Understanding Reputational Risk: A Guide for Risk-Aware Organizations

- Reputational Risk: An Overview

- Causes of Reputational Risk

- Internal Missteps: The Silent Saboteurs

- External Shocks: The Uncontrollable Storms

- Industry-Specific Triggers: The Devil in the Details

- The Domino Effect of Ignored Warning Signs

- The Impact of Reputational Risk on Businesses

- Financial Consequences: The Immediate Fallout

- Operational Disruptions: The Ripple Effect

- Strategic and Long-Term Consequences

- A Heavy Price to Pay

- Reputational Risk Management Strategies

- Proactive Monitoring: Seeing the Storm Before It Hits

- Crisis Management: A Blueprint for Survival

- Leveraging Technology: A Digital Shield

- The Human Element: Building a Culture of Integrity

- Reputation by Design: A Strategic Imperative

- Reputational Risk Across Industries

- Financial Sector: The Fragile Currency of Trust

- Healthcare: A Matter of Life and Trust

- Retail: Where Loyalty Can Vanish Overnight

- Technology: Innovating Under Scrutiny

- Lessons Across Sectors

- The Role of SearchInform in Managing Reputational Risk

- SearchInform’s Tools: Safeguarding Your Reputation

- SearchInform in Action: A Strategic Partnership

- Ready to Protect What Matters Most?

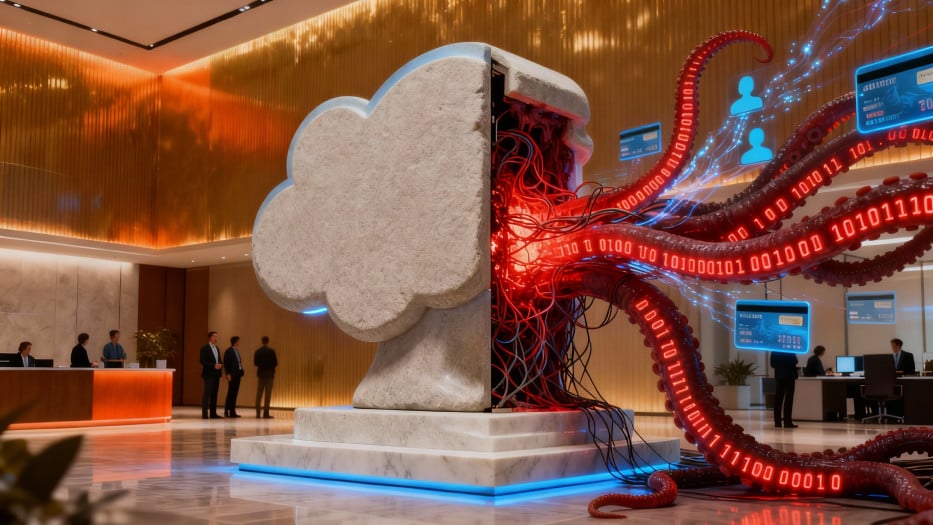

Imagine a well-known brand, trusted by millions, suddenly embroiled in controversy—an environmental scandal, a data breach, or even an ill-conceived tweet gone viral. What follows is swift and merciless: public outrage, plunging stock prices, and the long road to rebuild shattered trust. This is reputational risk—a challenge as subtle as it is formidable.

Reputational Risk: An Overview

At its core, reputational risk is the potential for damage to a company's standing or goodwill. Unlike operational risks tied to processes or financial risks tied to balance sheets, reputational risk is intangible but no less impactful. It governs public perception, customer trust, and, ultimately, the very survival of a business.

Consider the infamous case of Volkswagen’s 2015 emissions scandal. The carmaker’s deliberate emissions test manipulation led to billions in fines and a tarnished reputation. Trust, once shaken, proved difficult to rebuild. Yet, the modern digital landscape adds another dimension. Social media’s immediacy and the permanence of online records mean that one misstep can echo infinitely, magnifying the stakes.

But reputational risk isn’t a 21st-century invention. From Johnson & Johnson’s swift handling of the 1982 Tylenol tampering crisis to BP’s faltering response to the Deepwater Horizon oil spill, the way companies manage such risks has evolved dramatically. In today’s interconnected age, the speed of response can make the difference between redemption and ruin.

