Dynamic Risk Assessment for a Secure Business Environment

- Introduction to Dynamic Risk Assessment

- Core Concepts of Dynamic Risk Assessment

- What Makes Dynamic Models Unique?

- The Lifeblood of Dynamic Risk Assessment: Real-Time Data

- The Human Element: Flexibility in Action

- Bridging Strategy and Adaptability

- The Benefits of Dynamic Risk Assessment

- The Real-Time Edge

- Mitigating Threats Before They Escalate

- The Decision-Making Revolution

- Beyond the Obvious: Additional Advantages

- A Competitive Advantage in Disguise

- Applications of Dynamic Risk Assessment

- Safeguarding Lives in Healthcare

- Protecting Finances with Precision

- Elevating Safety in Aviation

- Managing Disasters with Foresight

- Logistics: A Study in Efficiency

- Pioneering New Frontiers

- Challenges in Dynamic Risk Assessment

- The Data Dilemma: Managing Overload

- Privacy vs. Progress: Walking a Tightrope

- Scalability: From Small Teams to Global Operations

- Cultural Resistance: Breaking Old Habits

- Cost vs. Value: The Investment Debate

- Overcoming the Challenges: A Path Forward

- Dynamic Risk Assessment and Business Strategy

- Aligning Risk and Business Goals

- Empowering the Workforce

- Measuring Success: The ROI of Dynamic Risk Assessment

- Building Strategic Resilience

- A Roadmap to Success

- How SearchInform Enhances Dynamic Risk Assessment

- Real-Time Monitoring for Immediate Action

- Customizable Solutions for Every Industry

- Simplifying Compliance and Mitigating Fraud

- The Future of Dynamic Risk Assessment with SearchInform

Introduction to Dynamic Risk Assessment

Imagine standing in the middle of a bustling city, navigating unpredictable traffic, shifting weather, and an ever-changing skyline. This metaphor aptly describes the essence of dynamic risk assessment—a fluid, real-time approach to identifying and managing risks that evolve as rapidly as the environments they inhabit. Unlike traditional static models that provide a snapshot of risk, dynamic risk assessment operates like a live feed, adapting to current conditions and future probabilities.

This transformation from static to dynamic models didn’t happen overnight. Risk management in its earliest form was a slow-moving ship, relying on historical data and pre-determined scenarios. However, as organizations became increasingly interconnected and volatile external factors—from geopolitical tensions to technological disruptions—demanded immediate responses, static models began to falter. Enter dynamic risk assessment, a method designed not just to analyze risks but to anticipate them in real time.

Modern organizations, whether multinational conglomerates or lean startups, recognize that a static approach to risk is no longer sufficient. The stakes are higher, with reputations, operations, and compliance on the line. Dynamic risk assessment, therefore, isn't just a strategy—it’s a necessity.

Dynamic risk assessment doesn’t just demand a shift in tools or technology—it calls for a deeper understanding of its foundational concepts. To truly grasp its power, it’s essential to explore the principles that drive this approach and how it fundamentally differs from traditional risk management. Let’s delve into the core concepts that make dynamic risk assessment an indispensable asset for modern organizations.

Core Concepts of Dynamic Risk Assessment

Dynamic risk assessment is the art of staying one step ahead. Picture navigating a winding mountain road—each turn reveals new challenges, from unexpected weather changes to sudden wildlife crossings. Success in such scenarios requires more than a map; it demands constant vigilance, quick decision-making, and the ability to adjust plans on the fly. This is precisely the essence of dynamic risk assessment.

At its core, this approach thrives on adaptability. Unlike static risk models that function like a photograph—a fixed snapshot of threats—dynamic models act more like a live video feed, offering real-time updates and nuanced perspectives. This adaptability mirrors the flexibility of a seasoned traveler who adjusts their itinerary based on traffic, weather, or local events.

What Makes Dynamic Models Unique?

