Cyber Attacks on Banks: Threat Landscape and Countermeasures

- Impacts of Cyber Attacks on Banks

- Preventive Measures and Best Practices

- Implement Robust Cybersecurity Policies

- Employee Training and Awareness

- Multi-Factor Authentication (MFA)

- Regular Security Audits and Penetration Testing

- Network Segmentation and Access Controls

- Endpoint Security Solutions

- Secure Coding Practices

- Vendor Risk Management

- Incident Response Plan

- Collaboration and Information Sharing

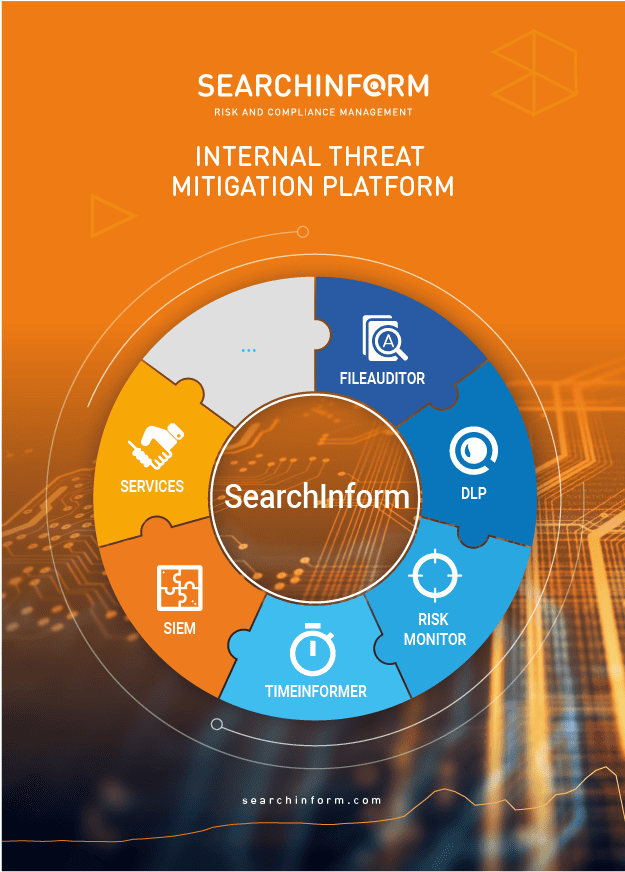

- Unlocking Security Excellence with SearchInform Solutions

Cyber attacks on banks refer to malicious activities carried out by individuals, groups, or organizations with the intent to compromise the security of financial institutions and their digital assets. The ultimate goal of cyber attacks on banks is often to steal sensitive financial data, disrupt banking services, commit fraud, extort money through ransom payments, or cause reputational damage to the targeted institution.

Cyber attacks on banks are a significant concern in the realm of cybersecurity. These attacks can take various forms, ranging from malware infections to sophisticated hacking attempts aimed at stealing sensitive financial data or disrupting banking services. Here are some common types of cyber attacks that banks may face:

Phishing Attacks: These devious schemes involve the art of crafting fraudulent emails or messages that bear an uncanny resemblance to correspondence from esteemed financial institutions, namely banks. Their nefarious aim? To lure unsuspecting recipients into divulging prized treasures of information such as login credentials or personal data.

Malware: A menacing arsenal of malicious software—viruses, worms, or Trojans—stands ready to infiltrate the digital fortresses of banks. Once inside, these treacherous entities embark on a mission to pilfer sensitive data, covertly observe activities, or clandestinely gain access to the inner sanctums of banking systems.

Distributed Denial of Service (DDoS) Attacks: Picture a legion of commandeered computers, conscripted into service by cybercriminal overlords. Together, they launch a relentless assault on the bastions of banking, inundating servers and network infrastructure with a deluge of traffic. The result? A veritable siege that renders the bank's operations inaccessible to rightful patrons.

Insider Threats: Among the guardians of the vaults lurks a shadowy menace—employees or contractors entrusted with access to the inner workings of the bank. Whether by design or unwitting folly, these insiders may betray their sacred trust, imperiling the sanctity of sensitive information and precipitating breaches or security breaches.

