Risk Treatment Plan: Your Guide to Effective Risk Management

Introduction to Risk Treatment Plans

Risk management is an essential aspect of any organization’s strategic framework, ensuring that potential threats are identified, understood, and handled proactively. A risk treatment plan is a central tool in this process, guiding companies toward managing risks effectively and minimizing their impact on operations. But what exactly does it entail?

At its core, a risk treatment plan outlines how identified risks will be handled—whether they will be avoided, mitigated, transferred, or accepted. Its purpose is not only to prevent potential harm but also to enhance the resilience and agility of an organization in the face of uncertainty. By systematically addressing risks, organizations can safeguard their resources, protect their reputation, and drive sustained growth.

The importance of a risk treatment plan cannot be overstated, as it ties directly into strategic decision-making. Without such a plan, companies are left vulnerable, reacting to threats without a clear path forward. A well-structured risk treatment plan, on the other hand, is a proactive strategy, turning risk management into a competitive advantage rather than a defensive measure.

The principles behind a solid risk treatment plan are simple yet powerful: understand the risks, prioritize them based on their potential impact, and apply the right strategies to reduce or eliminate their effects. These principles lay the foundation for building a plan that is both effective and adaptable. But a plan is only as good as the components that make it up. To create a comprehensive and actionable treatment plan, it’s essential to dive deeper into its key components. Let's explore how risk identification, evaluation, and the development of mitigation strategies form the backbone of an effective risk treatment plan.

Components of a Risk Treatment Plan

Creating a robust risk treatment plan is a methodical process that requires attention to detail and careful consideration of various elements. At its heart, a risk treatment plan serves as a roadmap for managing uncertainty, detailing how to deal with potential threats and vulnerabilities. However, the true strength of any plan lies in its components, each one contributing to a cohesive strategy that guides decision-making and safeguards the organization.

Risk Identification and Analysis

Before any treatment options can be selected, an organization must first recognize and understand the risks it faces. This is the foundational step of the risk treatment plan. Risk identification is not just about ticking off obvious threats; it’s about digging deeper, identifying both internal and external factors that could cause disruption. For example, a business might be aware of cyberattacks but may not immediately consider operational risks like supply chain disruptions or even employee burnout. Identifying such risks early on can help ensure that no potential threats are overlooked.

Once risks are identified, the next critical step is risk analysis. This phase focuses on understanding the nature of each risk—its likelihood of occurrence and its potential impact. A company may face multiple risks, but not all are equally dangerous. For instance, a minor delay in a marketing campaign may be far less impactful than a data breach that compromises customer information. Therefore, it’s crucial to evaluate each risk based on its severity and the likelihood of it materializing. This analysis helps the organization direct its resources effectively, ensuring that attention is focused on the most pressing risks first.

Risk Evaluation and Prioritization

With risks identified and analyzed, the next logical step is to evaluate their significance. This is where an organization must determine which risks deserve the most attention and resources. Risk evaluation involves assessing both the likelihood and the potential impact of each identified threat. Not all risks are created equal—some have a far-reaching effect on business operations, while others may have minimal consequences.

For example, a large financial institution might prioritize mitigating cybersecurity risks, given the vast amount of sensitive customer data they manage. In contrast, a small retail store might focus on ensuring physical security or dealing with operational delays caused by supplier issues. Prioritizing risks allows businesses to focus their efforts where they matter most, ensuring that limited resources aren’t spread too thin. This phase is essential in shaping a risk treatment plan that is both actionable and efficient.

Risk Mitigation Strategies

Once the risks are identified, analyzed, and prioritized, the next step is crafting specific mitigation strategies. Risk mitigation is the process of reducing the likelihood or impact of a risk, or even eliminating it altogether. The treatment options vary depending on the nature of the risk.

Take, for example, an organization facing the threat of a cyberattack. Mitigation strategies could involve enhancing cybersecurity measures—installing firewalls, implementing strong encryption methods, and conducting regular vulnerability assessments. For a company facing operational risks, mitigation might involve diversifying suppliers or implementing more robust contingency plans. The key here is to create a comprehensive set of actions that reduce exposure to risks, making the organization more resilient in the face of uncertainty.

One of the most common forms of mitigation involves improving internal processes. A company that experiences frequent delays due to poorly organized workflows might look into streamlining operations to reduce the risk of inefficiency. Another example is implementing regular employee training to combat human error, one of the leading causes of security breaches.

Contingency Planning and Response

No matter how well-planned the mitigation strategies are, some risks are inevitable. That’s where contingency planning comes in. Contingency plans are designed to prepare an organization for the worst-case scenario, ensuring that it can respond swiftly and efficiently when things go wrong. A solid contingency plan includes predefined responses, clear roles and responsibilities, and communication strategies to minimize confusion during a crisis.

For instance, a company may have a detailed disaster recovery plan in place for when its IT systems go down. This might include backup servers, data recovery procedures, and a crisis communication plan for keeping stakeholders informed. Similarly, a retail chain might have a crisis management plan ready for instances of fraud or theft, detailing how to handle investigations and customer communications.

The importance of contingency planning cannot be overstated. It’s the safety net that allows an organization to bounce back from setbacks, minimizing downtime and preserving business continuity. Without such plans in place, the impact of unforeseen events can be catastrophic. But with proper preparation, organizations are far better equipped to weather the storm.

