Risk Assessment Steps for Effective Risk Management

- Introduction to Risk Assessment: Why It Matters

- The Role of Risk Assessment in Business Continuity

- Step-by-Step Guide to Risk Assessment

- Identifying Risks: Tools and Techniques

- Analyzing Risks: Qualitative vs. Quantitative Approaches

- Evaluating Risks: Prioritization Criteria

- Mitigating Risks: Control Measures and Action Plans

- Monitoring and Reviewing Risks: Best Practices

- Proactive Risk Communication: A New Essential

- Risk Categories to Address

- Operational Risks

- Financial Risks

- Cybersecurity Risks

- Legal and Compliance Risks

- Environmental and Social Risks

- Strategic Risks

- Common Challenges in Risk Assessment

- Lack of Comprehensive Data

- Misaligned Objectives Across Teams

- Inadequate Tools and Technology

- Resistance to Change

- Overwhelming Volume of Risks

- Unclear Accountability

- Case Studies and Real-World Applications

- Examples of Effective Risk Assessments in Various Industries

- Lessons Learned from Risk Assessment Failures

- Manufacturing: Ignoring Cyber Threats

- Nonprofit Organization: Fraud by Insiders

- Emerging Risks in a Post-Pandemic World

- The Role of Technology in Transforming Risk Assessment

- Cross-Industry Collaboration in Risk Management

- SearchInform Solutions for Effective Risk Management

- SearchInform Tools for Risk Identification

- Automated Risk Analysis with SearchInform

- Real-Time Monitoring: Staying Ahead of Threats

- Enhanced Incident Response and Reporting

- Customizable Risk Management Frameworks

- Data-Driven Decision-Making

Introduction to Risk Assessment: Why It Matters

Picture this: you're piloting a ship through stormy waters, with waves crashing and no compass to guide you. Feels daunting, doesn’t it? For businesses, risk assessment is that indispensable compass, offering clarity amidst uncertainty. It steers organizations through uncharted challenges—be it cyberattacks, market instability, or operational hiccups—allowing them to navigate toward stability and growth.

In today’s high-stakes business landscape, where threats evolve faster than ever, risk assessment isn’t merely a checkbox; it’s a cornerstone of strategic decision-making. Each step taken during a risk assessment can be the difference between thriving through adversity and being blindsided by it.

The Role of Risk Assessment in Business Continuity

Let’s face it: no one can predict every twist and turn. However, risk assessment ensures businesses are prepared to adapt. It acts as a shield against potential disruptions, whether it’s a sudden supply chain failure or a cyberattack threatening critical data. By identifying and addressing vulnerabilities, organizations safeguard not only their operations but also their reputation and financial stability.

Think of it as building a safety net—one that empowers businesses to bounce back swiftly when the unexpected happens. And it all starts with understanding the key risk assessment steps.

Now, let’s dive deeper into how these steps unfold and transform uncertainty into actionable strategies.

Step-by-Step Guide to Risk Assessment

Risk assessment isn’t just about checking boxes; it’s about crafting a roadmap to protect your business from the unforeseen. Each risk assessment step builds on the last, creating a robust framework that prepares you for whatever comes your way. Let’s break down the process into actionable steps that ensure no threat goes unnoticed.

Identifying Risks: Tools and Techniques

Think of this as shining a flashlight into every corner of your business. Identifying risks involves uncovering vulnerabilities across operations, finances, cybersecurity, and compliance. How do you do it?

- Traditional Methods: SWOT analysis, brainstorming, and historical data reviews.

- Advanced Techniques: Leverage tools like risk identification software, threat modeling, or even AI-driven analytics to dig deeper and catch what human eyes might miss.

This initial step is crucial—it sets the stage for everything that follows. Skipping it is like heading into battle without knowing your enemy.

Analyzing Risks: Qualitative vs. Quantitative Approaches

Once you’ve mapped out potential risks, the next step is to measure their significance. Should you prioritize protecting against a costly data breach or preparing for a supply chain hiccup?