Traditional risk assessments have long relied on rigid templates: identify a threat, assess its likelihood, and craft a mitigation strategy. While this method worked in stable environments, it often crumbles in today’s volatile and fast-paced world. Dynamic risk assessment flips this outdated model on its head, prioritizing continuous monitoring and recalibration. It doesn't merely identify risks—it anticipates them.

Consider a retail company preparing for the holiday season. A static model might highlight general supply chain vulnerabilities, but a dynamic approach goes further. It analyzes real-time data, from port delays to weather forecasts, allowing managers to preemptively reroute shipments or adjust inventory. The result? Fewer disruptions and happier customers.

The Lifeblood of Dynamic Risk Assessment: Real-Time Data

The secret ingredient in dynamic risk assessment is real-time data. This isn’t just about gathering numbers—it’s about interpreting stories. Market trends reveal consumer behavior shifts. Social media sentiment highlights emerging reputational risks. IoT devices monitor machinery, alerting operators to potential failures.

For instance, an energy company using dynamic models can track equipment performance through sensor data. A subtle vibration in a turbine might signal an impending failure. With this insight, technicians can address the issue before it spirals into a costly outage.

But leveraging data isn’t solely about technology; it’s a mindset shift. Organizations must view data as a living entity—one that evolves, interacts, and paints a holistic picture of risk. This perspective fosters resilience, allowing teams to respond effectively, no matter how unpredictable the circumstances.

The Human Element: Flexibility in Action

While technology drives dynamic risk assessment, human adaptability is equally crucial. Imagine a pilot in the cockpit during turbulent weather. Instruments provide vital information, but it’s the pilot’s intuition and decision-making skills that ensure a safe landing. Similarly, organizations must empower teams to think critically, question assumptions, and act decisively.

Training plays a pivotal role here. Employees need more than technical expertise; they must cultivate a proactive mindset. Consider a cybersecurity team handling a potential breach. A static model might dictate standard protocols, but a dynamic approach encourages creative problem-solving. Team members analyze the hacker’s patterns, adapt firewalls, and isolate systems in real time, minimizing damage.

Bridging Strategy and Adaptability

Dynamic risk assessment isn’t just about reacting to threats; it’s about building a bridge between strategy and adaptability. By integrating risk management into broader business goals, organizations create a culture where resilience becomes second nature. This alignment ensures that risk mitigation supports, rather than hinders, growth.

As we explore the profound benefits of dynamic risk assessment in the next section, it becomes clear that adaptability isn’t merely a survival mechanism—it’s a competitive advantage. The ability to pivot, adjust, and thrive in the face of uncertainty sets industry leaders apart. So, how exactly do these benefits manifest? Let’s uncover the transformative impact of dynamic risk assessment on decision-making, compliance, and beyond.

The Benefits of Dynamic Risk Assessment

Dynamic risk assessment is more than just a buzzword; it’s a game-changing tool that reshapes how organizations operate in an unpredictable world. Unlike traditional methods, which feel like checking the weather forecast once and hoping for the best, dynamic models are like having a personal meteorologist providing constant updates, letting you adjust your plans as the storm unfolds—or as the sun unexpectedly breaks through.

The Real-Time Edge

Imagine a global supply chain stretching across continents. With static assessments, risks such as geopolitical instability or natural disasters might only be flagged after they’ve already caused delays. Dynamic risk assessment changes the narrative. It sifts through vast streams of real-time data—shipping schedules, local news, social media chatter—and pinpoints brewing issues before they disrupt operations.

Take, for example, a logistics company monitoring port activity in Southeast Asia. A sudden labor strike could mean delayed shipments. While a static model might only identify such risks during annual reviews, a dynamic system catches early warning signs, enabling managers to reroute shipments or renegotiate contracts. The result? Smoother operations and fewer irate customers waiting for their orders.