The components we've covered—risk identification, evaluation, mitigation, and contingency planning—serve as the foundation of a comprehensive risk treatment plan. Together, they ensure that organizations are well-prepared to face and respond to potential risks. However, the real challenge lies in choosing the right methods to handle these risks effectively. In the following section, we’ll delve into the various types of risk treatment methods, from avoidance to acceptance, and explore how these approaches are implemented to address specific challenges. Let's take a closer look at how different treatment strategies can be tailored to fit the unique needs of an organization.

Types of Risk Treatment Methods

Once the risks have been identified and evaluated, the next step in a risk treatment plan is determining how to handle them. The right treatment method can make all the difference in reducing the potential damage and ensuring long-term business stability. Different risks demand different approaches, and a comprehensive risk treatment plan typically involves a blend of several methods. Let's take a closer look at the core strategies organizations can use to address various risks.

Avoidance Strategies

Avoidance is one of the most direct and often most effective ways to handle risk. In some situations, the best choice is simply to steer clear of a risk altogether. This might seem like an obvious strategy, but in practice, it requires careful assessment of the company’s goals and the potential pitfalls of certain actions. For example, a technology firm might decide not to enter a new market that’s known for political instability. Similarly, an organization may opt not to pursue certain high-risk investments that don't align with its core mission or financial goals.

One of the key benefits of avoidance is its ability to entirely eliminate the potential for a risk to occur. However, this strategy isn't always feasible, as it can require turning down potentially profitable opportunities or taking on other forms of risk in its place. It’s a delicate balance. Take, for instance, a multinational corporation that avoids expanding into a country with uncertain regulatory frameworks. While they miss out on new revenue opportunities, they sidestep the risk of potential financial penalties or business interruptions.

The decision to avoid a risk typically stems from a calculated assessment, weighing the potential losses from the risk against the opportunity. It’s a preventive measure that can help preserve resources, but it’s not always an option when the risk is integral to business operations or growth.

Mitigation Techniques

Mitigation takes a slightly different approach by addressing the risk directly, aiming to reduce both the probability of its occurrence and the potential impact if it does arise. This is where many organizations spend their efforts, creating detailed strategies to control or minimize the damage that certain risks could cause.

For instance, in the case of operational risks, a company might implement new quality control measures or improve its supply chain resilience to prevent disruptions. A manufacturer might diversify its suppliers to reduce dependency on a single vendor, thus lowering the risk of an unexpected disruption. Mitigation can also take the form of preventive maintenance in industries reliant on heavy machinery or equipment. Here, the goal isn’t necessarily to avoid the risk, but to reduce the severity of its impact when it happens.

In the financial sector, mitigation often involves sophisticated risk management systems that analyze market trends and financial indicators. These systems allow organizations to make informed decisions, hedging against certain risks like currency fluctuations or market downturns. This method allows companies to continue operating in the face of uncertainty while minimizing losses and maintaining stability.

Mitigation requires ongoing vigilance and adaptability. As risks evolve, so must the strategies designed to counter them. It’s a continual process of assessment and refinement that helps organizations stay ahead of potential threats.

Risk Transfer Approaches

Risk transfer involves shifting the responsibility for managing a risk to another party. This approach is commonly used in scenarios where the risk is difficult or costly to mitigate internally. One of the most common ways to transfer risk is through insurance. Companies across industries purchase insurance policies to protect themselves against financial losses caused by specific risks, such as property damage, liability claims, or cyberattacks.

For example, an organization might invest in cyber insurance to transfer the financial burden of a potential data breach. By doing so, they effectively outsource the risk to the insurer, shifting the financial responsibility while still maintaining business continuity. However, insurance isn’t a catch-all solution—it only covers specific risks, and there are limits to the protection it provides.

Another form of risk transfer is outsourcing. When a company hires a third-party provider for specialized services, such as IT support or customer service, it transfers the associated risks to that provider. For example, a business might outsource its IT security services to an external vendor that specializes in managing cybersecurity risks. While this doesn't absolve the company from all responsibility, it does shift some of the risk management burden to the third-party expert.

Risk transfer is particularly useful for risks that are difficult to control internally or require expertise that the organization lacks. However, it also introduces the need for strong contracts and clear agreements to ensure that the third party meets their obligations.

Risk Acceptance

In some cases, an organization may decide to accept a risk rather than take proactive steps to eliminate it. This approach is most commonly used when the cost of mitigating or transferring the risk is greater than the potential impact. Risk acceptance is also relevant when a risk has minimal or negligible consequences.

For example, a small business might decide to accept the minor risk of a small-scale fraud incident, acknowledging that the financial loss would be manageable. Similarly, an organization may choose to accept certain operational risks if the probability of them occurring is low and the cost of preventative measures outweighs the benefit.

While risk acceptance is a valid strategy, it requires careful consideration and should only be chosen when the consequences are well understood. Even when risks are accepted, businesses need to ensure they have a contingency plan in place in case the risks materialize. Risk acceptance isn't about ignoring the issue; it's about acknowledging it and deciding that, for now, the organization is willing to live with the consequences.

Risk acceptance often goes hand in hand with other strategies, such as mitigation. A company might accept minor risks but still take steps to mitigate larger, more consequential ones.

Making the Right Choice: Which Method to Use?

The beauty of a well-crafted risk treatment plan is that it allows organizations to tailor their approach to specific risks. There’s no one-size-fits-all solution. Depending on the severity, likelihood, and potential impact of a given risk, different treatment methods might be used in tandem. A single risk might be addressed using a mix of avoidance, mitigation, transfer, and acceptance strategies. For instance, an organization facing both financial risks and operational risks might use mitigation strategies to reduce operational risks, transfer financial risks through insurance, and accept some low-probability, low-impact risks as part of its day-to-day operations.