- Quantitative Analysis: This method attaches numbers to risks, like the estimated financial loss of a cyberattack.

- Qualitative Analysis: For risks that are harder to quantify, such as reputational damage, this approach uses ranking systems like “low,” “medium,” or “high” risk.

The best strategies often combine both approaches for a well-rounded perspective.

Evaluating Risks: Prioritization Criteria

Some risks are like potholes; others are like sinkholes. Evaluating risks involves categorizing them by likelihood and impact. Key prioritization factors include:

- Severity: How bad will it hurt if this happens?

- Frequency: Is it a rare occurrence or something that happens regularly?

- Preparedness: Do you already have measures in place to manage this risk?

By focusing your resources on high-impact, high-likelihood risks, you ensure the best return on your risk management investments.

from different sources:

Mitigating Risks: Control Measures and Action Plans

Mitigation is where your plans turn into action. Imagine you’ve identified that your biggest cybersecurity threat is phishing. How do you respond?

- Preventive Measures: Deploy anti-phishing software, conduct employee training, or establish stricter access controls.

- Reactive Plans: Have an incident response strategy ready if preventive measures fail.

For every identified risk, create a tailored action plan. The goal isn’t just to minimize the damage but to eliminate the risk whenever possible.

Monitoring and Reviewing Risks: Best Practices

Here’s the thing about risks—they don’t stay the same. New threats emerge, and old ones evolve. Monitoring and reviewing risks regularly ensures that your risk assessment steps remain relevant.

- Real-Time Tracking: Use dashboards and analytics to keep an eye on live data.

- Periodic Reviews: Schedule quarterly or biannual risk reassessments.

- Feedback Loops: Incorporate lessons from incidents to refine your strategies.

By staying proactive, you ensure that your risk management framework adapts to an ever-changing environment.

Proactive Risk Communication: A New Essential

One often-overlooked step in the risk assessment process is communication. Risk assessment doesn’t happen in isolation. Sharing insights with stakeholders, team members, and partners ensures alignment and collective vigilance.

- Internal Briefings: Keep teams informed about risk priorities and mitigation plans.

- External Transparency: Build trust with clients and partners by communicating your commitment to managing risks effectively.

Risk assessment isn’t a one-and-done deal—it’s a living, breathing process. By mastering each risk assessment step, you don’t just prepare for what could go wrong; you empower your organization to thrive in the face of uncertainty.

Ready for the next stage? Let’s explore how these strategies translate into addressing operational, financial, and cybersecurity risks.

Risk Categories to Address

Risk is a shapeshifter. It can disrupt operations, destabilize finances, or compromise sensitive data. Each type of risk requires a unique approach, and understanding these categories is critical to navigating the complex landscape of risk management. Let’s explore the most pressing categories and how addressing them helps strengthen your organization.

Operational Risks

Imagine your production line grinding to a halt because a key supplier couldn’t deliver materials on time. Operational risks include any disruption to daily business activities, from supply chain interruptions and equipment failures to workforce shortages and unexpected natural disasters.

How to tackle these risks?

- Contingency Planning: Develop backup plans for critical operations.

- Automation: Use technology to minimize human error and improve efficiency.

- Resilience Training: Equip teams to adapt to sudden operational changes.

Every operational hiccup can snowball into bigger challenges, but a proactive approach keeps disruptions manageable.

Financial Risks

A market crash, sudden currency fluctuations, or a major client defaulting on payments can send shockwaves through your business. Financial risks are silent predators, capable of eroding profits and destabilizing your organization.

Strategies to manage financial risks:

- Hedging Strategies: Protect against currency and interest rate volatility.

- Credit Management: Regularly assess the creditworthiness of partners and clients.

- Diversification: Spread investments across markets and industries to minimize exposure.

The right financial risk strategies don’t just protect—they ensure growth remains steady and sustainable.

Cybersecurity Risks

In an era where data is the new currency, cybersecurity risks are among the most critical to address. A single breach can compromise sensitive information, erode trust, and incur massive fines. From phishing attacks to ransomware, the threats are as varied as they are relentless.

