Risk Indicators:

The Cornerstone of Effective Business Risk Strategies

Introduction to Risk Indicators

Imagine steering a ship through treacherous waters without a compass or radar. Every wave feels like a gamble, and every decision could either save or sink you. That’s exactly how managing a business feels without risk indicators. These invaluable tools act as the compass and radar, signaling potential hazards before they become full-blown crises.

But what exactly are risk indicators, and why are they such game-changers? Think of them as the warning lights on a car dashboard. They don’t fix the problem, but they give you just enough notice to pull over and prevent a catastrophe. A risk indicator is a measurable factor that highlights potential vulnerabilities, helping organizations dodge pitfalls and chart a safer course toward their goals.

Risk indicators have come a long way since their early use in governance and compliance. Today, they are powered by cutting-edge technology, making them indispensable across industries. They offer more than just warnings—they build resilience, foster proactive decision-making, and provide businesses with a strategic edge in an ever-evolving landscape.

Mastering the art of using risk indicators isn’t just smart; it’s essential. Let’s dive deeper into how these tools have transformed from basic metrics to powerful decision-making allies.

Types of Risk Indicators

Key Risk Indicators (KRIs)

Picture your business as a racing car. KRIs are the dashboard lights alerting you to engine trouble before you blow a gasket. These risk indicators provide early warnings tied to specific, measurable factors critical to your organization’s success. In banking, for example, a spike in loan default rates is a clear sign of growing credit risk. For a tech company, an uptick in customer churn could highlight dissatisfaction. The real magic of KRIs? They don’t just warn you of problems—they allow you to act before those problems snowball into crises. By leveraging KRIs, businesses can turn potential disasters into opportunities for innovation and growth.

Operational Risk Indicators

Think of operational risk indicators as the pulse of your organization’s day-to-day activities. They monitor internal processes like supply chain management, IT system performance, and workforce stability. For example, a logistics company might use delayed shipments as an operational risk indicator, signaling bottlenecks in the supply chain. If left unchecked, these risks can cascade into customer dissatisfaction and revenue loss. Monitoring operational risk indicators ensures that the core machinery of your business runs smoothly and efficiently, enabling long-term success.

Financial Risk Indicators

Financial risk indicators are the bedrock of economic resilience. These metrics help businesses keep their financial health in check by monitoring indicators such as revenue trends, debt-to-equity ratios, and market fluctuations. Imagine a global retailer noticing a consistent decline in profit margins—this financial risk indicator could point to rising operational costs or supply chain inefficiencies. Addressing these red flags early allows companies to adjust pricing strategies, renegotiate contracts, or optimize processes before profits take a major hit. In an unpredictable economy, keeping an eye on financial risk indicators is nothing short of survival.

Strategic Risk Indicators

No strategy survives without adaptability. Strategic risk indicators focus on long-term goals and external influences, providing insights into whether your company’s vision is aligned with the market landscape. For instance, declining market share or a wave of negative customer reviews could signal deeper issues with product positioning or branding. Strategic risk indicators act as a reality check, ensuring businesses remain competitive and their strategies stay relevant amidst changing trends.

Emerging Risk Indicators

What about risks you can’t see coming? That’s where emerging risk indicators shine. These metrics track trends or shifts that may not yet be fully understood but hold the potential for significant impact. Consider the rise of artificial intelligence in the workplace—it has created both opportunities and risks for businesses in every sector. By monitoring emerging technologies, geopolitical shifts, and evolving consumer behavior, organizations can proactively prepare for disruptions that others may overlook. Emerging risk indicators are not just about avoiding threats—they’re about seizing opportunities in a rapidly evolving world.

Industry-Specific Risk Indicators

Every industry faces unique challenges, and tailoring risk indicators to these challenges is key. In healthcare, patient safety metrics or infection rates serve as critical risk indicators. In retail, inventory turnover and shrinkage rates are vital for spotting inefficiencies. Financial institutions may rely on liquidity ratios or credit exposure levels to gauge stability. These industry-specific risk indicators ensure organizations focus on the risks most relevant to their success, making them more agile and resilient.

A Holistic Approach to Risk Indicators

Risk indicators work best when viewed as a cohesive system rather than isolated metrics. For example, a sudden dip in quarterly sales (financial risk indicator) might coincide with shipping delays (operational risk indicator) and negative customer reviews (strategic risk indicator). By connecting the dots between these insights, businesses can uncover underlying issues and tackle them effectively.

Moreover, integrating emerging risk indicators into this mix allows companies to anticipate future challenges, whether they’re driven by technology, global events, or shifting consumer expectations. The interplay of these different types of risk indicators creates a comprehensive risk management framework, empowering businesses to protect their assets, seize new opportunities, and ensure sustainable growth.

