SOX Section 404 Compliance: Understanding the Nuances

- Overview of SOX Section 404

- Historical Context and Significance:

- Objectives and Requirements of SOX Section 404:

- Challenges and Pitfalls in SOX Section 404 Compliance

- Best Practices for Achieving Compliance

- Top-Level Commitment:

- Risk Assessment:

- Documentation and Process Mapping:

- Segregation of Duties:

- Training and Awareness:

- Continuous Monitoring:

- Internal Audit Function:

- External Auditor Collaboration:

- Remediation and Follow-Up:

- Continuous Improvement:

- Documentation Retention:

- Board Oversight:

- Empowering SOX Section 404 Compliance With SearchInform Solutions

Overview of SOX Section 404

Section 404 of the Sarbanes-Oxley Act (SOX) of 2002 is a critical provision aimed at improving corporate governance and financial reporting in the United States. It was enacted in response to a series of high-profile corporate scandals, such as Enron and WorldCom, which shook investor confidence and highlighted the need for regulatory reforms.

Historical Context and Significance:

Before SOX, there was a lack of accountability and transparency in corporate financial reporting. Companies could manipulate financial data without proper oversight, leading to misleading information for investors and stakeholders. The collapse of Enron and other corporations exposed weaknesses in the regulatory framework and highlighted the necessity for reforms to restore trust in the financial markets.

SOX, signed into law by President George W. Bush in July 2002, aimed to address these issues by imposing stringent regulations on public companies and enhancing corporate governance practices. Section 404, in particular, focuses on internal controls over financial reporting (ICFR) to ensure the accuracy and reliability of financial statements.

Objectives and Requirements of SOX Section 404:

- Enhance Financial Reporting Integrity: The primary objective of Section 404 is to improve the accuracy and reliability of financial reporting by requiring management and auditors to assess and report on the effectiveness of internal controls related to financial reporting.

- Implementation of Effective Internal Controls: Public companies subject to SOX are required to establish and maintain adequate internal control structures and procedures for financial reporting. This includes controls over the initiation, authorization, processing, and recording of financial transactions.

- Management Assessment: Management is responsible for assessing the effectiveness of internal controls over financial reporting and providing an annual report on the adequacy of these controls.

- Auditor Attestation: External auditors are required to attest to the accuracy of management's assessment of internal controls. This involves auditing and testing the effectiveness of internal controls and issuing an opinion on whether they are suitably designed and operating effectively.

- Disclosure: Companies must disclose any material weaknesses in their internal controls over financial reporting identified during the assessment process. This disclosure ensures transparency and informs investors and stakeholders about potential risks.

Section 404 compliance has significant implications for public companies, including increased costs associated with compliance efforts and potential legal and reputational risks for non-compliance. However, it has played a crucial role in restoring investor confidence and improving corporate governance standards in the aftermath of corporate scandals.

Understanding Compliance Requirements

SOX Section 404 stands as a cornerstone of corporate governance reforms in the wake of high-profile financial scandals. Enacted in 2002, this provision addresses the critical need for transparency and accountability in financial reporting. Its significance lies in its aim to bolster investor confidence by ensuring the accuracy and reliability of corporate financial statements.

At its core, Section 404 mandates that public companies establish and maintain robust internal controls over financial reporting. These controls are designed to govern the initiation, authorization, processing, and recording of financial transactions. By implementing effective internal controls, companies can mitigate the risk of financial misstatements and fraudulent activities.

One of the key requirements of Section 404 is the assessment of internal controls by management. Company executives are tasked with evaluating the effectiveness of these controls and providing an annual report on their adequacy. This process involves scrutinizing the design and operation of internal controls to identify any weaknesses that could compromise financial integrity.

External auditors also play a crucial role in Section 404 compliance. They are required to attest to the accuracy of management's assessment of internal controls. This involves conducting audits and tests to ensure that controls are suitably designed and operating effectively. Auditor attestation provides an additional layer of assurance to investors regarding the reliability of financial reporting.

Section 404 mandates disclosure of any material weaknesses identified in internal controls. This transparency requirement ensures that investors and stakeholders are informed about potential risks. Companies must disclose weaknesses promptly, allowing investors to make informed decisions about the reliability of financial information.

While compliance with Section 404 entails increased costs and efforts for public companies, its benefits in terms of investor trust and market integrity are substantial. By holding companies accountable for the effectiveness of their internal controls, Section 404 contributes to a more transparent and trustworthy financial environment.

Challenges and Pitfalls in SOX Section 404 Compliance

Navigating SOX Section 404 compliance poses various challenges and pitfalls for public companies, stemming from its stringent requirements and complex nature.