Mitigating Threats Before They Escalate

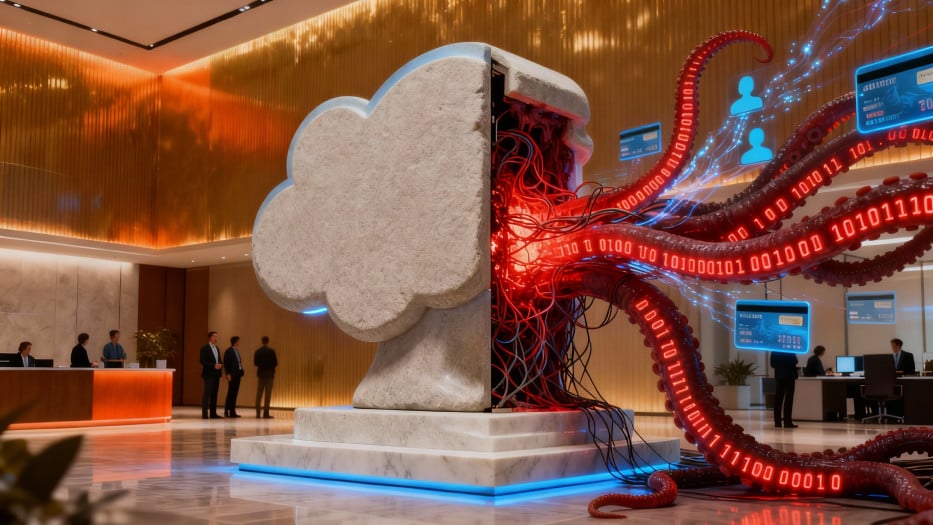

Real-time identification and mitigation of risks aren’t just beneficial—they’re transformative. Think of cybersecurity, one of today’s most pressing concerns. For financial institutions, every second counts when dealing with potential breaches. A dynamic risk model flags anomalies like suspicious login attempts or unusual transaction patterns, enabling immediate countermeasures. It’s not about waiting for a breach to occur—it’s about stopping it before it even begins.

Consider the regulatory environment, a labyrinth of shifting laws and guidelines. Staying compliant can feel like trying to hit a moving target. Here, dynamic risk assessment acts as a guiding hand. By continuously scanning for updates to laws and regulations, organizations can adapt without scrambling, ensuring they remain on the right side of compliance without unnecessary stress or penalties.

The Decision-Making Revolution

One of the most exciting benefits of dynamic risk assessment is its impact on decision-making. Decisions often need to be made quickly, with incomplete information—a recipe for sleepless nights for executives. Dynamic models fill in the gaps by providing up-to-the-minute insights, empowering leaders to make informed choices without hesitation.

Picture a retailer gearing up for the holiday shopping frenzy. A static assessment might predict general sales trends but won’t account for live changes like unexpected demand surges or inventory shortages. A dynamic system tracks purchasing behaviors in real time, flagging which products are flying off the shelves and identifying restocking needs. This real-time responsiveness keeps shelves stocked, customers happy, and profits soaring.

Beyond the Obvious: Additional Advantages

Dynamic risk assessment also excels in areas often overlooked. In crisis management, it becomes a lifeline. When natural disasters strike, dynamic models help governments and organizations allocate resources more effectively, predicting which areas need the most immediate support. During the COVID-19 pandemic, companies using dynamic assessments were better equipped to manage supply chain disruptions, shift to remote work, and ensure employee safety.

Then there’s the issue of adaptability. Organizations embracing dynamic risk assessment often find their teams working smarter, not harder. Employees aren’t bogged down with outdated reports or rigid protocols. Instead, they have the tools to respond flexibly to challenges, fostering a culture of innovation and resilience.

A Competitive Advantage in Disguise

The benefits of dynamic risk assessment go beyond avoiding disasters—it’s a competitive advantage. In a crowded marketplace, speed and accuracy are key differentiators. Companies that can adapt faster to changing conditions often outperform their less agile competitors. It’s the difference between thriving and merely surviving.