Risk indicators are more than just a shield against disaster—they’re a roadmap to uncovering opportunities and strengthening your organization’s future. By mastering their nuances and weaving them into decision-making, businesses can transform risk management into a powerful competitive advantage. But how do you identify the right risk indicators, monitor them effectively, and ensure they provide actionable insights? Let’s dive into the strategies, tools, and best practices for developing and monitoring risk indicators, setting the stage for smarter, more proactive risk management.

Developing and Monitoring Risk Indicators

Building a strong framework for risk indicators is like assembling the ultimate defense system for your business. It doesn’t just alert you to potential threats—it equips you with the knowledge to respond swiftly and decisively. But how do you ensure that your risk indicators are not just relevant but also actionable? Here’s how to build, refine, and maintain a robust system for developing and monitoring these essential tools.

Identifying Critical Risk Factors: The First Step in Proactive Management

Every business, whether it’s a multinational corporation or a local startup, faces unique challenges. Identifying the critical factors that could threaten your operations or growth is the cornerstone of effective risk indicator development. Consider the following:

- Healthcare: Patient safety metrics like infection rates and treatment success are critical for compliance and reputation.

- Retail: Indicators such as inventory turnover, shrinkage, and seasonal sales trends provide valuable insights into operational health.

- Finance: Loan default rates, market volatility, and liquidity ratios are crucial risk indicators for economic stability.

To uncover these critical factors, conduct a risk assessment. Engage teams across departments, analyze historical data, and keep an eye on external trends such as regulatory changes or economic fluctuations. A thorough understanding of these risks ensures your indicators are tailored to your specific needs.

Setting Thresholds for Effective Monitoring: When to Ring the Alarm

Setting thresholds for risk indicators is akin to programming an early warning system—it tells you when it’s time to take action. But these thresholds must be meaningful and balanced. For instance:

- A logistics company might set delivery delays of more than 5% as a threshold, signaling a need for immediate supply chain adjustments.

- A tech firm might monitor employee turnover rates, setting a threshold at 10% annually to maintain stability and innovation.

Thresholds should be data-driven and reviewed regularly to stay aligned with shifting business conditions. Too low, and you’ll be drowning in false alarms. Too high, and you might miss critical risks.

Tools for Tracking Risk Indicators: Making Data Work for You

In today’s fast-paced world, manually tracking risk indicators is not just tedious—it’s impossible. Modern technology provides a suite of tools to automate and enhance risk monitoring. Key tools include:

- Dashboards and Visualization Software: Tools like Tableau or Power BI centralize your data and display it in easily digestible formats, allowing decision-makers to spot trends at a glance.

- Analytics Platforms: Advanced analytics use machine learning to uncover patterns and predict potential risks, offering insights beyond human analysis.

- Automated Alerts and Notifications: Real-time notifications ensure you’re immediately aware of any risk indicator exceeding its threshold, enabling swift action.

These tools not only improve efficiency but also enhance accuracy, reducing the chances of overlooked risks or misinterpretations.

The Role of Risk Indicator Contextualization: Understanding the Bigger Picture

Risk indicators become exponentially more valuable when viewed within their broader context. For instance:

- A manufacturing company notices an uptick in defective products (operational risk indicator). When paired with supplier performance data, it reveals that raw material quality is the root cause.

- A retailer sees declining sales (financial risk indicator). Cross-referencing with customer feedback shows that a competitor’s new promotion is siphoning customers.

Contextualizing risk indicators allows businesses to address root causes rather than just surface symptoms, ensuring long-term solutions instead of short-term fixes.

Engaging Stakeholders in Risk Monitoring: A Collaborative Approach

Effective risk monitoring isn’t a one-person job. It’s a team effort requiring collaboration across all levels of the organization. Here’s how to engage stakeholders:

- Frontline Employees: Educate staff on the importance of risk indicators in their roles. For example, warehouse workers can monitor stock discrepancies, contributing valuable on-the-ground insights.

- Middle Management: Equip managers with tools and training to interpret risk indicators, ensuring they can take action within their teams.

- Leadership: Present clear, concise summaries of key risk indicators to executives, empowering them to make informed strategic decisions.

By fostering a culture of collaboration, businesses ensure that risk monitoring becomes an integral part of their operations.

from different sources:

Enhancing Risk Monitoring Through Regular Reviews and Updates

A successful risk indicator framework isn’t static—it evolves with your business. Regularly reviewing your indicators ensures they remain relevant as internal processes, market conditions, and regulatory landscapes change. For example:

- An e-commerce platform may need to update fraud detection indicators to match new tactics used by cybercriminals.