ATM Skimming: Imagine a clandestine operation unfolding under the cloak of darkness, as malevolent hands surreptitiously install insidious contraptions upon unsuspecting ATMs. These devices, like insatiable leeches, latch onto card information belonging to unwitting customers, fueling a black market economy of illicit transactions and counterfeit cards.

Ransomware: A digital plague descends upon the bank's systems, as insidious malware encrypts files and entire domains with ruthless efficiency. Locked out and held hostage, users find themselves at the mercy of cyber extortionists, compelled to yield to their demands under threat of operational disruption and ruinous financial losses.

Social Engineering: The realm of human psychology becomes the battleground in this clandestine conflict, as cyber assailants employ cunning stratagems to exploit the frailties of human nature. Armed with honeyed words and beguiling personas, they deceive and manipulate bank employees, coaxing them into unwittingly granting access to prized troves of information or systems, circumventing even the most fortified of technical defenses.

To combat these threats, banks employ various cybersecurity measures, including robust encryption protocols, multi-factor authentication, intrusion detection systems, employee training on security best practices, regular security audits, and collaboration with law enforcement agencies and cybersecurity experts. Despite these efforts, cyber attacks on banks continue to evolve, highlighting the ongoing need for vigilance and innovation in cybersecurity defenses.

Impacts of Cyber Attacks on Banks

The impacts of cyber attacks on banks are multifaceted and far-reaching, extending beyond mere financial losses to encompass broader ramifications for both institutions and their customers.

First and foremost, cyber attacks can inflict significant financial harm on banks, resulting in direct losses from stolen funds, fraudulent transactions, and operational disruptions. These financial setbacks can erode profits, damage shareholder confidence, and impair the long-term viability of the institution.

Moreover, the reputational damage incurred by banks in the wake of a cyber attack can be profound and enduring. Trust, once lost, is difficult to regain, and customers may flee to competitors perceived as more secure, leading to a loss of market share and diminished brand value.

The fallout from a cyber attack extends beyond the financial realm, impacting customer trust and confidence in the banking industry as a whole. The perception of banks as custodians of financial security may be undermined, fostering a climate of uncertainty and fear among consumers.

Operational disruptions caused by cyber attacks can impede the delivery of essential banking services, inconveniencing customers and undermining the smooth functioning of the economy. Transactions may be delayed or disrupted, loans may be unavailable, and critical financial infrastructure may falter, exacerbating economic instability.

In addition to financial and reputational repercussions, cyber attacks on banks can have broader societal impacts, undermining confidence in the digital economy and highlighting vulnerabilities in the global financial system. Governments, regulators, and international organizations may be compelled to enact stricter cybersecurity regulations and standards, imposing additional compliance burdens on banks and reshaping the regulatory landscape.

Ultimately, the impacts of cyber attacks on banks are profound and pervasive, affecting not only the targeted institutions but also the broader economy, society, and regulatory environment. As cyber threats continue to evolve in sophistication and scale, banks must remain vigilant in their efforts to safeguard against potential attacks and mitigate the adverse consequences of breaches.

Preventive Measures and Best Practices

Preventive measures and best practices play a pivotal role in fortifying banks against the ever-looming threat of cyber attacks. Here's a comprehensive guide to safeguarding banking systems and customer data:

Implement Robust Cybersecurity Policies

Developing and enforcing robust cybersecurity policies is paramount for banks in today's digital landscape. These policies should encompass a wide array of considerations, including access control, data encryption, incident response, and employee training. By establishing clear guidelines and protocols, banks can ensure that all staff members are aware of their responsibilities and understand the importance of adhering to security best practices.

Regularly reviewing and updating these policies is essential to keep pace with evolving cyber threats and regulatory requirements. Banks must remain vigilant in monitoring emerging trends and adapting their policies accordingly. Additionally, fostering a culture of cybersecurity awareness among employees can further reinforce the effectiveness of these policies, encouraging proactive behavior and swift response to potential threats.