The key to success in risk treatment is a deep understanding of the organization’s objectives, resources, and risk tolerance. A comprehensive risk treatment plan balances proactive measures with practical solutions, ensuring that risks are addressed in a way that aligns with the organization’s broader goals. As risks evolve, so too must the treatment methods. Staying flexible and responsive is crucial in ensuring that the plan remains effective over time.

The Next Step: Developing and Implementing the Plan

Now that we've covered the different treatment methods, the next natural step is understanding how to develop a risk treatment plan that incorporates these strategies and transforms them into actionable steps. This phase focuses on translating the theory into practice, ensuring that the treatment methods are not only suitable but also seamlessly integrated into daily operations. Let's explore how this process unfolds, from identifying critical assets to implementing policies that guide every aspect of risk management.

Steps to Develop a Risk Treatment Plan

The process of developing a risk treatment plan is both art and science. It requires deep analysis, strategic thinking, and the ability to adapt to an ever-changing landscape. A well-designed risk treatment plan can be the difference between a company that survives a crisis and one that falters under pressure. But how do organizations go from identifying risks to implementing effective treatments? Let’s walk through the essential steps involved in developing a comprehensive risk treatment plan.

Identifying Critical Assets and Risks

The first step in any risk treatment plan is identifying what’s at stake. It’s easy to focus on the risks themselves, but before that, you must pinpoint your most critical assets—those resources, people, or processes that are essential to your business operations. These could be anything from your intellectual property to key employees, critical supply chain partnerships, or customer data. Knowing what needs protecting is foundational to the risk treatment process.

In this phase, companies typically map out the different types of risks they face. For example, an e-commerce company might identify risks such as data breaches, fraud, and supply chain disruptions. Meanwhile, a manufacturing company might focus on operational risks like equipment failure or workforce safety. The point is that every business has unique assets that need protection, and the process starts with clearly defining them. This step is more than just a checklist—it’s about understanding what matters most to the organization.

Once you’ve identified critical assets, the next logical step is to conduct a thorough risk assessment to identify potential threats. This involves looking at internal factors (like employee behavior or outdated systems) and external forces (such as economic shifts, technological changes, or regulatory challenges). For example, a financial institution might consider the risk of cyber-attacks and regulatory compliance failures, while a healthcare provider might focus on risks related to patient data protection and the impact of changing health policies.

Evaluating Risk Impact and Likelihood

Identifying risks is important, but it’s only half of the equation. After all, not all risks carry the same weight. This is where risk evaluation comes into play. At this stage, companies need to assess the likelihood of each identified risk occurring and determine its potential impact on the organization. This process can be complex, as it often requires input from multiple departments and stakeholders.

Take a look at a tech startup, for instance. The likelihood of a cybersecurity breach might be high, especially if they are storing sensitive user data, but the impact might be manageable if they have the right preventative measures in place. On the other hand, a small local business might face a much lower chance of experiencing a cyberattack, but the impact could be devastating if it were to happen—potentially jeopardizing their reputation and customer trust. By evaluating both the likelihood and the potential consequences of each risk, companies can prioritize which risks to focus on first.

The evaluation process also involves considering the company’s risk tolerance—what level of risk can the business realistically accept without jeopardizing its survival or growth? This will vary from company to company. A large multinational corporation might have more resources to weather certain risks than a small enterprise, which may need to take a more cautious approach. Understanding risk tolerance is crucial to making decisions that are not only practical but also aligned with the company’s overall strategy and goals.

Selecting the Right Treatment Options

Once risks have been evaluated, the next task is selecting the appropriate treatment strategies. This is where a risk treatment plan becomes more than just an abstract idea—it starts taking shape through concrete actions. The options for treatment depend largely on the nature of the risk and its potential impact.

In some cases, companies will choose to avoid certain risks altogether. For instance, an organization might decide not to enter a high-risk market due to political instability, or avoid using a certain technology because of security concerns. In other instances, a business might look at mitigation as the best strategy, employing methods to reduce the likelihood or severity of a risk. A good example of this is a financial institution that invests heavily in encryption technology to mitigate the risk of a data breach.

For risks that cannot be avoided or mitigated, organizations may opt to transfer the risk. Insurance policies, for example, are a common way to transfer financial risks. Similarly, outsourcing certain functions to a third-party provider can shift the responsibility for specific risks, such as IT or cybersecurity, to that provider. It’s crucial that these transfer mechanisms are clearly defined through contracts or insurance policies, ensuring that the external parties fulfill their obligations.

Lastly, there are situations where accepting the risk is the most feasible option. This approach is typically chosen when the cost of mitigating or transferring the risk outweighs the potential consequences. For instance, a company might accept the risk of small fluctuations in currency exchange rates if the costs of hedging are too high for the expected impact. The key to this decision lies in evaluating the trade-offs and determining whether the potential impact is low enough to justify risk acceptance.

Developing Policies and Procedures

Once the treatment options are selected, the next step is to solidify the plan by developing clear, actionable policies and procedures. This step transforms the abstract concepts into day-to-day actions that everyone in the organization can follow. For example, if the risk treatment plan involves strengthening cybersecurity protocols, policies may be developed to enforce password complexity, regular system updates, and staff training.