- A pharmaceutical company might revise compliance indicators based on updated global health regulations.

Routine audits of your risk indicators keep your system agile and effective, enabling you to adapt to new challenges seamlessly.

Integrating Emerging Technologies for Smarter Risk Monitoring

As technology advances, so too does the potential for enhancing risk monitoring. Emerging technologies such as artificial intelligence and blockchain are transforming how businesses track and respond to risk indicators:

- AI-powered analytics can predict risks by analyzing massive datasets, uncovering patterns and anomalies that humans might miss.

- Blockchain technology ensures transparency and security in data tracking, making it invaluable for industries like finance and supply chain.

Integrating these tools into your risk monitoring framework ensures you stay ahead of the curve, leveraging cutting-edge solutions to enhance efficiency and accuracy.

The Cost of Ignoring Risk Indicators

Failing to monitor and act on risk indicators can lead to dire consequences—operational disruptions, financial losses, and reputational damage. Businesses that overlook these tools often find themselves blindsided by avoidable crises. In contrast, companies that prioritize risk monitoring not only survive but thrive, turning potential threats into opportunities for innovation.

Risk indicators are the foundation of proactive risk management, but they’re only as effective as the strategies used to develop and monitor them. With the right framework, tools, and collaboration, your business can stay one step ahead of potential challenges. So, what happens once you’ve built a system for tracking risk indicators? The next step is learning how to use these insights to inform smarter business decisions. Let’s explore how risk indicators shape strategies and drive success!

How to Use Risk Indicators in Business Decision-Making

Using risk indicators is like having a crystal ball for your business—but instead of magic, it’s powered by data and strategy. These tools don’t just highlight potential threats; they guide decisions that shape your organization’s future. Let’s explore how businesses can leverage risk indicators to stay ahead of the curve and make smarter, more proactive choices.

The Role of Risk Indicators in Forecasting and Prevention

Risk indicators are the unsung heroes of forecasting, offering a glimpse into potential challenges before they manifest. Imagine a tech company noticing a surge in attempted cyberattacks—a clear risk indicator that it’s time to enhance cybersecurity measures. By identifying trends early, businesses can implement preventative actions, minimizing disruption and safeguarding resources.

In supply chain management, for example, risk indicators like supplier delays or increased raw material costs help organizations anticipate bottlenecks. Armed with this foresight, they can diversify suppliers or adjust production schedules, turning potential setbacks into manageable challenges. Forecasting with risk indicators isn’t just about avoiding pitfalls; it’s about creating opportunities for innovation and resilience.

Risk Indicators vs. Performance Indicators: Understanding the Difference

While risk indicators and performance indicators both provide valuable insights, they serve distinct purposes:

- Risk Indicators: Focus on potential threats and vulnerabilities. For instance, an increase in employee turnover might indicate dissatisfaction, hinting at deeper organizational issues.

- Performance Indicators: Track achievements and success metrics, such as quarterly revenue growth or customer satisfaction scores.

When used together, these tools provide a 360-degree view of your business. For example, a drop in customer satisfaction (performance indicator) might align with a rise in customer complaints (risk indicator), signaling the need for immediate action. Balancing these insights ensures businesses stay on track while addressing emerging risks.

Case Studies: Successful Implementations of Risk Indicators

Case Study 1: A Global Logistics Company A leading logistics provider used operational risk indicators to monitor delivery delays and supplier performance. When a key supplier began missing deadlines, the risk indicator triggered a review. The company quickly identified alternative suppliers, minimizing disruptions during peak seasons. This proactive approach not only saved millions in lost revenue but also improved customer satisfaction.

Case Study 2: A Financial Institution A major bank leveraged financial risk indicators to track non-performing loans. When these loans exceeded a set threshold, the bank tightened lending criteria and introduced new risk mitigation strategies. As a result, the bank avoided significant losses during a market downturn, protecting its reputation and maintaining investor confidence.

Case Study 3: A Retail Chain A retailer noticed a spike in inventory discrepancies through its operational risk indicators. An investigation revealed theft within the supply chain. By addressing this vulnerability, the company improved inventory accuracy, reduced shrinkage, and saved substantial costs.

Enhancing Strategic Decisions with Risk Indicators

Risk indicators play a pivotal role in shaping long-term strategies. For example:

- Market Expansion: A retail chain looking to expand internationally might monitor geopolitical and economic risk indicators in target regions. This data helps the company choose markets with high growth potential and manageable risks.

- Product Development: A tech startup tracking customer feedback as a risk indicator might uncover dissatisfaction with existing features, informing future product improvements.

- Workforce Planning: By monitoring employee engagement metrics, companies can anticipate retention challenges and refine hiring strategies.