How to stay secure?

- Endpoint Protection: Safeguard all devices connected to your network.

- Data Encryption: Ensure sensitive data is unreadable to unauthorized users.

- Regular Assessments: Conduct vulnerability and penetration tests to stay ahead of threats.

Cybersecurity risks evolve rapidly, but robust defenses can transform your vulnerabilities into strengths.

Legal and Compliance Risks

Non-compliance with industry regulations or legal standards can result in hefty fines, lawsuits, and a tarnished reputation. These risks can also arise from contracts, employee disputes, or intellectual property issues.

Key steps to manage legal risks:

- Compliance Audits: Regularly review processes to ensure alignment with regulations.

- Policy Updates: Keep policies and procedures current to reflect changing legal requirements.

- Training Programs: Educate employees about legal standards and compliance expectations.

Staying ahead of compliance requirements is like maintaining a safety net for your business.

Environmental and Social Risks

Businesses are increasingly held accountable for their environmental impact and social responsibility. Environmental risks, such as climate change or resource scarcity, can disrupt operations, while social risks, like community backlash or employee dissatisfaction, can hurt your reputation.

Addressing these risks:

- Sustainability Programs: Invest in eco-friendly practices and renewable resources.

- Stakeholder Engagement: Communicate openly with communities and investors.

- Diversity and Inclusion: Foster a culture that values and respects every team member.

By addressing these risks, organizations can build stronger relationships and a positive brand image.

Strategic Risks

Strategic risks arise from high-level decisions that shape the future of your business. Entering new markets, launching products, or adopting new technologies can all pose challenges if not carefully planned.

Mitigating strategic risks:

- Market Research: Understand the landscape before making major moves.

- Scenario Planning: Prepare for multiple outcomes with flexible strategies.

- Leadership Alignment: Ensure decision-makers are aligned on goals and approaches.

Strategic risks are opportunities in disguise—when managed well, they can propel your business forward.

Each category of risk is interconnected, and neglecting one can amplify the others. By following the proper risk assessment steps and addressing risks holistically, you can create a business that’s prepared for anything.

Next, let’s examine the challenges businesses face in implementing risk assessment and how to overcome them with practical solutions.

Common Challenges in Risk Assessment

Risk assessment might sound straightforward on paper, but in practice, it’s a labyrinth of hurdles that demand careful navigation. Each risk assessment step can be derailed by common pitfalls if not approached strategically. Let’s uncover these challenges and explore how businesses can transform them into opportunities for growth.

Lack of Comprehensive Data

Data is the lifeblood of risk assessment, but many organizations operate with fragmented or incomplete information. Imagine trying to assemble a puzzle with missing pieces—it’s frustrating and ineffective. Without a clear view of all potential risks, businesses are left vulnerable to blind spots.

How to address this:

- Centralized Data Systems: Implement tools that consolidate data from multiple departments into a single platform.

- Data Quality Checks: Regularly audit and cleanse data to ensure accuracy and reliability.

- Advanced Analytics: Use machine learning algorithms to identify patterns and anomalies that might otherwise go unnoticed.

By enhancing data collection and analysis, businesses can establish a solid foundation for their risk assessment steps.

Misaligned Objectives Across Teams

Risk management isn’t a solo act—it’s a symphony requiring harmony across departments. Yet, misaligned goals between teams can create silos, leaving crucial risks unaddressed. For example, an IT team might focus on cybersecurity while the finance department worries about cash flow, missing opportunities for synergy.

Solutions to bridge the gap:

- Cross-Functional Collaboration: Host regular interdepartmental meetings to align risk priorities.

- Unified Risk Framework: Develop a standardized approach to risk assessment that caters to all teams.

- Leadership Buy-In: Ensure top executives champion the importance of cohesive risk management efforts.

A unified approach ensures that every risk assessment step is tackled from multiple angles, leaving no stone unturned.