But what drives these moments of reputational peril? Understanding the root causes—both internal and external—is key to preventing such crises. Reputational risk often begins with seemingly small missteps, but the factors fueling it can be as diverse as the industries they impact. Let's delve into the origins of this elusive threat.

Causes of Reputational Risk

Every crisis has a beginning—a single spark that can ignite a wildfire. Reputational risk is no exception. While its fallout can be dramatic and public, the causes often lurk beneath the surface, unnoticed until it's too late. These origins are as varied as the businesses they impact, ranging from internal slip-ups to external shocks.

Internal Missteps: The Silent Saboteurs

Reputational risk often begins at home. Consider Wells Fargo’s infamous fake accounts scandal. What started as employees under pressure to meet unrealistic sales goals soon spiraled into a national outrage, costing the bank billions in fines and shattering customer trust. Internal causes like this are some of the most insidious because they erode confidence from within.

Data breaches are another all-too-common example. When Equifax revealed in 2017 that hackers had accessed sensitive information for over 140 million consumers, it wasn’t just the breach that damaged the company’s reputation—it was the sluggish response and lack of transparency that followed. Customers expect companies to protect their information, and when that trust is broken, the consequences are swift and severe.

Even smaller incidents, like an offhand comment by an executive or leaked internal communications, can snowball. Remember when a major airline faced backlash after video footage of an employee mistreating a passenger went viral? The incident itself might have been isolated, but the company’s lack of empathy in its response deepened the public’s distrust.

External Shocks: The Uncontrollable Storms

While internal causes are often within a company’s control, external factors present a more unpredictable challenge. Negative media coverage, for instance, can be relentless. Social media amplifies outrage at lightning speed, turning isolated issues into global talking points. A single tweet or viral post can spark a PR crisis, as fast-food giants, clothing brands, and tech companies have learned all too well.

Cyberattacks are another potent external threat. Target’s massive data breach in 2013, where hackers accessed millions of credit card details, is a cautionary tale. The financial impact was staggering, but the reputational damage was even more profound. Customers lost faith in the retailer’s ability to safeguard their information, a trust that took years to rebuild.

Industry-Specific Triggers: The Devil in the Details

Some industries face unique reputational landmines. In healthcare, for example, patient confidentiality is paramount. Even a minor breach of medical records can shatter public confidence. One hospital group learned this the hard way when stolen patient data appeared on the dark web, prompting fears about identity theft and fraud.

In retail, supply chain ethics are under constant scrutiny. A clothing brand accused of sourcing materials unethically can quickly find itself at the center of a boycott. For industries like finance, even the slightest hint of regulatory non-compliance or unethical lending practices can trigger a reputational crisis.

The Domino Effect of Ignored Warning Signs

The trouble with reputational risk is that its causes are often interconnected. A cyberattack might expose systemic weaknesses, leading to regulatory fines and negative media coverage. Similarly, internal misconduct can provide fertile ground for external scrutiny.

So, what can companies do to stay ahead of these risks? This is where proactive measures become critical—identifying vulnerabilities before they explode into full-blown crises. But the question remains: how prepared are businesses to manage the ripple effects when things go wrong?

This raises an even more pressing question: what happens when these sparks of reputational risk ignite a full-blown crisis? The aftermath can ripple across every facet of a business, leaving financial losses, operational disruptions, and long-term strategic challenges in its wake. To truly understand the gravity of reputational risk, it’s essential to examine its profound and often irreversible impact on organizations.

The Impact of Reputational Risk on Businesses

When reputational risk materializes, the consequences can be swift, severe, and far-reaching. Unlike other risks, the damage often doesn’t stop at financial loss—it seeps into every corner of an organization, from employee morale to long-term strategic goals. Rebuilding trust is not just expensive; it’s an uphill battle that many businesses fail to overcome entirely.

Financial Consequences: The Immediate Fallout

Imagine a bustling stock exchange floor when a scandal breaks. Stock prices plummet, shareholders panic, and media outlets flood the airwaves with speculation. This was precisely the scene in 2015 when Volkswagen’s emissions scandal came to light. Within days, the company lost over $25 billion in market value. For publicly traded companies, reputation isn’t just an abstract concept—it’s a tangible asset, often making up a significant portion of their valuation.

But it’s not just large corporations that feel the heat. Small and medium-sized enterprises (SMEs) rely on goodwill to attract investors and secure loans. A tarnished reputation can result in canceled funding, increased interest rates, or even insolvency.