These applications illustrate how risk indicators go beyond crisis management, serving as tools for informed and strategic decision-making.

The Power of Real-Time Decision-Making with Risk Indicators

In today’s fast-paced business environment, real-time insights are essential. Advanced tools now allow businesses to monitor risk indicators in real time, ensuring swift responses to emerging threats. For instance:

- A financial institution tracking market fluctuations can adjust investment strategies instantly, avoiding potential losses.

- A healthcare organization monitoring patient safety metrics can respond immediately to prevent adverse events.

Real-time decision-making powered by risk indicators transforms businesses into agile, responsive entities capable of navigating even the most unpredictable challenges.

The Human Factor in Risk Indicator Utilization

While technology plays a significant role, the human element remains critical. Decision-makers must interpret risk indicators within the context of their industry, organizational goals, and market dynamics. Training employees to understand and act on risk indicators ensures that the entire organization benefits from these insights. Collaboration across departments further enhances the accuracy and relevance of decisions.

Risk indicators aren’t just about identifying problems—they’re about seizing opportunities and driving success. By integrating them into your decision-making process, you can turn risks into stepping stones for growth. But how can technology take this capability to the next level? Let’s explore the role of cutting-edge solutions in enhancing risk indicator tracking and application. Keep reading to discover the future of risk management.

The Role of Technology in Enhancing Risk Indicators

Technology has revolutionized how businesses approach risk management, turning reactive strategies into proactive solutions. By leveraging cutting-edge tools, companies can enhance the precision, efficiency, and scope of their risk indicators, transforming them from static metrics into dynamic decision-making allies. Let’s dive into how technology is reshaping risk management and elevating the potential of risk indicators.

Advanced Analytics and Machine Learning: Predicting Risks Before They Strike

Imagine being able to see the warning signs of a problem before it even surfaces. Advanced analytics and machine learning make this possible by analyzing vast amounts of data to uncover hidden patterns and trends. These technologies enhance the effectiveness of risk indicators in several key ways:

- Predictive Capabilities: Machine learning algorithms can identify potential risks by analyzing historical and real-time data. For example, in healthcare, AI models analyze patient records to predict disease outbreaks or complications, enabling preventative care.

- Customized Risk Profiles: Advanced analytics allow organizations to create tailored risk indicators that align with their specific challenges and goals. A financial institution, for instance, can use AI to predict credit default risks by analyzing customer spending habits and market trends.

- Real-Time Adaptation: Machine learning adapts as new data flows in, ensuring that risk indicators remain relevant even in rapidly changing environments. This continuous learning makes the technology invaluable for dynamic industries like retail or logistics.

By harnessing the power of AI and analytics, businesses can transform risk indicators into predictive tools that guide smarter, faster decisions.

Automation in Risk Indicator Tracking: Streamlining the Process

Manual risk monitoring is time-consuming, error-prone, and simply not scalable in today’s fast-paced world. Automation changes the game by making risk indicator tracking more efficient and accurate. Here’s how:

- Real-Time Alerts: Automated systems monitor risk indicators continuously, sending instant notifications when thresholds are breached. For instance, in manufacturing, automated tools can detect machinery anomalies and alert teams before a breakdown occurs.

- Integration Across Platforms: Automation connects risk indicators across different systems, providing a holistic view of organizational risks. This is particularly useful for large corporations with complex operations spanning multiple locations.

- Minimized Human Error: By automating repetitive tasks, businesses reduce the risk of oversight or inaccuracies, ensuring data integrity and reliability.

Automation not only saves time but also empowers organizations to respond to risks with unparalleled speed and precision.

IoT and Blockchain: Emerging Technologies Enhancing Risk Indicators

In addition to AI and automation, emerging technologies like IoT and blockchain are reshaping how businesses track and manage risk indicators.

-

IoT (Internet of Things): IoT devices generate real-time data from physical assets, creating new opportunities for risk monitoring. For example:

- In logistics, IoT sensors track vehicle conditions and delivery timelines, providing real-time insights into supply chain risks.

- In agriculture, IoT monitors weather patterns, soil conditions, and crop health, allowing farmers to anticipate and mitigate risks.

- Blockchain: Known for its security and transparency, blockchain ensures the accuracy and immutability of risk indicator data. This is particularly valuable in industries like finance and supply chain, where trust and accountability are paramount.

These technologies add another layer of sophistication to risk indicators, enabling organizations to monitor risks that were previously difficult or impossible to track.

The Rise of Risk Dashboards: Simplifying Complex Data

With so much data being generated, visualizing risk indicators effectively is crucial. Enter risk dashboards—user-friendly interfaces that consolidate complex data into clear, actionable insights. Features of an effective dashboard include:

- Customizable Views: Tailored displays let different teams focus on the risk indicators most relevant to their roles.