Firstly, the implementation of effective internal controls can be a daunting task. Companies must design control systems that cover all aspects of financial reporting processes, from transaction initiation to recording and reporting. This requires thorough understanding and documentation of business processes, which can be time-consuming and resource-intensive.

Secondly, assessing the effectiveness of internal controls presents its own set of challenges. Management must evaluate whether controls are designed appropriately and operating effectively to prevent and detect material misstatements in financial statements. This requires ongoing monitoring and testing of controls, often involving coordination across different departments and business units.

Thirdly, external auditor involvement adds another layer of complexity to Section 404 compliance. Companies rely on auditors to provide assurance on the effectiveness of their internal controls, but auditor requirements and expectations can vary. Coordinating with auditors and addressing their concerns can be challenging, particularly if there are disagreements about the adequacy of controls.

Additionally, the cost of compliance with Section 404 can be significant, especially for smaller companies with limited resources. Compliance efforts may involve hiring additional staff, investing in technology, and conducting extensive testing and documentation. These costs can strain budgets and divert resources from other strategic initiatives.

The risk of misinterpretation or misapplication of Section 404 requirements is a common pitfall. The complexity of the regulation and evolving guidance from regulatory bodies and auditing standards can lead to confusion and errors in implementation. Companies must stay abreast of regulatory updates and seek guidance from experts to ensure compliance.

The identification and remediation of material weaknesses in internal controls can be challenging and time-consuming. Material weaknesses expose companies to increased risk of financial fraud or errors, leading to potential reputational damage and legal liabilities. Addressing these weaknesses requires careful analysis, remediation planning, and monitoring to ensure effectiveness.

Achieving and maintaining compliance with SOX Section 404 is an ongoing process that requires commitment, expertise, and resources. Companies must proactively address challenges and pitfalls to strengthen their internal controls and uphold the integrity of financial reporting.

Best Practices for Achieving Compliance

Achieving compliance with SOX Section 404 requires a proactive and strategic approach, incorporating best practices to effectively design, implement, and maintain internal controls over financial reporting. Here are some key best practices:

Top-Level Commitment:

Strong commitment and support from senior management and the board of directors are vital for effective compliance with SOX regulations. Without their leadership buy-in, allocating resources and prioritizing compliance efforts becomes challenging. It sets the tone for the entire organization, emphasizing the importance of adhering to regulatory standards. Leadership endorsement ensures that compliance initiatives receive the necessary attention and resources they deserve. It fosters a culture of integrity and accountability throughout the organization, reinforcing the significance of compliance with SOX regulations. Thus, top-level commitment plays a crucial role in driving successful compliance efforts and maintaining transparency and trust within the organization.

Risk Assessment:

Conducting a comprehensive risk assessment is paramount in the journey towards SOX compliance. It involves identifying and prioritizing areas of significant financial reporting risk within the organization. Emphasis should be placed on areas where the likelihood of material misstatements or fraudulent activities is higher. By focusing on these critical areas, companies can allocate resources effectively and implement robust internal controls to mitigate risks. Through diligent risk assessment, organizations can proactively safeguard the accuracy and reliability of their financial reporting processes.

Documentation and Process Mapping:

Comprehensively documenting key financial processes and controls is crucial for achieving compliance with SOX regulations. This involves capturing all relevant details and procedures to provide a clear understanding of the control environment. Additionally, process mapping plays a pivotal role in this endeavor, as it helps visualize the flow of transactions and identify potential gaps or inefficiencies in control implementation. By meticulously documenting processes and conducting thorough mapping exercises, organizations can pinpoint areas for improvement and design more effective controls. Thus, documentation and process mapping serve as foundational steps in ensuring the integrity and reliability of financial reporting practices.

Segregation of Duties:

Implementing segregation of duties is imperative for upholding the integrity of financial processes within an organization. This involves dividing responsibilities among multiple individuals to prevent conflicts of interest and reduce the risk of errors or fraud. By ensuring that no single person has unchecked authority over all aspects of a financial transaction, companies can enhance control effectiveness and accountability. Segregation of duties serves as a critical control mechanism, providing checks and balances that safeguard against potential vulnerabilities. Thus, organizations must prioritize the implementation of robust segregation of duties policies to mitigate risks and maintain compliance with regulatory requirements.