For businesses in competitive markets, reputational risk can also drive customers to competitors. When a data breach compromised millions of credit card details at a major retailer, the immediate financial loss was compounded by customers taking their loyalty elsewhere.

Operational Disruptions: The Ripple Effect

A damaged reputation doesn’t only hurt profits—it also destabilizes internal operations. Employees feel the weight of public scrutiny, often leading to increased stress and decreased morale. Consider Uber’s struggles in the wake of high-profile allegations of workplace misconduct. The company faced not only a public relations nightmare but also widespread internal dissatisfaction that led to employee departures and disrupted operations.

Attrition is a significant side effect of reputational damage. Talented employees may no longer see the company as a desirable workplace, creating a vicious cycle where operational performance declines further due to a brain drain. Moreover, hiring new talent becomes exponentially harder when a company’s name is mired in controversy.

Vendors and partners can also lose faith, delaying shipments, renegotiating contracts, or even severing ties altogether. The result? Delays in service delivery, increased costs, and strained relationships that disrupt the supply chain.

Strategic and Long-Term Consequences

The long-term impact of reputational risk can be the hardest to quantify—and the most devastating. Partnerships that took years to cultivate can dissolve overnight. Regulatory bodies may tighten their grip, subjecting the company to rigorous audits and compliance checks, as Facebook has experienced repeatedly following privacy violations.

A damaged reputation also has a way of lingering. Customers might forgive but rarely forget. For years after the 2008 financial crisis, major banks struggled to regain public trust. Some resorted to rebranding and exhaustive public relations campaigns, yet skepticism about their ethics persisted.

Companies may also find their ability to innovate stifled. A tarnished brand can struggle to launch new products or services, as potential buyers hesitate to engage with a company they perceive as unreliable.

A Heavy Price to Pay

One of the most overlooked consequences of reputational damage is the psychological toll on leadership. Executives find themselves caught in a storm of scrutiny, juggling crisis management and operational priorities. In some cases, CEOs or key figures may resign, further destabilizing the organization.

But the question remains: is reputational damage always permanent? While some companies manage to rise from the ashes, the journey is long, requiring relentless effort, resources, and an unwavering commitment to transparency and accountability.

What separates companies that recover from those that falter? The ability to anticipate, manage, and mitigate reputational risk effectively. This is where strategy meets execution, and the next discussion will explore precisely how organizations can safeguard their reputation in an unpredictable world.

Reputational Risk Management Strategies

Managing reputational risk is like steering a ship through stormy seas. The goal isn’t just to avoid disasters but to navigate confidently, knowing that unforeseen challenges will arise. In today’s interconnected world, where public perception can change overnight, companies must adopt both proactive and reactive strategies to safeguard their most valuable intangible asset: trust.

Proactive Monitoring: Seeing the Storm Before It Hits

Imagine a world where a company could predict reputational threats before they spiral out of control. While this might sound futuristic, tools for proactive risk monitoring bring organizations closer to this ideal. Social listening platforms, media sentiment analysis, and AI-driven alerts can help businesses identify potential risks in their infancy.

Take, for instance, a global beverage company that noticed a sudden spike in negative social media chatter about its advertising campaign. By responding promptly and issuing a heartfelt apology, the company avoided what could have been a major backlash. The lesson is clear: being vigilant pays off.

Internally, organizations can deploy systems to monitor employee activity for red flags like data mishandling or inappropriate behavior. While the intent isn’t to micromanage, having oversight mechanisms in place ensures potential risks are addressed before they snowball into public crises.

Crisis Management: A Blueprint for Survival

When a crisis does occur, time is of the essence. The difference between a controlled response and a public relations nightmare often lies in preparation. A well-rehearsed crisis management plan can mean the difference between weathering the storm and capsizing.

Consider Johnson & Johnson’s response to the 1982 Tylenol tampering incident. Faced with a potentially catastrophic reputational risk, the company acted decisively by recalling millions of bottles and introducing tamper-proof packaging. Their swift action not only protected lives but also reinforced public trust in their commitment to safety.

The key to successful crisis management lies in three pillars: transparency, empathy, and decisive action. A defensive or dismissive stance, on the other hand, can deepen public skepticism. Take the case of a major airline that initially denied accountability after video footage of passenger mistreatment surfaced. Their delayed apology amplified public outrage, turning a manageable crisis into a lasting reputational scar.