- Trend Analysis: Interactive graphs and charts highlight patterns, helping decision-makers anticipate future risks.

- Centralized Monitoring: Dashboards bring together data from multiple sources, offering a comprehensive view of organizational risks in one place.

Risk dashboards make it easier for teams to understand, communicate, and act on risk indicator data, bridging the gap between analytics and action.

Cloud-Based Solutions: Access Anywhere, Anytime

The rise of cloud computing has made tracking risk indicators more accessible than ever. Cloud-based solutions allow businesses to monitor risks from anywhere, ensuring that critical decisions aren’t delayed. Key benefits include:

- Scalability: Cloud platforms grow with your business, accommodating increasing data volumes and complexity.

- Collaboration: Teams across locations can access the same risk indicators in real time, fostering seamless communication and coordinated responses.

- Security: Leading cloud providers offer robust security features, protecting sensitive data from breaches.

By moving risk monitoring to the cloud, organizations gain flexibility and resilience, ensuring they’re always prepared for the unexpected.

While technology amplifies the potential of risk indicators, it also brings its own set of challenges. From managing overwhelming volumes of data to ensuring seamless integration with legacy systems, organizations must navigate a complex landscape to unlock the full value of these tools. And let’s not forget the human element—interpreting risk indicators effectively requires clarity, context, and strategy. Up next, we’ll delve into the challenges and limitations of using risk indicators, explore common pitfalls, and discuss practical solutions to overcome them. Let’s tackle the hurdles that stand between potential risks and actionable insights.

Challenges and Limitations of Risk Indicators

While risk indicators are indispensable tools for modern businesses, they are not without their hurdles. The journey from identifying risks to leveraging actionable insights is often fraught with challenges. Let’s explore these limitations, unpack their impact, and discuss ways to navigate them effectively.

False Positives: When Sensitivity Becomes a Setback

Imagine receiving an alert for every minor fluctuation in your business metrics—it’s overwhelming and counterproductive. One of the biggest challenges with risk indicators is false positives. Overly sensitive thresholds can trigger alerts for inconsequential events, leading to:

- Alert Fatigue: Decision-makers may begin to ignore alerts, potentially overlooking critical risks.

- Resource Wastage: Time and energy are spent investigating non-issues, diverting focus from actual threats.

- Erosion of Trust: Frequent false alarms can reduce confidence in the reliability of risk indicators.

Balancing sensitivity with accuracy is crucial. Regularly refining thresholds and leveraging advanced analytics can help reduce false positives, ensuring alerts are meaningful and actionable.

Misinterpretations: The Devil in the Details

A risk indicator is only as useful as the interpretation it receives. Misunderstanding or misanalyzing these metrics can lead to poor decisions, including:

- Overreacting: Acting on incomplete data can cause unnecessary disruptions.

- Underreacting: Misreading a subtle yet critical risk indicator may allow a small issue to escalate into a crisis.

- Contextual Blind Spots: Viewing risk indicators in isolation, without understanding their broader implications, can result in ineffective responses.

To combat this, businesses should focus on providing teams with contextual training and access to dashboards that consolidate and contextualize data, making it easier to interpret risk indicators holistically.

Integration Into Existing Systems: Bridging the Old and New

Risk indicators often need to coexist with legacy systems, creating integration challenges that include:

- Technical Compatibility: Older systems may lack the flexibility to accommodate modern risk indicator tools, resulting in data silos or inefficiencies.

- Scalability Issues: As businesses grow, systems that can’t handle increased data volumes can bottleneck operations.

- Resource Intensity: The time and cost required for system upgrades or new implementations can deter organizations from adopting enhanced risk monitoring tools.

Investing in scalable and adaptive tools, like those offered by SearchInform, helps bridge this gap by ensuring seamless integration without requiring an overhaul of existing infrastructure.

Data Overload: Drowning in Information

With the advent of big data, businesses are inundated with information. While this provides opportunities, it also introduces challenges such as:

- Filtering Relevant Metrics: Sifting through vast datasets to identify meaningful risk indicators can be daunting.

- Analysis Paralysis: Too much information can overwhelm decision-makers, delaying critical actions.

- Maintaining Data Integrity: Ensuring data accuracy and reliability across multiple sources is a persistent challenge.

Streamlining data collection processes and employing analytics platforms to prioritize key risk indicators helps businesses focus on what truly matters.