Employee Training and Awareness

Investing in ongoing training and awareness programs is crucial for equipping bank employees with the knowledge and skills needed to combat cyber threats effectively. These programs should cover a wide range of topics, including phishing tactics, social engineering techniques, and best practices for safeguarding sensitive information.

By educating employees about the latest cyber threats and arming them with practical strategies for mitigating risks, banks can significantly reduce the likelihood of successful cyber attacks. Regular training sessions, workshops, and simulated phishing exercises can help reinforce key concepts and ensure that employees remain vigilant in their day-to-day activities.

Multi-Factor Authentication (MFA)

Implementing multi-factor authentication (MFA) is a fundamental step in enhancing the security of banking systems and data. MFA requires users to verify their identity using multiple factors, such as passwords, biometrics, or security tokens, before gaining access to sensitive information or systems.

By adding an extra layer of security beyond traditional password-based authentication, MFA helps mitigate the risk of unauthorized access and credential theft. Banks should mandate the use of MFA for accessing critical systems and data, ensuring that even if one factor is compromised, attackers still face significant barriers to entry.

Regular Security Audits and Penetration Testing

Conducting regular security audits and penetration tests is essential for identifying vulnerabilities in banking systems and networks. These assessments involve systematically evaluating the effectiveness of existing security controls and identifying potential weaknesses that could be exploited by attackers.

By proactively identifying and addressing vulnerabilities, banks can reduce the risk of successful cyber attacks and minimize the potential impact of security breaches. Regular audits and penetration tests also provide valuable insights into emerging threats and help inform the development of proactive security measures.

Network Segmentation and Access Controls

Segmenting networks and enforcing strict access controls are critical components of a comprehensive cybersecurity strategy for banks. Network segmentation involves dividing the banking infrastructure into smaller, isolated segments to limit the spread of cyber attacks and contain any potential breaches.

By compartmentalizing sensitive data and systems, banks can minimize the impact of security incidents and prevent attackers from moving laterally within the network. Strict access controls, such as the principle of least privilege, further restrict access to sensitive information and systems, ensuring that only authorized users with a legitimate need can access them.

Endpoint Security Solutions

Deploying robust endpoint security solutions is essential for protecting devices connected to the banking network from malware and other threats. These solutions, which may include antivirus software, intrusion detection systems, and endpoint encryption tools, help detect and mitigate security threats at the endpoint level.

By continuously monitoring endpoint devices for signs of malicious activity and enforcing security policies, banks can reduce the risk of successful cyber attacks and safeguard sensitive data. Regularly updating software patches and libraries is also crucial for addressing known vulnerabilities and maintaining the integrity of endpoint security measures.

Secure Coding Practices

Adhering to secure coding practices is paramount for developing and maintaining banking applications and software systems. By following established guidelines and best practices, developers can minimize the risk of introducing vulnerabilities that could be exploited by attackers.

Regularly updating software patches and libraries is essential for addressing known vulnerabilities and reducing the risk of exploitation. By staying abreast of emerging threats and adopting proactive security measures, banks can minimize the likelihood of successful cyber attacks and protect their systems and data from harm.

Vendor Risk Management

Implementing a rigorous vendor risk management program is essential for assessing and mitigating the security risks associated with third-party vendors and service providers. Banks should conduct thorough assessments of vendors' security practices and ensure that they adhere to strict security standards and contractual obligations.

By vetting vendors and service providers carefully, banks can minimize the risk of supply chain attacks and ensure the integrity of their banking infrastructure. Regularly monitoring vendor performance and conducting periodic audits can further mitigate the risk of security breaches and enhance overall cybersecurity posture.

Incident Response Plan

Developing and maintaining a comprehensive incident response plan is critical for guiding the organization's response in the event of a cyber attack or data breach. This plan should outline clear roles and responsibilities, establish communication protocols, and provide detailed procedures for responding to security incidents.

Regularly reviewing and updating the incident response plan is essential to ensure that it remains effective in the face of evolving cyber threats. Conducting regular drills and tabletop exercises can help test the plan's efficacy and familiarize key stakeholders with their roles and responsibilities in the event of a security incident.