As we move forward, it’s worth exploring where these benefits make the biggest splash. Dynamic risk assessment isn’t confined to one sector or use case—it’s a versatile approach that’s revolutionizing industries, from finance to healthcare to disaster management. But how exactly does it play out in these fields? Let’s dive into the real-world applications that showcase its power.

Applications of Dynamic Risk Assessment

Dynamic risk assessment is a Swiss Army knife of risk management—versatile, precise, and indispensable across industries. Its ability to adapt and respond in real-time has revolutionized sectors ranging from healthcare to aviation. Every industry faces unique risks, but they share a common challenge: the need to anticipate, mitigate, and adapt to evolving threats. This is where dynamic risk assessment shines, not only providing insights but also actively shaping the way organizations respond.

Safeguarding Lives in Healthcare

Imagine a hospital emergency room during a pandemic. The stakes couldn’t be higher, with staff racing to treat patients while managing limited resources. Here, dynamic risk assessment becomes a lifesaving tool. By analyzing real-time data such as patient inflow, staff availability, and medical supply levels, hospitals can allocate resources more effectively. For instance, predictive models can forecast which departments might become overwhelmed, allowing administrators to reassign staff or expedite supply orders.

Beyond crisis management, dynamic risk assessment plays a critical role in everyday operations. Equipment monitoring is a prime example. A subtle fluctuation in a ventilator’s performance might signal an impending failure. Dynamic models catch these warning signs, prompting preemptive maintenance and ensuring patient safety.

Protecting Finances with Precision

In the financial world, where milliseconds can mean millions, dynamic risk assessment is indispensable. Think of a global bank processing thousands of transactions every second. Among these, a single fraudulent activity could ripple into catastrophic losses. Dynamic models scan for anomalies—unusual transaction patterns, sudden access from unfamiliar locations—and trigger immediate countermeasures.

Consider a real-world example: a regional bank using dynamic risk assessment reduced fraud losses by 40% in one year. By integrating real-time monitoring with advanced analytics, it flagged high-risk transactions before they were completed, protecting both its reputation and bottom line.

Elevating Safety in Aviation

In aviation, dynamic risk assessment is as critical as the engines powering a flight. Pilots rely on it to navigate ever-changing variables—weather conditions, mechanical issues, and air traffic congestion. For example, during a transatlantic flight, a sudden storm front might emerge. A dynamic model processes data from onboard sensors, meteorological updates, and traffic control, helping pilots chart safer, more efficient routes.

This adaptability extends beyond the cockpit. Airlines use dynamic models to optimize maintenance schedules, preventing mechanical failures and reducing downtime. One leading airline reported a 25% decrease in delays after adopting such a framework, demonstrating how real-time adjustments ripple through an entire operation.

Managing Disasters with Foresight

Disaster recovery is another domain where dynamic risk assessment has become a cornerstone. Picture a coastal city preparing for a hurricane. Static plans might allocate resources based on historical storm patterns, but dynamic models use live data—wind speeds, evacuation trends, infrastructure status—to fine-tune responses in real-time.

During Hurricane Harvey, dynamic risk assessments helped emergency responders prioritize rescue operations. By mapping flood levels against population density, they directed resources to areas with the greatest need, saving countless lives.

Governments are also leveraging these models for long-term resilience. Dynamic assessments predict the impacts of climate change, guiding urban planning to reduce vulnerability to future disasters.

Logistics: A Study in Efficiency

Few industries exemplify the value of dynamic risk assessment better than logistics. Picture a delivery company managing hundreds of trucks across sprawling urban areas. A static risk model might plan routes based on average traffic patterns, but a dynamic system adapts routes in real-time, accounting for accidents, construction, or weather disruptions.

Take the case of a logistics firm struggling with delays. By adopting dynamic risk assessment, it integrated GPS data, traffic reports, and weather forecasts into its operations. Within months, delivery times improved by 30%, showcasing the tangible benefits of agility.

Pioneering New Frontiers

Dynamic risk assessment isn’t limited to traditional industries—it’s paving the way for innovation in cutting-edge fields. Autonomous vehicles, for instance, rely on dynamic models to process environmental data and make split-second decisions. Similarly, space exploration missions use these frameworks to assess risks during launches, in orbit, and on return.