Inadequate Tools and Technology

Let’s face it: outdated tools are no match for today’s complex risk landscape. Relying on spreadsheets or manual processes is like using a flip phone in the era of smartphones—inefficient and prone to errors. Without the right technology, businesses struggle to keep pace with evolving threats.

Tech-forward solutions:

- AI-Powered Platforms: Automate repetitive tasks like data collection and risk scoring to save time and improve accuracy.

- Visualization Tools: Use dashboards to present risks in an intuitive, actionable format.

- Integration Capabilities: Ensure risk management tools seamlessly integrate with existing systems for smoother workflows.

Upgrading technology transforms risk assessment from a reactive chore to a proactive strategy.

Resistance to Change

Humans are creatures of habit, and introducing new risk assessment steps or tools can often face pushback. Whether it’s employees clinging to familiar processes or leadership hesitating to invest, resistance can stall progress.

How to foster acceptance:

- Training and Education: Show teams the benefits of new tools and methodologies through hands-on training.

- Pilot Programs: Start small with a specific project to demonstrate effectiveness before scaling up.

- Clear Communication: Emphasize how improved risk management aligns with organizational goals.

Winning over skeptics is essential for a seamless transition to enhanced risk practices.

Overwhelming Volume of Risks

In today’s dynamic business environment, the sheer number of risks can be paralyzing. From cybersecurity threats to legal compliance issues, the challenge lies in distinguishing between critical risks and minor concerns.

Prioritization strategies:

- Risk Matrices: Map risks by likelihood and impact to visualize priorities.

- Scenario Analysis: Simulate potential outcomes to understand the real-world implications of each risk.

- Dynamic Ranking: Regularly update risk priorities as situations evolve.

By focusing on what truly matters, businesses can allocate resources effectively and avoid spreading themselves too thin.

Unclear Accountability

Who owns the risk assessment process? Without defined roles and responsibilities, risks can fall through the cracks, leading to reactive firefighting instead of proactive planning.

Clarifying ownership:

- Risk Owners: Assign specific individuals to oversee different types of risks.

- Accountability Frameworks: Use tools like RACI charts to delineate roles (Responsible, Accountable, Consulted, Informed).

- Performance Metrics: Track and reward accountability to encourage active participation.

Clear accountability ensures that every risk assessment step is executed with precision and purpose.

Challenges are inevitable, but they’re also opportunities in disguise. By addressing these hurdles head-on, businesses can strengthen their risk management frameworks and stay resilient in the face of uncertainty.

Up next, we’ll explore real-world applications of these strategies and lessons learned from both successes and failures in risk assessment.

Case Studies and Real-World Applications

What does risk assessment look like in action? Real-world examples bring theory to life, showcasing both the triumphs of effective risk management and the pitfalls of overlooking key risk assessment steps. From healthcare to finance, let’s explore how organizations navigate the complexities of risk—and the lessons we can learn from their experiences.

Examples of Effective Risk Assessments in Various Industries

-

Healthcare: Safeguarding Patient Data

A leading healthcare provider faced increasing cyber threats targeting sensitive patient information. By implementing a layered cybersecurity framework, conducting regular penetration tests, and using advanced data encryption, they successfully reduced breaches. This case underscores how thorough risk assessment steps can protect not just data, but trust in healthcare systems. -

Retail: Combatting Fraud in E-Commerce

A retail giant battling payment fraud adopted AI-powered monitoring tools to flag unusual transaction patterns. By aligning their risk assessment steps with fraud prevention measures, they reduced fraudulent transactions, boosting customer confidence in their online platform.

Lessons Learned from Risk Assessment Failures

Manufacturing: Ignoring Cyber Threats

A manufacturing firm suffered a ransomware attack that halted production for weeks. Their reliance on outdated cybersecurity measures and a lack of incident response planning revealed critical weaknesses in their risk assessment process. Post-incident, the company revamped its risk framework, incorporating regular cybersecurity audits and employee training.