Collaboration and Information Sharing

Fostering collaboration and information sharing with industry peers, government agencies, and cybersecurity organizations is essential for staying abreast of emerging threats and best practices. Participating in threat intelligence sharing initiatives can provide valuable insights into evolving cyber threats and help inform proactive security measures.

By sharing information and collaborating with other organizations, banks can enhance their ability to detect and mitigate cyber threats effectively. Establishing partnerships with trusted entities and participating in industry-wide initiatives can further strengthen the collective cybersecurity posture of the banking sector.

Implementing these preventive measures and best practices enables banks to enhance their cybersecurity posture and mitigate the risk of cyber attacks. Investing in robust cybersecurity policies, employee training and awareness programs, multi-factor authentication, regular security audits, network segmentation, endpoint security solutions, secure coding practices, vendor risk management, incident response planning, and collaboration and information sharing initiatives is essential for effectively safeguarding banks' systems and data against a wide range of cyber threats.

Unlocking Security Excellence with SearchInform Solutions

SearchInform solutions offer a multitude of benefits for organizations looking to bolster their cybersecurity, enhance operational efficiency, and mitigate various risks. Here are some key advantages:

Comprehensive Data Protection: SearchInform solutions provide comprehensive data protection by enabling organizations to monitor, analyze, and protect sensitive information across multiple channels and endpoints. By implementing robust data loss prevention (DLP) measures, organizations can prevent unauthorized access, leakage, or theft of sensitive data, ensuring compliance with regulatory requirements and safeguarding intellectual property.

Proactive Threat Detection: SearchInform solutions leverage advanced analytics and machine learning algorithms to detect and respond to potential security threats in real-time. By continuously monitoring network activity, user behavior, and endpoint devices, organizations can proactively identify and mitigate security incidents before they escalate into major breaches, minimizing potential damage and disruption to operations.

Enhanced Compliance: With SearchInform solutions, organizations can ensure compliance with regulatory requirements and industry standards related to data protection, privacy, and cybersecurity. By implementing robust compliance management features, organizations can streamline audit processes, demonstrate adherence to regulatory mandates, and mitigate the risk of non-compliance penalties or legal liabilities.

Improved Operational Efficiency: SearchInform solutions streamline and automate various cybersecurity processes, such as incident response, threat detection, and policy enforcement, thereby improving operational efficiency and reducing manual workload. By centralizing security management tasks and providing actionable insights into security posture, organizations can optimize resource allocation, enhance productivity, and focus on strategic initiatives.

Advanced Insider Threat Prevention: SearchInform solutions include sophisticated insider threat detection capabilities that enable organizations to identify and mitigate risks associated with malicious insiders or negligent employees. By monitoring user activity, analyzing behavior patterns, and detecting anomalies in real-time, organizations can prevent data breaches, intellectual property theft, and other insider-driven security incidents.

Comprehensive Risk Management: SearchInform solutions offer comprehensive risk management capabilities that enable organizations to assess, prioritize, and mitigate cybersecurity risks effectively. By conducting thorough risk assessments, organizations can identify vulnerabilities, prioritize remediation efforts, and implement proactive security measures to protect against emerging threats and vulnerabilities.

Scalability and Flexibility: SearchInform solutions are designed to scale with the evolving needs and requirements of organizations, offering flexibility to adapt to changing business environments and technology landscapes. Whether deployed on-premises, in the cloud, or as a hybrid solution, SearchInform solutions provide scalability, agility, and customization options to meet the unique needs of organizations of all sizes and industries.

SearchInform solutions offer a comprehensive suite of capabilities that enable organizations to strengthen their cybersecurity posture, enhance operational efficiency, ensure compliance, mitigate risks, and protect sensitive data from internal and external threats. By leveraging advanced technologies and analytics, organizations can proactively detect and respond to security incidents, safeguard critical assets, and maintain a resilient security posture in today's dynamic threat landscape.

Take the first step towards enhanced cybersecurity and risk mitigation with SearchInform solutions. Safeguard your organization's sensitive data, streamline operational efficiency, and stay ahead of emerging threats. Schedule a demo or contact us to learn more.

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!