The applications are limitless because the essence of dynamic risk assessment lies in its ability to adapt. Whether safeguarding lives, protecting assets, or unlocking efficiency, it empowers organizations to act decisively in the face of uncertainty.

As we turn to the challenges of implementing this transformative approach, it’s worth asking: what barriers stand in the way of making dynamic risk assessment a universal tool? Understanding these challenges is the first step toward overcoming them, ensuring this powerful method reaches its full potential.

Challenges in Dynamic Risk Assessment

Dynamic risk assessment is undoubtedly a powerful tool, but like any cutting-edge approach, it comes with its fair share of challenges. Implementing a system capable of real-time adaptability often feels like assembling a car while driving it. Each piece must fit perfectly, and any misstep can lead to costly inefficiencies or vulnerabilities. These challenges, however, are not insurmountable. They require a blend of strategic foresight, technological expertise, and a willingness to innovate.

The Data Dilemma: Managing Overload

Imagine trying to sip water from a firehose—that’s what handling the sheer volume of data in dynamic risk assessment can feel like. In today’s hyper-connected world, organizations are inundated with information: social media feeds, IoT device outputs, transactional data, weather forecasts, and more. While this flood of data is the lifeblood of dynamic models, it also poses a significant challenge.

Take the case of a retail chain with hundreds of stores across multiple regions. Their dynamic risk assessment system monitors everything from inventory levels to customer foot traffic. But without robust algorithms to filter, analyze, and prioritize this data, the system risks becoming paralyzed by noise. Effective dynamic models rely on advanced technologies—machine learning, AI, and big data analytics—to separate actionable insights from irrelevant clutter.

Privacy vs. Progress: Walking a Tightrope

With great data comes great responsibility. The more information a dynamic risk assessment system gathers, the more critical it becomes to ensure privacy and security. In an age of stringent regulations like GDPR and CCPA, balancing innovation with compliance is a constant struggle.

Consider the healthcare sector, where patient data is both a goldmine for dynamic risk models and a potential legal minefield. A hospital implementing dynamic assessments must tread carefully to ensure sensitive information remains protected while enabling real-time decision-making. Encryption, anonymization, and strict access controls become essential tools for navigating this delicate balance.

However, even with these safeguards, questions linger. Can organizations truly ensure data security in an era of sophisticated cyber threats? The answer lies in continuous improvement—evolving security protocols as dynamically as the risks they’re designed to mitigate.

Scalability: From Small Teams to Global Operations

A dynamic risk model that seamlessly manages a single department might falter when stretched across a global enterprise. Scalability is a common hurdle, particularly for organizations undergoing rapid growth or operating in diverse markets.

Picture a tech startup using dynamic risk assessment to manage cybersecurity threats. The system works flawlessly during its early stages, flagging phishing attempts and preventing breaches. But as the company expands, onboarding thousands of employees and launching in new regions, the same model struggles to keep up with the increased complexity.

The key to scalability lies in modular design. By building systems that can grow incrementally—adding new features or integrating with other platforms—organizations can avoid the pitfalls of outgrowing their dynamic risk assessment capabilities.

Cultural Resistance: Breaking Old Habits

Technology isn’t the only challenge; sometimes, the biggest hurdles are cultural. Organizations steeped in tradition often struggle to embrace the agility and fluidity required for dynamic risk assessment. Employees accustomed to static models may resist the shift, viewing it as an unnecessary complication rather than a critical evolution.

This resistance is particularly common in industries with established hierarchies, such as finance or manufacturing. Breaking through these barriers requires more than technology—it demands a cultural transformation. Training programs, leadership buy-in, and clear communication about the benefits of dynamic models are essential to overcoming skepticism.