Leveraging Technology: A Digital Shield

Technology has become an indispensable ally in managing reputational risk. AI and machine learning tools can analyze vast datasets, flagging anomalies that might indicate brewing trouble. These tools are particularly effective in industries like finance, where even subtle discrepancies can point to larger issues.

For example, an international bank used predictive analytics to identify unusual transaction patterns that suggested internal fraud. By addressing the issue quietly and efficiently, the bank avoided both financial loss and public embarrassment.

Data visualization tools also allow executives to see the bigger picture, mapping out potential vulnerabilities and their interconnections. The ability to act on insights, rather than raw data, is what separates companies that lead from those that lag.

The Human Element: Building a Culture of Integrity

While tools and systems play a critical role, they’re only as effective as the people behind them. A culture of integrity, reinforced by strong leadership, is the cornerstone of reputational risk management. Employees at all levels must understand that their actions—no matter how small—can impact the company’s reputation.

Regular training programs, open communication channels, and clear ethical guidelines ensure that employees feel empowered to act responsibly. A retail company, for example, implemented an anonymous whistleblower hotline after a series of minor fraud incidents. Not only did this initiative reduce internal risk, but it also signaled to customers that the company took its values seriously.

Reputation by Design: A Strategic Imperative

Managing reputational risk isn’t just about reacting to crises—it’s about designing processes and policies that inherently protect a company’s reputation. This might include stricter supplier vetting in the retail sector, robust patient confidentiality protocols in healthcare, or ethical investment practices in finance.

Reputation by design also involves fostering relationships with stakeholders. Open dialogues with customers, partners, and even regulators can build a reservoir of goodwill that companies can draw on during challenging times.

As businesses continue to innovate and expand, the question isn’t whether they’ll face reputational challenges but when. The next step in this journey lies in understanding how different industries face unique reputational pressures—and what lessons they can teach us about resilience.

Reputational Risk Across Industries

Reputational risk is universal, but its triggers and consequences can vary dramatically depending on the industry. What might be a minor hiccup for one sector could spell disaster for another. To understand the nuanced ways reputational risk plays out, we need to look at the unique pressures and expectations different industries face.

Financial Sector: The Fragile Currency of Trust

In finance, trust isn’t just a virtue; it’s the foundation of the business. Customers entrust banks and investment firms with their life savings, their futures. One breach of that trust can have catastrophic consequences.

Think of the 2008 financial crisis, which left a lasting scar on the reputation of major banks. Practices once seen as opaque suddenly came under a harsh spotlight, eroding public confidence. Even years later, financial institutions continue to rebuild trust, often with costly advertising campaigns and community-focused initiatives.

Modern examples highlight how fragile this trust remains. When a leading bank suffered a cyberattack exposing customer data, it wasn’t just a technical failure—it was perceived as a failure to protect its customers. The backlash was swift, with clients withdrawing funds and regulators stepping in to impose hefty fines.

Yet, this isn’t just a cautionary tale. Financial institutions that invest in robust cybersecurity measures, transparent communication, and ethical lending practices not only protect themselves but also position their brand as a pillar of stability in an unpredictable world.

Healthcare: A Matter of Life and Trust

In healthcare, reputational risk takes on a deeply personal dimension. Patients entrust healthcare providers with their most private information—and their lives. A breach of that trust can be devastating, both for individuals and for the institutions involved.

Consider a hospital that falls victim to ransomware, with hackers locking critical systems and threatening to release patient records. The immediate chaos impacts patient care, but the long-term damage to the hospital’s reputation is equally severe. Patients might question whether their data—and by extension, their well-being—is safe in such hands.

But reputational risk in healthcare isn’t limited to data breaches. Publicized cases of malpractice, even if rare, can shake confidence in an entire system. A single misstep in patient care or billing practices can become a headline, casting a shadow over years of good work.

The most resilient healthcare organizations are those that prioritize transparency. One hospital, after a widely publicized error, invited regulators and the media to observe their revised safety protocols, turning a crisis into an opportunity to rebuild trust.

Retail: Where Loyalty Can Vanish Overnight

In the world of retail, reputational risk often revolves around customer experience and brand values. Modern consumers are savvier and more vocal than ever, using their purchasing power to support companies that align with their ethical standards.