Training and Awareness:

To ensure compliance with SOX regulations, organizations must prioritize the provision of training and awareness programs for employees involved in financial reporting processes. These programs aim to equip staff with the necessary knowledge and skills to fulfill their roles and responsibilities related to internal controls effectively. By fostering a culture of understanding and accountability, organizations empower employees to recognize the importance of compliance and the significance of their contributions to maintaining control integrity. Therefore, investing in comprehensive training and awareness initiatives is essential for promoting compliance and mitigating risks associated with financial reporting inaccuracies or fraudulent activities.

Continuous Monitoring:

Establishing mechanisms for continuous monitoring and evaluation of internal controls is crucial for ensuring compliance with SOX requirements. These mechanisms enable organizations to detect deficiencies promptly and take corrective actions. Implementing automated controls, where feasible, streamlines the monitoring process and enhances efficiency. Additionally, conducting regular testing and reviews provides valuable insights into control effectiveness and identifies areas for improvement. By adopting a proactive approach to continuous monitoring, organizations can maintain the integrity of their financial reporting processes and minimize the risk of material misstatements or fraudulent activities.

Internal Audit Function:

Utilizing the internal audit function is integral to ensuring the effectiveness of internal controls within an organization. This function serves as an independent assurance mechanism, providing valuable insights into the adequacy and reliability of control measures. By leveraging internal audit findings, organizations can identify areas for improvement and take proactive steps to strengthen controls. Internal auditors play a vital role in evaluating the design and implementation of controls, as well as assessing their ongoing effectiveness. By collaborating closely with internal auditors, organizations can enhance their control environment and mitigate the risk of financial misstatements or fraudulent activities.

External Auditor Collaboration:

Collaboration and open communication with external auditors are essential components of successful compliance with SOX regulations. By fostering a collaborative relationship, organizations can ensure alignment on control objectives and expectations from the outset. It's crucial to engage auditors early in the compliance process to provide them with insight into the organization's control environment and operational dynamics. This early engagement enables auditors to better understand the organization's risk profile and tailor their audit procedures accordingly. By maintaining open lines of communication throughout the compliance process, organizations can address any concerns or questions raised by external auditors promptly. Ultimately, effective collaboration with external auditors enhances the efficiency and credibility of the compliance process, contributing to the organization's overall success in meeting regulatory requirements.

Remediation and Follow-Up:

Addressing identified deficiencies or material weaknesses in internal controls promptly is essential for maintaining compliance and mitigating risks. Organizations must develop clear remediation plans with defined timelines and responsibilities to ensure accountability and progress tracking. By promptly implementing remediation actions, organizations can minimize the impact of control deficiencies and strengthen their control environment. Furthermore, timely follow-up to monitor progress is crucial to ensure that remediation efforts are effective and on track. Regular monitoring allows organizations to identify any obstacles or challenges and make necessary adjustments to remediation plans. Overall, proactive remediation and diligent follow-up are critical components of a robust compliance program, helping organizations maintain control integrity and meet regulatory requirements.

Continuous Improvement:

Embracing a culture of continuous improvement in internal controls is essential for organizations striving for sustained compliance and effectiveness. Regularly assessing and updating control procedures allows companies to adapt to evolving business processes, regulatory requirements, and organizational structures. By staying proactive and responsive to changes, organizations can ensure that their internal controls remain relevant and robust. This iterative approach fosters agility and resilience in the face of emerging risks and challenges. Moreover, it demonstrates a commitment to excellence and ongoing optimization, instilling confidence in stakeholders and enhancing overall governance practices. Therefore, embracing continuous improvement in internal controls is key to maintaining compliance and driving organizational success in dynamic environments.

Documentation Retention:

Maintaining comprehensive documentation of internal controls, assessments, and remediation efforts is essential for demonstrating compliance with SOX regulations. Documentation serves as tangible evidence of adherence to regulatory requirements and provides support during audits and reviews. By retaining thorough records, organizations can demonstrate the effectiveness of their internal controls and the diligence with which they address deficiencies. Documentation also serves as a valuable reference for internal stakeholders, enabling them to understand control procedures and responsibilities. Additionally, it facilitates continuity and knowledge transfer, ensuring that control practices remain consistent over time. Therefore, prioritizing documentation retention is crucial for fostering transparency, accountability, and regulatory compliance within organizations.

Board Oversight:

Establishing regular reporting mechanisms is essential for keeping the board of directors informed about SOX compliance efforts and the effectiveness of internal controls. Board oversight plays a pivotal role in ensuring accountability and transparency within the organization. By receiving regular updates on compliance initiatives and control effectiveness, the board can fulfill its oversight responsibilities effectively. These reporting mechanisms enable the board to stay informed about potential risks and challenges related to SOX compliance, allowing them to provide guidance and support as needed. Moreover, board oversight promotes a culture of accountability throughout the organization, reinforcing the importance of compliance with regulatory requirements. Therefore, establishing robust reporting mechanisms is critical for fostering governance and maintaining stakeholder confidence in the organization's commitment to compliance and integrity.