Adapting to Evolving Risks: A Moving Target

Risks are not static—they evolve with market trends, technological advancements, and regulatory changes. A risk indicator that’s relevant today might become obsolete tomorrow. Common adaptation challenges include:

- Emerging Threats: Identifying and creating risk indicators for new vulnerabilities, such as cybersecurity risks or environmental disruptions.

- Lagging Systems: Legacy tools may struggle to adapt quickly to new risks, leaving businesses exposed.

- Resource Constraints: Limited budgets and personnel can delay updates to risk indicator frameworks.

Implementing flexible, technology-driven solutions allows organizations to stay agile, adapting their risk indicators as new challenges arise.

Human Resistance: The Cultural Challenge

Even the most advanced risk indicator tools can fail if employees resist change or don’t understand their value. Challenges include:

- Lack of Awareness: Employees may not recognize how risk indicators benefit their roles, leading to poor engagement.

- Fear of Automation: Concerns about being replaced by automated tools can hinder adoption.

- Misalignment: Without clear communication, teams might not align their efforts with the organization’s broader risk management goals.

Building a culture of transparency and collaboration, supported by training programs, ensures that employees view risk indicators as allies rather than adversaries.

Risk indicators have their complexities, but the right strategies and tools can transform these challenges into strengths. The next step? Learning from real-world applications to understand how risk indicators drive success across industries. Let’s explore practical examples that bring these concepts to life. Keep reading!

Real-World Examples of Risk Indicators

Risk indicators are not just theoretical tools—they play a crucial role in real-world scenarios across various industries. By examining their applications, successes, and even failures, we can uncover valuable lessons about how to leverage risk indicators effectively. Let’s dive into compelling examples that highlight the power of these metrics in action.

Industry-Specific Risk Indicators: Tailored Tools for Unique Challenges

Every industry faces distinct risks, and risk indicators must be customized to reflect these nuances. Here’s how they come to life in different sectors:

- Finance: Liquidity ratios, credit exposure, and capital adequacy are critical risk indicators for financial institutions. For instance, during times of economic uncertainty, monitoring these metrics helps banks manage credit risk and maintain stability.

- Healthcare: Metrics like infection rates, patient outcomes, and compliance with safety protocols serve as key risk indicators. A hospital tracking an uptick in post-surgical infections can swiftly implement corrective measures to protect patient safety.

- Retail: Inventory turnover rates, customer return patterns, and shrinkage levels reveal potential vulnerabilities. A retailer noticing a sudden spike in shrinkage can investigate and address theft or operational inefficiencies.

- Energy: For oil and gas companies, monitoring environmental impact and equipment failure rates are vital risk indicators. These metrics help mitigate environmental hazards and ensure operational continuity.

- Technology: In the tech sector, cyberattack attempts, system uptime, and innovation cycles are key indicators. A software company observing an increase in cyber threats can enhance its security measures before an incident occurs.

These examples show how risk indicators, when tailored to an industry’s specific needs, can safeguard assets, ensure compliance, and drive operational efficiency.

Lessons from High-Profile Failures: Ignoring Warnings Comes at a Cost

The consequences of neglecting or misinterpreting risk indicators are starkly evident in high-profile cases. Here are a few cautionary tales:

- 2008 Financial Crisis: One of the most infamous examples of ignored risk indicators. Financial institutions overlooked warning signs like rising default rates and inflated asset valuations, leading to a global economic collapse. If these metrics had been heeded, the crisis might have been mitigated.

- Deepwater Horizon Oil Spill (2010): In the energy sector, risk indicators related to equipment maintenance and safety protocols were downplayed. This oversight resulted in one of the largest environmental disasters in history, costing billions in damages and irreparable harm to the company’s reputation.

- Target’s Data Breach (2013): Risk indicators, such as increased network traffic and unauthorized access alerts, signaled a cyberattack. However, these warnings were not acted upon promptly, leading to a massive data breach affecting millions of customers.

These examples underscore the importance of not only monitoring risk indicators but also acting on their warnings with urgency and precision.

Positive Case Studies: Success Stories of Effective Risk Management

While failures provide lessons, success stories inspire confidence in the potential of risk indicators. Consider these examples:

- A Global Logistics Leader: By monitoring delivery delays and supplier performance, a logistics company identified bottlenecks and diversified suppliers. This proactive use of operational risk indicators minimized disruptions, especially during peak demand seasons.

- A Multinational Bank: A major bank used financial risk indicators to track rising loan defaults during an economic downturn. By tightening lending criteria and enhancing customer risk assessments, the bank avoided significant losses and maintained investor trust.

- An E-Commerce Giant: An e-commerce platform noticed a sudden spike in customer returns. Investigating this risk indicator revealed a supplier quality issue. Addressing the problem improved product quality and customer satisfaction, reinforcing the company’s reputation.