Nonprofit Organization: Fraud by Insiders

A nonprofit experienced financial losses due to fraudulent activities by a trusted employee. The absence of checks and balances in their internal processes allowed the fraud to go unnoticed for months. The organization later introduced strict internal controls and implemented whistleblower policies to prevent similar incidents.

Emerging Risks in a Post-Pandemic World

The COVID-19 pandemic reshaped global risk landscapes. Businesses that had robust contingency plans were better equipped to handle supply chain disruptions and remote work challenges. Organizations now incorporate pandemic-related scenarios into their risk assessment steps to ensure future preparedness.

The Role of Technology in Transforming Risk Assessment

Real-world examples also demonstrate the power of technology in revolutionizing risk assessment. AI and machine learning are helping businesses predict risks more accurately, while blockchain is enhancing transparency in supply chains. Companies adopting these innovations often outpace competitors in managing risks effectively.

Cross-Industry Collaboration in Risk Management

Some of the most effective risk management strategies come from sharing insights across industries. For instance, financial firms adopting cybersecurity strategies from the tech sector or healthcare providers learning supply chain resilience techniques from logistics companies. Collaboration fosters innovation in risk management practices.

These examples and lessons prove that risk assessment isn’t just about avoiding threats—it’s about leveraging knowledge to create opportunities and drive growth. By incorporating advanced tools, learning from failures, and refining their risk assessment steps, businesses can stay ahead of the curve.

Up next, we’ll dive into how SearchInform’s solutions bring these strategies to life, empowering organizations to take risk management to the next level.

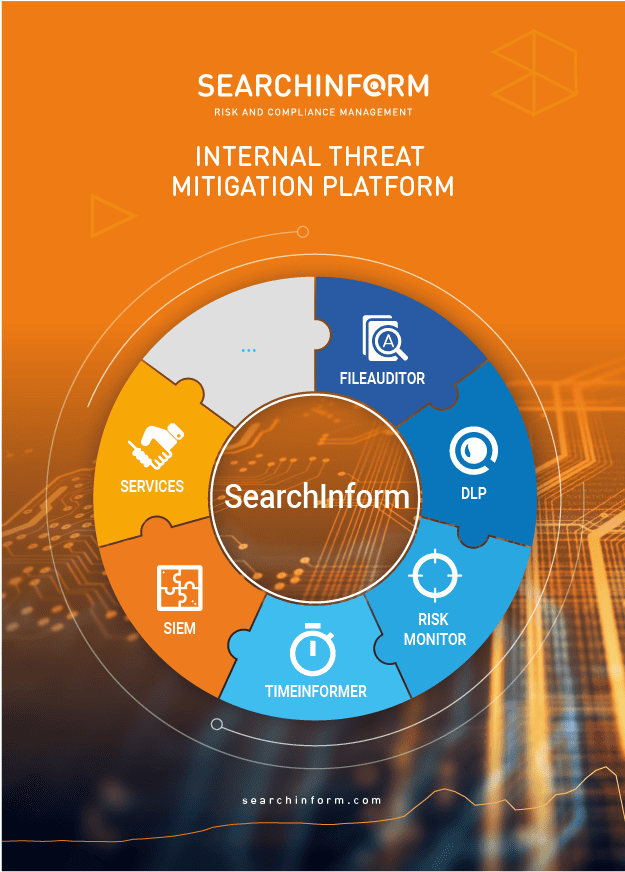

SearchInform Solutions for Effective Risk Management

In a world where risks multiply faster than ever, organizations need more than traditional methods to stay protected—they need intelligence, agility, and precision. This is where SearchInform comes in, revolutionizing how businesses approach risk assessment steps with cutting-edge tools and strategies that transform vulnerability into resilience. Let’s explore how SearchInform’s solutions empower organizations to identify, analyze, and mitigate risks seamlessly.

SearchInform Tools for Risk Identification

Risk identification is the first and perhaps most critical step in any risk management process. Without understanding what threats exist, there’s no way to mitigate them. SearchInform offers a suite of advanced tools designed to uncover risks across various domains, including:

- Cybersecurity Threats: From phishing attacks to insider threats, SearchInform tools scan your digital landscape, flagging vulnerabilities before they escalate.