The role of leadership here is essential. Strong leadership ensures that everyone in the organization understands the importance of the risk treatment plan and knows their role in implementing it. Policies should be clear and easily communicated, and there must be systems in place to ensure adherence. This could involve creating risk management committees, appointing risk officers, or establishing protocols for reporting incidents.

Additionally, procedures for monitoring the effectiveness of risk treatments must be outlined. How will the organization track progress? How will the risk treatment plan be adjusted over time as new risks emerge or business objectives evolve? These policies and procedures should provide a roadmap for ongoing risk management, ensuring that the plan doesn’t remain static but evolves with the business.

Implementing the Risk Treatment Plan

At this point, the risk treatment plan is ready for execution. However, implementation is not just about applying the treatment strategies; it’s about embedding them into the culture and operations of the organization. This means integrating risk management into everyday decision-making, training employees, and ensuring that all stakeholders are aligned.

For example, if a company is implementing a new risk mitigation strategy such as improving employee training on cybersecurity protocols, it is essential that every employee is trained, from the CEO to the newest intern. The more ingrained the risk treatment methods become within the company’s operations, the more effective they will be.

Successful implementation also involves monitoring the progress of risk treatments, evaluating whether they are achieving the desired outcomes, and making necessary adjustments. For instance, if a mitigation strategy designed to reduce operational risk isn’t having the desired effect, the organization may need to tweak its approach or invest in additional tools.

Continuous Monitoring and Improvement

A risk treatment plan is never truly finished. Business environments change, and new risks arise constantly. Continuous monitoring is crucial for ensuring that the plan remains effective and that the organization stays ahead of emerging threats. This means regularly reviewing risk assessments, tracking the success of treatment strategies, and adjusting the plan as needed.

For instance, as the digital landscape evolves, cybersecurity threats may shift, requiring the organization to update its mitigation strategies or adopt new technologies. Regular risk audits, feedback from employees, and reviews of industry trends all contribute to the dynamic nature of the risk treatment plan. By fostering a culture of ongoing improvement and vigilance, organizations can ensure that their risk treatment plan remains relevant and effective in the face of change.

Moving Forward: Integration and Adaptation

Developing a risk treatment plan isn’t a one-time event—it’s an ongoing process that requires adaptation and flexibility. As risks evolve and new challenges arise, the treatment plan must be revisited and refined. The next step is integrating these strategies into a broader organizational framework, ensuring that every part of the company contributes to the success of the plan. Through careful planning, clear execution, and constant vigilance, organizations can navigate the complexities of risk management and emerge stronger in the face of adversity.

Implementing and Monitoring the Risk Treatment Plan

Developing a comprehensive risk treatment plan is one thing, but ensuring its successful implementation and ongoing monitoring is another. A plan is only as effective as its execution, and for a risk treatment plan to achieve its goals, it must be integrated into the daily operations of the organization. This phase is where theory meets reality, where the strategic ideas laid out in the planning stages are turned into actions that can be measured, evaluated, and improved over time.

The Role of Tools and Technology in Implementation

One of the first steps in implementing a risk treatment plan is ensuring that the right tools and technologies are in place. The tools you use for implementation can make a significant difference in how efficiently the plan is carried out. This can range from software that automates risk identification to systems that track the effectiveness of mitigation strategies.

For instance, in the realm of cybersecurity, a company might rely on intrusion detection systems (IDS) to monitor their network in real-time, automatically alerting the risk management team when suspicious activity is detected. Similarly, project management software can help track the implementation of risk mitigation actions, ensuring that deadlines are met and progress is visible.

The goal is to provide the team with clear, actionable data, enabling them to make informed decisions quickly. Without the right tools, the risk treatment plan may falter at the first hurdle—whether that’s missing a key risk or being slow to implement a necessary mitigation.

Employee Training and Awareness

One of the most critical elements in implementing a risk treatment plan is ensuring that everyone within the organization understands their role in the process. This starts with employee training. It’s not enough to create a risk treatment plan and assume employees will follow it; they must be actively involved in the process.

Consider an organization rolling out a new data security protocol. If employees are not trained on how to spot phishing emails, how to protect sensitive data, or the importance of regularly updating passwords, even the best plan can fall short. Effective training should not be a one-time event. It should be continuous, with refresher courses, updates on emerging risks, and scenario-based learning to keep employees prepared.

Training should also involve building a risk-aware culture. Employees at every level, from management to entry-level, should understand the organization's risk tolerance, the importance of following the treatment plan, and how their actions (or inactions) can affect overall risk management. A culture that prioritizes risk awareness makes it easier for employees to spot potential issues early, potentially preventing larger problems down the road.

Continuous Monitoring of the Risk Treatment Plan

Even after the risk treatment plan has been implemented, the work is far from over. The ongoing monitoring of the plan is critical to ensuring its effectiveness. This phase involves tracking how well the treatment strategies are working, making adjustments as needed, and remaining vigilant for new risks that may emerge over time.

Continuous monitoring is particularly important in fast-paced environments like technology, finance, or healthcare, where risks can evolve rapidly. For example, a healthcare provider that has implemented a risk treatment plan to protect patient data may find that new vulnerabilities emerge as digital health technologies continue to evolve. Without continuous monitoring, these risks could go unnoticed, potentially leading to a data breach.

At this stage, organizations must regularly revisit their risk assessments to ensure that no new risks have cropped up or that previously assessed risks have shifted in nature. It’s not enough to simply execute the plan once and move on. Organizations need to establish systems for ongoing evaluation, such as periodic audits, risk reviews, or internal assessments, to ensure that the treatment plan remains aligned with the changing landscape.