These successes highlight how risk indicators can empower organizations to anticipate problems, respond proactively, and turn challenges into opportunities.

Emerging Applications: Risk Indicators in New Frontiers

As industries evolve, so too do the applications of risk indicators. Emerging trends include:

- Sustainability and ESG Metrics: Companies are increasingly monitoring environmental, social, and governance (ESG) risk indicators to align with global sustainability goals. For example, tracking carbon emissions and waste management metrics helps organizations reduce their environmental footprint.

- Cybersecurity: With the rise of digital threats, businesses are using cybersecurity risk indicators like phishing attempts, failed login attempts, and malware detections to stay ahead of cybercriminals.

- Artificial Intelligence: AI-powered risk indicators analyze real-time data to predict market trends, consumer behaviors, and potential risks, enabling businesses to adapt more effectively.

These applications demonstrate the growing scope and relevance of risk indicators in addressing modern challenges.

Risk indicators are far more than abstract concepts—they’re practical, actionable tools that shape decision-making and drive results. From high-profile failures to inspiring success stories, they provide critical insights that help businesses navigate uncertainty. But what role does SearchInform play in enhancing these capabilities? Let’s explore how SearchInform empowers organizations to master risk indicators and build resilience in an ever-changing world. Keep reading!

The Role of SearchInform in Mastering Risk Indicators

In a world where risks evolve at lightning speed, the ability to effectively monitor, analyze, and respond to risk indicators can define the difference between success and failure. Enter SearchInform, a trailblazer in risk management solutions that empowers organizations to harness the full potential of their risk indicators. Whether you’re safeguarding financial assets, enhancing operational resilience, or fortifying strategic decisions, SearchInform’s comprehensive tools are designed to keep you ahead of the curve.

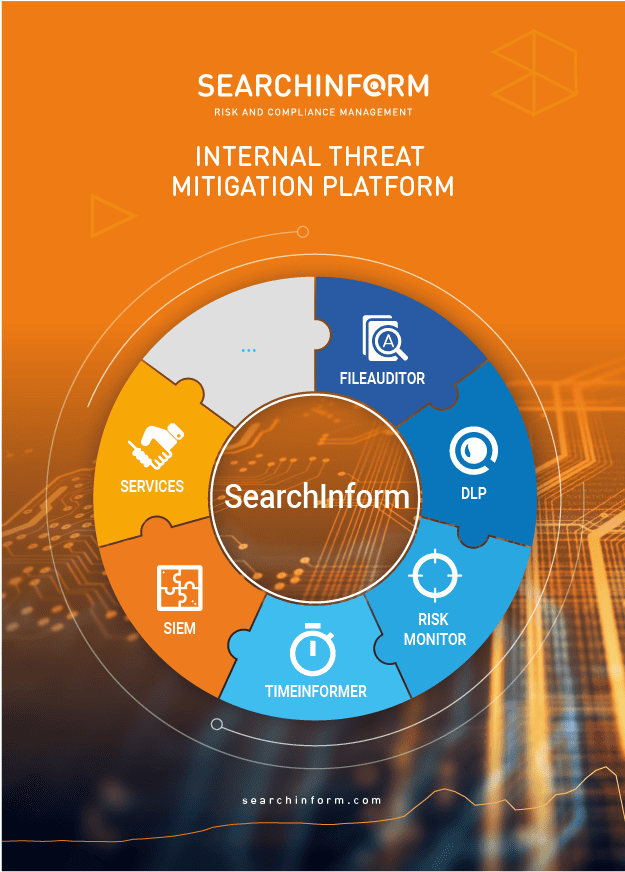

A Comprehensive Suite for Risk Management Excellence

SearchInform isn’t just another software solution—it’s a game-changing ally in navigating the complexities of risk management. Here’s how it stands out:

- Advanced Risk Monitoring: SearchInform’s platform leverages real-time analytics to track and interpret risk indicators with unparalleled accuracy. Whether it’s financial metrics, operational processes, or emerging threats, the system ensures that no red flag goes unnoticed.

- Customizable Dashboards: Every organization is unique, and SearchInform recognizes this. Its customizable dashboards allow businesses to focus on the risk indicators most relevant to their industry, size, and goals.

- Integrated Solutions: SearchInform seamlessly integrates with existing systems, reducing disruptions and ensuring a smooth transition to more advanced risk monitoring practices.

With SearchInform, businesses gain not just a tool but a complete ecosystem for proactive risk management.

Turning Data Into Actionable Insights

One of the greatest challenges in risk management is translating raw data into meaningful actions. SearchInform bridges this gap by offering tools that transform complex risk indicators into actionable insights:

- Predictive Analytics: SearchInform’s platform uses AI and machine learning to forecast risks before they materialize, empowering businesses to act preemptively.