Cost vs. Value: The Investment Debate

Dynamic risk assessment systems are not cheap. Between hardware upgrades, software licenses, and personnel training, the initial investment can seem daunting. For smaller organizations, these costs often feel prohibitive. Yet, the value of such systems becomes evident in the long run.

Take disaster recovery. A government agency might hesitate to invest in dynamic models for flood response, citing budget constraints. But when a storm hits, the ability to allocate resources efficiently could save millions—not to mention countless lives. Viewing dynamic risk assessment as a long-term investment rather than an immediate expense shifts the narrative from cost to value.

Overcoming the Challenges: A Path Forward

These challenges may seem formidable, but they’re also opportunities for growth. Organizations that successfully implement dynamic risk assessment often emerge stronger, more agile, and better equipped to navigate uncertainty.

The road ahead requires collaboration between technology providers, policymakers, and businesses. By addressing these hurdles head-on, dynamic risk assessment can become not just a tool for managing risks but a cornerstone of innovation and resilience.

As we look at the strategic implications of dynamic risk assessment, a critical question arises: how can organizations seamlessly integrate these models into their broader business strategies? The answer lies in aligning risk management with core objectives—a topic we’ll explore next.

Dynamic Risk Assessment and Business Strategy

Dynamic risk assessment isn’t just about managing threats; it’s a compass guiding organizations toward resilience and growth. When risk management integrates seamlessly into business strategy, it transforms from a defensive mechanism into a proactive enabler. It helps organizations not only weather storms but navigate them skillfully, ensuring continuity while uncovering opportunities in uncertainty.

Aligning Risk and Business Goals

Imagine a retail chain on the brink of a holiday rush. A static risk model might warn of general supply chain vulnerabilities, but a dynamic risk assessment digs deeper. It reveals real-time bottlenecks—such as delays at a key distribution hub—and recommends immediate action, like redirecting shipments or reallocating stock. The result? Customers find their shelves stocked, and the business meets demand without missing a beat.

This alignment between risk management and business continuity planning is essential. By embedding dynamic assessments into their strategic framework, organizations can anticipate disruptions and adapt quickly without losing momentum. It’s like having a backup plan that evolves as the situation unfolds, ensuring every decision is informed and timely.

Empowering the Workforce

Technology may power dynamic risk assessment, but people bring it to life. Employees are the front line of any risk management strategy, and their ability to recognize and respond to threats can make or break an organization’s success. That’s why training is crucial—not just to teach employees how to use tools, but to help them develop a proactive mindset.

Consider a cybersecurity team tasked with protecting a financial institution from evolving threats. Static protocols might dictate responses to known risks, but what about the unknown? Dynamic risk assessment encourages employees to think critically, analyze new data in real-time, and implement creative solutions. This mindset fosters a culture of vigilance, where employees act as active participants in risk mitigation rather than passive observers.

In one case, a multinational firm implemented workshops focused on dynamic risk scenarios, such as simulated phishing attacks and supply chain disruptions. Employees learned to identify subtle warning signs and respond effectively, resulting in a 30% reduction in security breaches within a year. These success stories highlight the importance of empowering teams with both knowledge and confidence.

Measuring Success: The ROI of Dynamic Risk Assessment

For decision-makers, one burning question often lingers: is it worth the investment? The answer lies in measurable outcomes. Companies that adopt dynamic risk assessment consistently report faster recovery times, lower financial losses, and greater operational efficiency during crises.

Take the example of a manufacturing company facing a sudden raw material shortage due to geopolitical tensions. Using dynamic models, the company identified alternative suppliers within hours, minimizing production downtime. What could have been a weeks-long crisis turned into a minor disruption, saving millions in potential losses.

Beyond immediate cost savings, the long-term benefits are just as compelling. Improved customer trust, enhanced market reputation, and streamlined operations all contribute to a healthier bottom line. In fact, organizations that prioritize dynamic assessments often find themselves not just surviving challenges but thriving in the face of them.