Adjusting the Plan Based on Insights

No plan is set in stone, and the risk treatment plan must remain flexible. As the organization grows and external factors change, adjustments to the treatment strategies may be necessary. For instance, a company that originally identified cybercrime as a low-priority risk might realize over time that the threat has become more sophisticated and thus demands additional focus.

This is where feedback loops play an essential role. Feedback should not only come from monitoring tools but also from employees, who may have valuable insights based on their firsthand experiences. For example, a risk treatment plan for financial fraud could be adjusted based on feedback from the finance team about gaps in the detection process. If an employee spots a weakness or has trouble understanding how a mitigation strategy works, the plan needs to be adapted accordingly.

Moreover, in highly regulated industries such as healthcare and finance, regulations are constantly evolving. A risk treatment plan must be adjusted in real-time to reflect new compliance requirements, ensuring that the organization avoids costly fines and maintains its reputation. Keeping an eye on the regulatory landscape and anticipating changes will help the organization stay one step ahead of potential risks.

Measuring Success and Effectiveness

A risk treatment plan’s success should never be judged on its implementation alone. To truly gauge whether the plan is achieving its objectives, organizations need to measure its effectiveness. This can be done through a combination of qualitative and quantitative assessments.

For example, if the goal of the plan is to reduce the frequency of cybersecurity breaches, the organization should track how often breaches occur post-implementation. If the number of breaches decreases, that’s a clear indication that the treatment plan is working. Alternatively, organizations can evaluate the financial impacts of mitigating a particular risk. If a company invests in insurance to transfer certain risks but finds that the premiums are far less than the cost of potential losses, it may view the plan’s effectiveness in cost savings.

Key performance indicators (KPIs) can help organizations quantify their risk treatment efforts. For example, in the case of operational risks, KPIs could include metrics like downtime, operational efficiency, or the speed of recovery after an incident. These measurable outcomes allow companies to make data-driven decisions about whether to continue with the current risk treatment methods or explore new strategies.

While the future of risk treatment is promising, with adaptive, agile plans supported by emerging technologies, challenges remain in implementing and refining these strategies. As businesses embrace new tools and approaches, they will inevitably encounter obstacles that require careful attention. Let's explore some of the common challenges organizations face in risk treatment and how they can be overcome.

Challenges in Risk Treatment

Even with the most carefully crafted risk treatment plans, organizations often encounter a range of challenges during implementation and ongoing management. While a well-designed plan can set the stage for success, overcoming obstacles is essential to ensuring that the treatment strategies effectively reduce risk and align with organizational goals. The path to risk mitigation is rarely linear, and understanding the common challenges can better equip businesses to navigate these hurdles.

Resource Constraints

One of the most significant challenges in implementing a risk treatment plan is the allocation of resources. Whether it’s time, money, or personnel, organizations often struggle to balance risk management efforts with other business priorities. Developing and executing a risk treatment plan requires significant investment in tools, training, and expertise. For smaller organizations, this can feel like an overwhelming commitment, especially when facing budget constraints or limited staff.

Take, for example, a small business trying to implement a cybersecurity risk treatment plan. While larger corporations can afford to hire specialized security teams or invest in sophisticated software, smaller companies may have to rely on a few IT professionals or basic tools. In such cases, prioritizing high-risk areas and finding creative ways to reduce costs—such as outsourcing or using open-source software—becomes critical. Balancing the costs and benefits of risk treatment options is essential, as ineffective resource management can lead to insufficient protection or missed opportunities for improvement.

Complexity of Risk Assessment

Risk treatment plans depend heavily on accurate risk assessments, but assessing risks can be a complex and subjective process. Many organizations face difficulties in quantifying and prioritizing risks, especially when those risks involve uncertain or evolving factors. The difficulty increases when the risks are interconnected or impact multiple departments across the organization.

For example, a manufacturing company may struggle to assess the full scope of risks related to supply chain disruptions, as the impact might vary depending on which suppliers are affected and how quickly the organization can recover. Similarly, cybersecurity risks can be tricky to assess because of the rapid evolution of threats and the difficulty of predicting the likelihood and impact of specific cyberattacks. This complexity makes it challenging to develop a risk treatment plan that accurately addresses the full range of potential risks.

One approach to overcoming this challenge is conducting regular risk assessments. By continuously revisiting and revising risk evaluations, businesses can stay more agile, adjusting their treatment strategies as they gain new insights and as the risk landscape evolves.

Resistance to Change

Another challenge that many organizations face when implementing a risk treatment plan is resistance to change. Employees may be reluctant to adopt new policies, processes, or technologies, especially if they’re unfamiliar with them or don’t see immediate benefits. For instance, a company might invest in new software to mitigate operational risks, but employees may resist the new system due to the learning curve or perceived disruptions to their workflow.

Overcoming this challenge requires effective communication and buy-in from all levels of the organization. Leaders must clearly explain the reasons behind the risk treatment plan, demonstrating how it will benefit not only the company but also the employees themselves. Engaging employees early in the process and offering training, support, and incentives can help reduce resistance and foster a culture of collaboration.

In some cases, companies have found success by creating “champions” within their workforce—individuals who are enthusiastic about the changes and can help motivate and guide their colleagues through the transition. A well-organized change management strategy can make the implementation of new risk treatment strategies smoother and more effective.