- Real-Time Alerts: Instant notifications ensure that decision-makers are informed of critical changes in their risk indicators the moment they occur.

- Comprehensive Reporting: Detailed reports help organizations not only respond to risks but also understand their root causes, fostering continuous improvement.

These features ensure that businesses don’t just react to risks—they stay ahead of them.

Addressing Industry-Specific Challenges

Risk indicators vary significantly across industries, and SearchInform tailors its solutions to address these unique needs:

- Finance: Monitor various risks with tools that enhance fiscal resilience.

- Healthcare: Track compliance metrics, patient safety indicators, and operational risks to protect both patients and reputations.

- Retail: Manage inventory turnover, shrinkage, and customer behavior to optimize operations and boost profitability.

- Energy: Monitor environmental impacts and equipment health to ensure operational efficiency and compliance.

- Technology: Identify cybersecurity risks, system vulnerabilities, and innovation cycles with solutions designed for the fast-paced tech world.

SearchInform’s ability to adapt to industry-specific risk indicators makes it a versatile and indispensable partner for businesses across sectors.

Enhancing Operational Resilience and Strategic Planning

Risk indicators aren’t just about avoiding threats—they’re about driving better decisions. SearchInform helps organizations use their risk indicators to:

- Enhance Resilience: By identifying vulnerabilities early, businesses can implement robust measures to minimize disruptions.

- Support Growth: SearchInform’s tools enable data-driven decision-making, ensuring that strategies are grounded in reality and risks are managed effectively.

- Foster Transparency: With clear, accessible data, teams across the organization can align their efforts and work collaboratively toward shared goals.

SearchInform doesn’t just help you avoid pitfalls; it transforms your risk indicators into levers for success.

Simplifying Complexity Through Automation

One of the standout features of SearchInform is its ability to automate the tracking and management of risk indicators. Automation reduces human error, saves time, and ensures consistency in risk monitoring. Key benefits include:

- Effortless Scalability: As your business grows, SearchInform grows with you, handling increasing data volumes with ease.

- Instant Insights: Automated systems provide instant access to critical data, empowering businesses to act in real time.

- Focus on Strategy: By handling routine monitoring tasks, SearchInform frees up your team to focus on high-value strategic initiatives.

Automation doesn’t just streamline processes; it transforms how organizations approach risk management.

The Transformative Power of SearchInform

Imagine a world where businesses anticipate risks before they even materialize. With SearchInform, this isn’t just a possibility—it’s the new normal. Let’s step into hypothetical but realistic scenarios that showcase how SearchInform can empower organizations to turn risk indicators into actionable strategies.

Scenario 1: A Retail Giant Tackling Hidden Inefficiencies

A global retail chain is grappling with inventory issues. Products vanish from shelves, supply chain delays mount, and revenue takes a hit. The culprit? A mix of operational inefficiencies and theft. Using SearchInform’s real-time monitoring tools, the company pinpoints discrepancies in inventory turnover and shipping delays. With automated alerts, they uncover vulnerabilities in their supply chain and address theft within their logistics network. The result? Millions saved, smoother operations, and a stronger bottom line.

Scenario 2: A Tech Innovator Defending Against Cyber Threats

A fast-growing tech company has become a prime target for cyberattacks. Phishing attempts, unusual login patterns, and unauthorized access alerts are piling up. Traditional tools are too slow to keep up, leaving the company exposed. By deploying SearchInform’s cybersecurity solutions, they gain real-time visibility into network vulnerabilities. The system’s instant alerts and predictive models allow the company to act swiftly, fortifying their defenses and preventing a potentially devastating data breach. In the process, they not only secure their systems but also protect their reputation and customer trust.

Why SearchInform is the Future of Risk Management

In today’s volatile world, relying on outdated risk management practices is no longer an option. SearchInform equips organizations with the tools they need to thrive in uncertainty:

- Proactive Prevention: Identify risks before they escalate.

- Streamlined Processes: Automate monitoring and reporting for efficiency.

- Unmatched Expertise: Leverage industry-specific solutions tailored to your unique challenges.

SearchInform is more than a service—it’s a strategic partner committed to empowering your business.

Take Control of Your Risk Management Today

Your risk indicators are the key to unlocking a more secure, resilient, and successful future. With SearchInform, you’re not just reacting to risks—you’re redefining how they’re managed. Don’t wait for the next crisis to strike—get ahead of it.

Explore how SearchInform can revolutionize your risk management strategy today. Your future starts with the decisions you make now—make them count.

Extend the range of addressed challenges with minimum effort

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!