A major fashion brand learned this the hard way when it was accused of unethical labor practices. Social media campaigns calling for boycotts gained traction almost instantly, forcing the company into damage control mode. Even after pledging reforms, it faced an uphill battle to win back consumers’ trust.

But retail isn’t only vulnerable to ethical lapses. Data breaches pose a significant threat, as seen in the high-profile case of a major retailer whose compromised payment systems exposed millions of credit card details. Customers, already inundated with choices, quickly shifted their loyalty to competitors who appeared more secure.

The antidote to these risks lies in transparency, accountability, and proactive measures. Brands that listen to their customers and act swiftly when issues arise not only survive but often come out stronger.

Technology: Innovating Under Scrutiny

For technology companies, reputational risk often centers on data privacy and ethical innovation. The public holds tech giants to a higher standard, expecting them to act as both innovators and custodians of personal information.

A recent example involved a global social media platform grappling with allegations of data misuse. The scandal not only triggered investigations but also ignited a public debate about digital ethics. While the platform eventually introduced stronger privacy controls, the damage to its reputation had already been done, with users migrating to alternatives perceived as more secure.

Tech companies must strike a delicate balance between innovation and responsibility. When they get it right, they set the standard for their industry. But when they falter, the backlash can be swift and unforgiving.

Lessons Across Sectors

Though the challenges differ, the underlying principles of managing reputational risk remain consistent. Transparency, accountability, and a commitment to ethical practices are universal tools for preserving trust. Each industry offers lessons that others can adapt, underscoring the importance of vigilance and preparation.

But while these insights are valuable, they raise an important question: how can companies translate these principles into actionable strategies? This requires tools, frameworks, and expert guidance—a challenge we’ll unravel next as we explore the role of technology in helping businesses manage reputational risk effectively.

The Role of SearchInform in Managing Reputational Risk

When it comes to reputational risk, the stakes are high, and the margin for error is razor-thin. Organizations today face a daunting reality: the very forces that drive growth—like digital transformation and global connectivity—also amplify vulnerabilities. Managing reputational risk requires more than reactive crisis management; it demands a proactive, data-driven approach. This is where SearchInform becomes a game-changer, equipping businesses with tools that go beyond traditional risk mitigation.

SearchInform’s Tools: Safeguarding Your Reputation

SearchInform offers a suite of powerful solutions designed to help organizations identify, monitor, and respond to potential threats before they escalate into full-blown crises. These tools work seamlessly to provide end-to-end reputation protection, offering both foresight and precision in managing risks.

Here’s how SearchInform helps:

-

Data Loss Prevention (DLP)

A critical aspect of reputational risk management is protecting sensitive data from leaks or breaches. SearchInform’s DLP solutions ensure that confidential information stays secure by monitoring how data is accessed, shared, and stored across your organization. -

Incident Response Automation

When an issue arises, time is of the essence. SearchInform’s incident response features allow companies to quickly investigate and resolve potential threats, minimizing downtime and protecting their reputation. Automation ensures a consistent, efficient response that aligns with best practices. -

Employee Behavior Analytics

Many reputational crises originate internally, whether through deliberate misconduct or inadvertent errors. SearchInform’s behavioral analysis tools detect unusual patterns in employee activities, helping organizations prevent insider threats and reinforce accountability. -

Regulatory Compliance Assistance

In highly regulated industries like finance, healthcare, and energy, reputational risk often overlaps with compliance risks. SearchInform’s solutions ensure that your organization meets regulatory requirements, reducing exposure to legal penalties and public scrutiny.

SearchInform in Action: A Strategic Partnership

When integrated effectively, SearchInform becomes more than a tool—it becomes a partner in preserving and enhancing your reputation. Whether your organization is navigating industry-specific challenges or preparing for the unknown, SearchInform equips you with the clarity, control, and confidence needed to thrive in today’s complex environment.

Ready to Protect What Matters Most?

Reputation isn’t just an asset—it’s the lifeblood of your organization. In a world where trust is hard to earn and easy to lose, the right tools can make all the difference. With SearchInform by your side, you don’t just manage reputational risk—you turn it into a strength.

It’s time to take control of your narrative, safeguard your legacy, and lead with confidence. Are you ready to make reputational excellence your competitive advantage? Let’s get started.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!