Keeping Up with Emerging Risks

The risk landscape is constantly shifting, and one of the most pressing challenges in risk treatment is staying ahead of emerging risks. Rapid technological advancements, changes in regulations, and evolving global conditions can create new vulnerabilities that weren’t previously on the radar. For example, the rise of artificial intelligence and automation has introduced new cybersecurity risks, while changes in environmental regulations may affect industries like manufacturing or energy.

Adapting to these new risks requires organizations to remain proactive and flexible. Regularly updating the risk treatment plan based on the latest trends and insights is key. This might involve using predictive analytics or engaging with industry experts to identify emerging risks before they become significant problems. It’s crucial for businesses to cultivate a forward-thinking mindset and build flexibility into their risk treatment plans, allowing them to quickly pivot and address new threats.

One approach that has proven effective in managing emerging risks is scenario planning. By simulating different risk scenarios and preparing responses in advance, companies can better anticipate future challenges and be more equipped to handle unforeseen events.

Monitoring and Continuous Improvement

A risk treatment plan is not a one-time task; it requires ongoing monitoring and continuous improvement. Organizations often struggle with maintaining the momentum needed to evaluate the effectiveness of their risk treatment strategies over time. As the business environment changes and new risks arise, the plan must be adapted to remain relevant and effective.

For example, a company that previously implemented a risk treatment plan for operational risks caused by supply chain disruptions may find that its strategy no longer addresses the challenges posed by the global pandemic. The plan may need to be adjusted to incorporate remote working risks, new cybersecurity threats, or shifts in customer behavior. Without regular reviews and a commitment to improvement, organizations risk finding themselves ill-prepared for evolving risks.

Integrating risk management into the organization’s broader strategic framework can help ensure continuous attention to risk treatment. By making risk assessment and monitoring part of the daily operations, businesses can more easily identify gaps and refine their strategies.

As organizations face a range of challenges in implementing effective risk treatment plans, the approach often needs to be tailored to specific industries. Each sector has unique risks that require customized strategies. Let's now explore how risk treatment plans vary across different industries and the specific considerations that must be taken into account.

Industry-Specific Risk Treatment Plans

When it comes to managing risks, a one-size-fits-all approach rarely works. Different industries face unique challenges and require tailored strategies to address their specific needs. A robust risk treatment plan must account for these variations, adapting to the particular risks inherent in each sector. Whether it's healthcare, financial services, or manufacturing, understanding the nuances of these industries is critical to developing a plan that is both effective and relevant.

Risk Treatment in Healthcare

Healthcare organizations deal with some of the most sensitive data and are often at the forefront of regulatory scrutiny. Managing risks in healthcare is not just about minimizing operational downtime or protecting financial assets; it’s about safeguarding patient privacy and ensuring the highest standards of care. In healthcare, the stakes are incredibly high. Data breaches or non-compliance with regulations like HIPAA can lead to significant fines, loss of trust, and even patient harm.

For example, a hospital’s risk treatment plan must address a range of potential risks, from cybersecurity threats to the physical safety of patients and staff. Cybersecurity is a growing concern in healthcare as more patient records and sensitive health data are stored digitally. A breach could compromise not only patient privacy but also the entire hospital’s reputation. Thus, a comprehensive risk treatment plan might involve implementing advanced encryption techniques, regular security audits, and staff training to recognize phishing or ransomware attacks.

Additionally, compliance risks are crucial in the healthcare sector. With ever-evolving regulations, healthcare organizations must ensure that they remain compliant with laws regarding patient confidentiality, billing practices, and even treatment protocols. A strong risk treatment plan here involves not only addressing immediate risks but also anticipating future regulatory changes.