Building Strategic Resilience

Dynamic risk assessment also plays a pivotal role in fostering long-term resilience. It encourages organizations to think beyond immediate threats and consider broader implications. For example, a tech company might use dynamic models to evaluate the risks of expanding into emerging markets. By analyzing factors like regulatory environments, political stability, and infrastructure readiness, the company can make informed decisions that align with its strategic goals.

This approach ensures that risk management is not an afterthought but a central pillar of business strategy. It shifts the narrative from reacting to risks to leveraging them as opportunities for innovation and growth.

A Roadmap to Success

As organizations embrace dynamic risk assessment, they unlock a new level of strategic agility. But the journey doesn’t end here. The next frontier lies in understanding how tools like SearchInform are redefining the landscape of risk management. By integrating advanced solutions, businesses can amplify the impact of their strategies, ensuring they’re not just prepared for the future—but shaping it.

How SearchInform Enhances Dynamic Risk Assessment

Dynamic risk assessment thrives on precision, adaptability, and foresight. SearchInform takes these principles and elevates them with innovative tools that make risk management not only possible but profoundly effective. Acting as a trusted partner for organizations, SearchInform provides solutions that combine cutting-edge technology with practical application, ensuring that no risk goes unchecked and no opportunity for mitigation is missed.

Real-Time Monitoring for Immediate Action

Imagine your organization as a ship navigating turbulent waters. Without a clear view of what lies ahead, you risk sailing straight into danger. SearchInform's real-time monitoring tools act as a radar system, scanning for potential risks as they emerge and allowing you to adjust your course before it’s too late.

- Behavioral analysis: By monitoring patterns in employee behavior, SearchInform flags anomalies that might indicate insider threats, such as unauthorized data access or unusual login times.

- Automated alerts: These tools provide instant notifications for emerging risks, whether it’s a spike in network activity or deviations in financial transactions, enabling swift responses.

For example, consider an organization experiencing an unusual spike in downloads from its server. With SearchInform, this activity is flagged instantly, and the risk team can act immediately to investigate and prevent a potential breach.

Customizable Solutions for Every Industry

No two organizations are alike, and neither are their risks. SearchInform understands this, offering highly customizable tools designed to meet the unique needs of different industries. Whether you’re in finance, healthcare, manufacturing, or retail, the solutions adapt seamlessly to your specific challenges.

- Industry-specific configurations: Healthcare providers can focus on patient data security, while retail businesses might prioritize supply chain integrity.

- Integration with existing systems: SearchInform’s tools are built to work alongside the platforms you already use, ensuring a smooth transition and maximum efficiency.

For example, a manufacturing company struggling with operational delays can use SearchInform to analyze machinery performance, employee workflows, and supply chain logistics, creating a holistic risk management strategy tailored to their industry.

Simplifying Compliance and Mitigating Fraud

Compliance is often a complex and burdensome process, with constantly evolving regulations adding to the challenge. SearchInform simplifies this by automating compliance monitoring and reporting. This not only reduces the workload on internal teams but also ensures that no critical updates are missed.

- Automated compliance checks: By continuously scanning for regulatory changes, SearchInform helps businesses stay compliant without the headache of manual updates.

- Fraud detection and prevention: Advanced algorithms monitor for suspicious activities, ensuring that fraudulent actions are stopped before they cause significant damage.

Consider a financial services firm handling high-value transactions. SearchInform’s fraud detection tools can instantly flag inconsistencies, such as mismatched account details or unusual transaction patterns, safeguarding the organization’s reputation and finances.

The Future of Dynamic Risk Assessment with SearchInform

The challenges organizations face today demand innovative solutions, and SearchInform delivers exactly that. By combining real-time monitoring, predictive analytics, and customizable tools, it transforms dynamic risk assessment from a reactive task into a proactive strategy.

Don’t let uncertainty hold your business back. With SearchInform, you can embrace the unknown with confidence, turning potential threats into opportunities for growth. Are you ready to see what’s next on your horizon? Let SearchInform guide the way.

Full-featured software with no restrictions

on users or functionality

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!