearchInform

The trust placed in SearchInform stems from its proven ability to combine advanced technologies with a user-friendly approach. Organizations that adopt its solutions often report:

- Reduced downtime due to proactive risk management.

- Improved compliance with regulatory requirements, minimizing legal and financial penalties.

- Enhanced decision-making through actionable insights provided by real-time monitoring and detailed reports.

- A stronger security posture, ensuring both internal and external threats are addressed swiftly and comprehensively.

Transform Risk into Opportunity

Risk management isn’t just about minimizing threats; it’s about turning uncertainty into opportunity. With SearchInform, organizations can shift their perspective from merely reacting to risks to leveraging them as a competitive advantage. By providing the tools to identify risks early and manage them effectively, SearchInform empowers businesses to stay ahead of the curve.

Don’t let risks dictate your future. Take control of your organization’s safety, security, and success. Explore how SearchInform can transform your risk identification strategy and prepare you to face challenges with confidence and clarity. The future of risk management is here—are you ready to embrace it?

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!