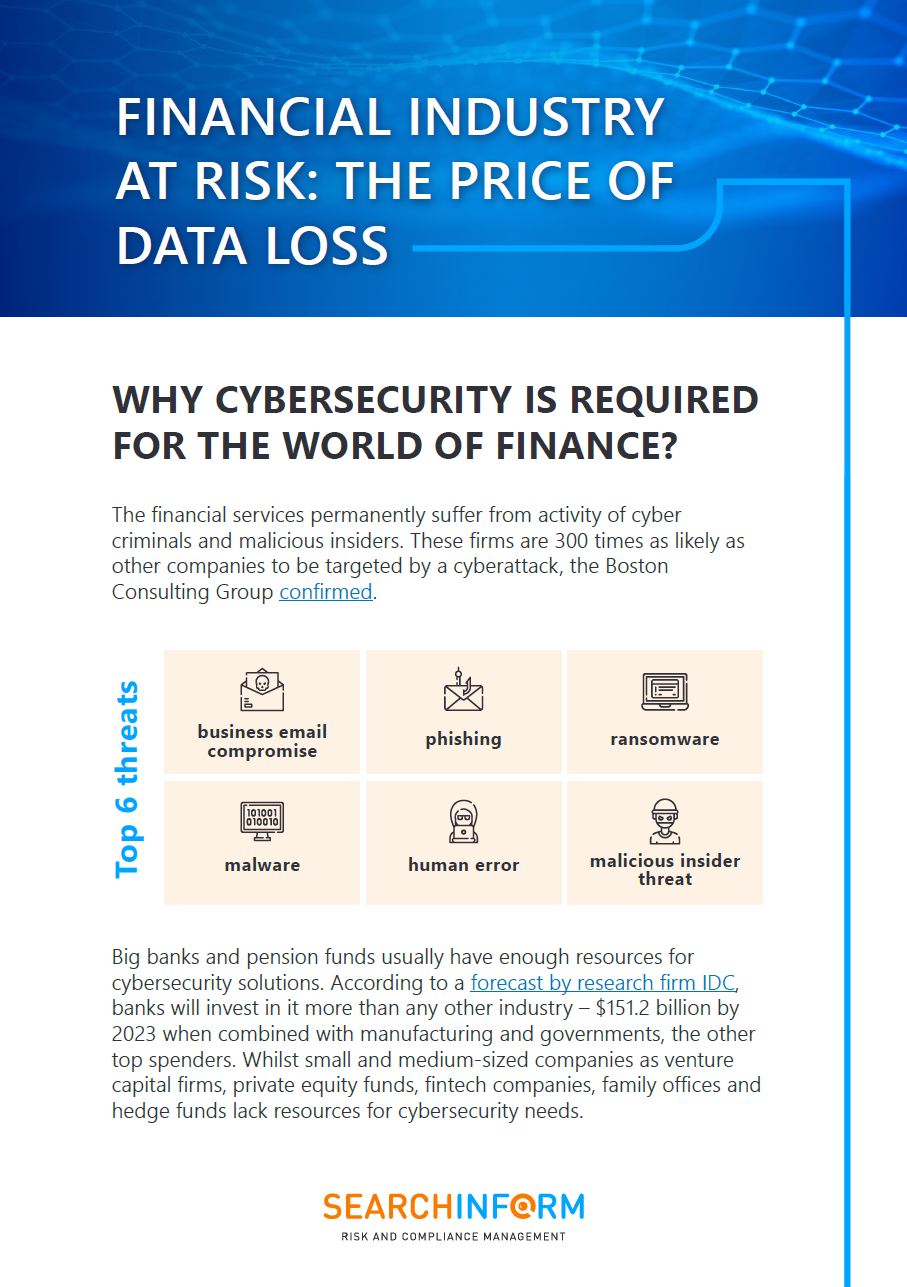

Risk Treatment in Financial Services

In the financial services sector, risk management is not just about protecting assets; it's also about maintaining trust. Financial institutions manage vast amounts of sensitive data and must navigate a complex web of regulations. From cybersecurity threats to regulatory compliance issues, the risks faced by banks, insurance companies, and investment firms are multifaceted and must be handled carefully to avoid significant financial and reputational damage.

For example, consider a bank’s approach to cybersecurity. A successful cyberattack could lead to severe financial losses, but the damage doesn’t stop there. Customer trust could be permanently eroded, resulting in long-term business decline. A well-constructed risk treatment plan would involve not just robust firewalls and intrusion detection systems but also comprehensive employee training, customer communication strategies, and cyber insurance to mitigate financial losses in the event of an attack.

Moreover, financial services organizations face regulatory risks. The introduction of stricter laws around data privacy, such as GDPR in Europe, has increased the complexity of managing risk. Financial firms must continually ensure that they are meeting regulatory requirements, and non-compliance can result in hefty fines and significant reputational damage. In this context, a risk treatment plan must not only focus on current regulations but also keep a close eye on potential future legislative changes.

Risk Treatment for Small and Medium Enterprises (SMEs) vs. Large Enterprises

Small and medium-sized enterprises (SMEs) face a different set of risks than large corporations, and their risk treatment plans must reflect their unique challenges. SMEs often have fewer resources to allocate towards risk management, which can make them more vulnerable to certain threats. However, this also means their risk treatment plans tend to be more flexible, allowing them to adapt quickly to changes in their environment.

For example, an SME in the retail industry might face operational risks such as supply chain disruptions or financial fraud. A well-tailored risk treatment plan for this business might involve diversifying suppliers, investing in fraud detection tools, or adopting better inventory management practices to reduce the chance of fraud. While large enterprises may have dedicated departments for risk management, SMEs must often prioritize their risks based on the most immediate threats to their operations.

Large enterprises, on the other hand, face a broader range of risks and often need more sophisticated risk treatment plans. These plans not only address the day-to-day operational risks but also the complexities of managing multiple stakeholders, international regulations, and large-scale financial operations. For instance, a multinational corporation must address the risks of operating in various jurisdictions, each with its own set of legal requirements and market dynamics. Their risk treatment plan may involve integrating global risk management frameworks, conducting frequent audits, and leveraging advanced technology for real-time risk monitoring.

Adapting Risk Treatment Plans Across Different Sectors

Across all industries, the ability to adapt the risk treatment plan to the specific risks an organization faces is paramount. A generic risk treatment plan can only go so far; it’s the customization of that plan, based on industry-specific needs, that ensures its success.

Take, for instance, the energy sector. Energy companies deal with environmental risks, supply chain disruptions, and regulatory risks. A well-designed risk treatment plan in this sector might include advanced monitoring systems to track environmental impacts, contingency plans for supply chain interruptions, and strategies to comply with local and international environmental regulations. For energy companies, being proactive about environmental risks is not just a regulatory requirement; it’s also part of corporate social responsibility.

In contrast, the retail sector might focus its risk treatment plan on fraud prevention, inventory management, and consumer data protection. With the rise of e-commerce, the risks related to cybersecurity and consumer privacy have become increasingly important. A retail company’s risk treatment plan may include customer data encryption, regular vulnerability assessments, and implementing fraud detection systems to mitigate potential losses.

The Flexibility and Importance of Tailored Risk Treatment Plans

Every industry operates within its own set of dynamics and faces its own risks, and the only way to effectively manage these risks is through tailored strategies. Industry-specific risk treatment plans enable organizations to address the most pertinent threats with the right level of precision, ensuring that they can respond quickly and effectively when issues arise.