- Behavioral Monitoring: Leveraging machine learning, SearchInform tracks anomalous employee behavior that may signal potential risks, such as fraud or data breaches.

These tools don’t just identify risks—they do so with precision and depth, offering actionable insights that businesses can act on immediately.

Automated Risk Analysis with SearchInform

Once risks are identified, analyzing them manually can be time-consuming and prone to human error. SearchInform eliminates these inefficiencies with its automated risk analysis capabilities.

Key benefits include:

- Speed and Accuracy: Advanced algorithms analyze risks in minutes, delivering detailed assessments that would take hours or days to complete manually.

- Customizable Risk Scoring: Tailor risk parameters to your business needs, ensuring the analysis aligns with your organizational priorities.

- Holistic Overview: SearchInform doesn’t just analyze risks in silos; it provides a comprehensive view, highlighting interdependencies between different risks for better decision-making.

With SearchInform’s automated solutions, businesses can focus on strategy rather than being bogged down by time-intensive analysis.

Real-Time Monitoring: Staying Ahead of Threats

In today’s fast-paced world, risks don’t wait—and neither should your response. SearchInform’s real-time monitoring solutions ensure that businesses stay one step ahead of emerging threats.

Here’s how:

- 24/7 Surveillance: Continuous monitoring of your systems, networks, and employee activities ensures nothing slips through the cracks.

- Immediate Alerts: Get notified the moment an anomaly is detected, whether it’s an unauthorized data transfer or a potential compliance violation.

- Integrated Dashboards: View all potential risks in a unified interface, making it easy to prioritize and act swiftly.

Real-time monitoring isn’t just about reacting faster; it’s about preventing risks from materializing in the first place.

Enhanced Incident Response and Reporting

Identifying and analyzing risks is just the beginning—effective risk management also requires a swift and coordinated response. SearchInform takes incident response to the next level by providing:

- Automated Workflow Triggers: As soon as a risk is detected, predefined workflows kick into action, ensuring timely and consistent responses.

- Detailed Incident Reports: Comprehensive reports on detected risks and actions taken help businesses refine their strategies and meet compliance requirements.

- Collaboration Tools: Facilitate seamless communication across teams during incidents, ensuring everyone is on the same page.

With these capabilities, SearchInform turns chaos into order, ensuring that businesses can address threats with confidence and clarity.

Customizable Risk Management Frameworks

Every business is unique, and so are its risks. SearchInform understands this, offering customizable frameworks that adapt to your organization’s specific needs.

- Industry-Specific Solutions: Whether you’re in finance, healthcare, retail, or manufacturing, SearchInform provides tailored tools to address the unique risks of your sector.

- Scalable Platforms: As your business grows, SearchInform scales with you, ensuring consistent protection at every stage of your journey.

- Intuitive Interfaces: User-friendly designs make it easy for teams to engage with risk management tools, regardless of technical expertise.

SearchInform doesn’t just fit into your organization—it becomes an integral part of how you operate.

Data-Driven Decision-Making

Risk management is as much about foresight as it is about action. SearchInform empowers leaders to make informed decisions with data-driven insights, offering:

- Predictive Analytics: Forecast potential risks based on historical data and emerging trends.

- Performance Metrics: Measure the effectiveness of risk management strategies and adjust accordingly.

- Visualized Data: Interactive graphs and charts make complex data easy to understand, enabling quicker, more confident decisions.

With SearchInform, you’re not just managing risks—you’re mastering them.

Risks don’t wait, and neither should you. SearchInform is more than a solution—it’s a partner in securing your organization’s future. By incorporating SearchInform into your risk management strategy, you gain a powerful ally in identifying, analyzing, and mitigating risks with unmatched precision and efficiency.

Ready to transform your risk management approach? Explore SearchInform today and take the first step toward a more secure, resilient future.

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!