Incorporating these best practices into their compliance efforts enhances the effectiveness of companies' internal controls and mitigates the risk of material misstatements in financial reporting. Compliance with SOX Section 404 not only satisfies regulatory requirements but also strengthens corporate governance and investor confidence.

Empowering SOX Section 404 Compliance With SearchInform Solutions

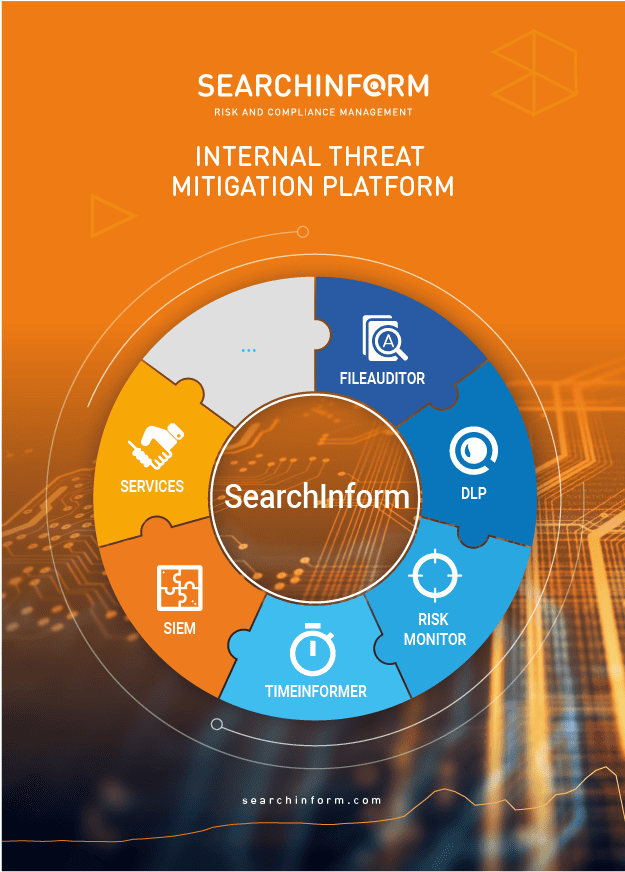

In the pursuit of SOX Section 404 compliance, organizations seek solutions that offer robust monitoring, risk assessment, and reporting capabilities. SearchInform solutions offer several benefits in achieving compliance with SOX Section 404:

Comprehensive Monitoring: SearchInform solutions provide comprehensive monitoring capabilities, allowing organizations to track and analyze user activities, data access, and system changes. This level of visibility enables companies to detect and prevent unauthorized access or data breaches, thereby enhancing internal control effectiveness.

Risk Assessment and Analysis: SearchInform solutions offer advanced risk assessment and analysis features, enabling organizations to identify potential risks and vulnerabilities within their IT infrastructure. By conducting thorough risk assessments, companies can prioritize control measures and allocate resources effectively to mitigate risks associated with financial reporting.

Automated Compliance Reporting: SearchInform solutions automate the process of compliance reporting, facilitating the generation of detailed reports and audit trails required for SOX Section 404 compliance. This streamlines compliance efforts and reduces the administrative burden associated with manual reporting tasks.

Real-time Alerts and Notifications: SearchInform solutions provide real-time alerts and notifications for suspicious activities or policy violations. By promptly alerting organizations to potential compliance issues, these solutions enable proactive intervention and remediation, minimizing the impact of control deficiencies.

Documentation and Evidence Management: SearchInform solutions offer robust documentation and evidence management capabilities, allowing organizations to maintain comprehensive records of internal controls, assessments, and remediation efforts. This documentation serves as evidence of compliance and provides support during audits and reviews.

Continuous Monitoring and Improvement: SearchInform solutions enable organizations to continuously monitor and improve their compliance posture. By leveraging advanced analytics and reporting features, companies can identify areas for enhancement and implement proactive measures to strengthen internal controls over time.

SearchInform solutions play a critical role in helping organizations achieve and maintain compliance with SOX Section 404 by providing comprehensive monitoring, risk assessment, automated reporting, real-time alerts, documentation management, and continuous improvement capabilities.

Take Control of Compliance: Explore How SearchInform Solutions Can Safeguard Your SOX Section 404 Compliance Efforts Today!

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!