A well-constructed risk treatment plan doesn’t just protect the organization—it helps it grow. By understanding the unique risks in their sector and crafting a plan to address them, companies can safeguard their assets, build trust with customers, and stay ahead of regulatory requirements. The next logical step is to explore how solutions like those offered by SearchInform can enhance these plans, providing the tools and strategies needed to manage risk more effectively.

How SearchInform Enhances Risk Treatment Plans

In today’s complex business landscape, the ability to effectively manage risk is crucial for maintaining organizational stability and fostering growth. SearchInform offers a comprehensive suite of tools designed to integrate seamlessly into risk treatment plans, enhancing every aspect of risk management. From real-time threat detection to compliance assurance, SearchInform’s solutions are crafted to meet the evolving needs of businesses across industries, enabling organizations to address risks with greater efficiency and precision.

Overview of SearchInform Tools

SearchInform’s platform provides a set of advanced tools that empower organizations to implement a more robust and dynamic risk treatment plan. These solutions are designed to address multiple layers of risk, from data breaches and cybersecurity threats to regulatory compliance challenge. With a focus on continuous monitoring, incident response, and data protection, SearchInform helps businesses reduce their exposure to risk and improve their overall resilience.

- Data Loss Prevention (DLP)

Protecting sensitive data is a top priority for any organization, and SearchInform’s DLP solution provides real-time monitoring and control over how data is accessed, shared, and transmitted. By tracking and flagging potential data leaks, whether intentional or accidental, the DLP solution helps mitigate the risk of exposing valuable intellectual property or customer information. For businesses that rely on safeguarding confidential data, this tool is essential in maintaining privacy and compliance with data protection regulations. - Security Information and Event Management (SIEM)

SIEM systems are at the core of modern risk treatment plans, providing organizations with a comprehensive view of security events across their network. SearchInform’s SIEM solution enables real-time visibility into potential threats, analyzing data from various sources to detect anomalies that could indicate a security breach. This proactive approach to threat detection helps businesses respond quickly, reducing the time between an attack and its containment. With the ability to correlate data from multiple touchpoints, SIEM tools provide organizations with a clearer understanding of their security posture and allow for quicker, more informed decisions.

Benefits of SearchInform Solutions

Integrating SearchInform’s suite of tools into your organization’s risk treatment plan provides a wide range of benefits that enhance both the efficiency and effectiveness of risk management efforts. By automating threat detection, streamlining compliance processes, and improving response times, businesses can significantly reduce their exposure to risk and position themselves for long-term success.

- Real-Time Threat Detection and Response

Speed is critical when managing risks, especially in industries where timely responses can make all the difference. SearchInform’s real-time threat detection tools ensure that potential threats are identified as soon as they occur, enabling a rapid response that limits damage. Whether it’s a cybersecurity breach, or a compliance violation, having real-time visibility into risks allows organizations to act swiftly and protect their assets. - Comprehensive Risk Coverage

SearchInform’s tools provide a holistic approach to risk management, addressing a wide range of potential threats across different areas of the business. From preventing data loss and securing sensitive information to detecting and responding to security incidents, these tools ensure that organizations have comprehensive coverage. This reduces the likelihood of overlooking critical risks and ensures that businesses are well-prepared for any challenges they may face. - Automated Risk Mitigation

As risks become more complex, managing them manually becomes increasingly difficult. SearchInform’s automation capabilities allow businesses to handle routine risk management tasks with ease, reducing the burden on human resources and increasing the speed of response. Automated alerts, incident detection, and compliance checks ensure that the risk treatment plan runs smoothly without requiring constant manual oversight. - Compliance Assurance

Staying compliant with industry regulations is a constant challenge for businesses, especially in highly regulated sectors like finance, healthcare, and manufacturing. SearchInform helps businesses ensure they are meeting legal and regulatory requirements by providing tools that monitor data handling practices, track compliance metrics, and generate audit-ready reports. By integrating compliance checks into the risk treatment plan, organizations can avoid costly penalties and maintain their reputation with regulators and customers. - Scalable Solutions

As organizations grow, so do their risks. SearchInform’s solutions are scalable, meaning they can evolve alongside the business to handle an increasing volume of data, users, and risk factors. Whether a company is expanding into new markets, adding new services, or managing a growing customer base, SearchInform’s platform ensures that the risk treatment plan remains effective and relevant, no matter the size or complexity of the organization.

The Future of Risk Treatment with SearchInform

The future of risk management is increasingly reliant on advanced technologies, and SearchInform is at the forefront of this evolution. As threats become more sophisticated and regulations continue to tighten, organizations need tools that can keep pace with the changing landscape. SearchInform’s solutions provide the agility and intelligence required to anticipate and respond to emerging risks, ensuring that businesses are always prepared for what lies ahead.

For organizations looking to elevate their risk treatment plans, SearchInform offers a suite of powerful tools that integrate seamlessly into existing workflows. From identifying risks early to responding swiftly and maintaining compliance, SearchInform equips businesses with the tools they need to stay resilient in the face of uncertainty.

Don't wait for the next threat to disrupt your operations. Take control of your risk management strategy today with SearchInform’s cutting-edge solutions. Protect your organization, safeguard your assets, and build a foundation for future success. Reach out now to discover how SearchInform can enhance your risk treatment plan and fortify your organization against the unknown.

Full-featured software with no restrictions

on users or functionality

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!