How Cybersecurity Can Prevent Corporate Fraud

- Introduction to Corporate Fraud and Cybersecurity

- Definition and Overview of Corporate Fraud

- The Growing Role of Cybersecurity in Combating Corporate Fraud

- Real-World Examples of Corporate Fraud in the Digital Age

- Types of Corporate Fraud Exploiting Cybersecurity Vulnerabilities

- Phishing and Social Engineering Attacks

- Insider Threats and Data Breaches

- Financial Fraud Through Cyber Attacks

- Supply Chain Fraud and Cybersecurity Weaknesses

- Impact of Corporate Fraud on Businesses

- Financial Losses and Economic Impact

- Reputational Damage and Customer Trust

- Legal Consequences and Compliance Issues

- Cybersecurity Measures to Prevent Corporate Fraud

- Implementing Strong Authentication and Access Controls

- The Role of Encryption in Protecting Sensitive Data

- Importance of Regular Security Audits and Assessments

- Utilizing Artificial Intelligence and Machine Learning for Fraud Detection

- Future Trends in Corporate Fraud and Cybersecurity

- Emerging Cyber Threats Targeting Corporations

- The Evolving Landscape of Cybersecurity Regulations

- Predictions for the Future of Fraud Prevention Technologies

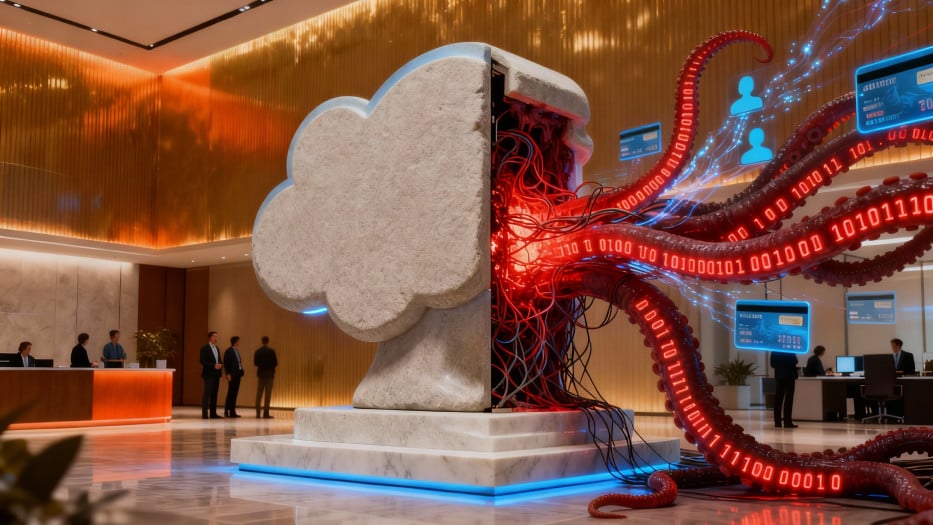

Introduction to Corporate Fraud and Cybersecurity

Corporate fraud represents a significant and growing threat to businesses in the digital age. With technological advancements, fraudsters have developed increasingly sophisticated methods to exploit vulnerabilities within organizations. Understanding corporate fraud and the crucial role cybersecurity plays in mitigating these risks is essential for maintaining the integrity and success of any business.

Definition and Overview of Corporate Fraud

Corporate fraud involves a wide range of illicit activities carried out by individuals or groups within or related to a company. These activities often include deceit, manipulation, or misrepresentation of financial information, all with the goal of personal or corporate gain. Common forms of corporate fraud include:

- Embezzlement

- Insider trading

- Financial statement fraud

- Bribery

The consequences of corporate fraud are far-reaching, leading to financial losses, legal penalties, and severe damage to a company’s reputation. As the digital landscape continues to evolve, the methods used to commit corporate fraud have become more complex, often involving cyber-enabled tactics like phishing, ransomware, and data breaches.

The Growing Role of Cybersecurity in Combating Corporate Fraud

As corporate fraud becomes more intertwined with digital technologies, the importance of cybersecurity in preventing and detecting fraudulent activities has never been greater. Cybersecurity measures are now essential tools in safeguarding an organization against the various threats of corporate fraud. Key strategies include:

- Employee Training: Regularly educating staff on cybersecurity best practices and emerging threats can significantly reduce the risk of fraud from within the organization.

- Advanced Threat Detection: Leveraging technologies such as artificial intelligence (AI) and machine learning (ML) to identify unusual patterns or behaviors can help detect fraudulent activities early.

- Data Encryption: Protecting sensitive data through encryption ensures that even if data is intercepted, it remains unusable to fraudsters.

- Continuous Monitoring and Audits: Implementing ongoing monitoring and conducting frequent security audits can help identify and address potential vulnerabilities before they are exploited.

Real-World Examples of Corporate Fraud in the Digital Age

The digital era has seen several high-profile cases of corporate fraud that highlight the critical need for robust cybersecurity measures. Some notable examples include:

- Enron Scandal (2001): The collapse of Enron was largely due to elaborate financial fraud and accounting manipulations. This case led to significant changes in corporate governance laws, including the Sarbanes-Oxley Act.

- Wirecard Scandal (2020): Wirecard, a German payment processing company, was involved in one of the biggest corporate frauds in recent history, involving false accounting and inflating profits. The scandal revealed major shortcomings in the company’s cybersecurity and internal controls.

- Equifax Data Breach (2017): Although primarily a cybersecurity failure, the Equifax data breach resulted in massive identity theft and fraud, affecting millions of individuals. The breach underscored the importance of safeguarding personal data and the catastrophic consequences of inadequate cybersecurity practices.

These cases illustrate the diverse ways in which corporate fraud can manifest, often exploiting digital weaknesses. As fraudsters continue to adapt and evolve their tactics, organizations must prioritize cybersecurity to protect against the ever-present threat of corporate fraud.

Corporate fraud is a dynamic and evolving challenge that demands a proactive approach. By integrating robust cybersecurity practices, organizations can significantly reduce the risks associated with corporate fraud, ensuring long-term security and stability.

Types of Corporate Fraud Exploiting Cybersecurity Vulnerabilities

Corporate fraud has evolved significantly in the digital era, with cybercriminals continuously finding new ways to exploit cybersecurity vulnerabilities. These vulnerabilities create entry points for various types of corporate fraud, each posing unique threats to the financial stability and reputation of businesses. Understanding these threats is crucial for organizations aiming to protect themselves from potential financial and legal repercussions.

Phishing and Social Engineering Attacks

Phishing and social engineering attacks are among the most prevalent methods used to commit corporate fraud. These tactics involve manipulating individuals within an organization into revealing sensitive information or granting unauthorized access to systems.

Phishing attacks often come in the form of deceptive emails that appear to be from legitimate sources. These emails trick employees into clicking on malicious links or downloading harmful attachments, leading to unauthorized access to company data. Social engineering takes this a step further by exploiting human psychology. Fraudsters may pose as trusted colleagues or authority figures, convincing employees to divulge confidential information or transfer funds.

The impact of phishing and social engineering attacks can be devastating. Once fraudsters gain access to internal systems, they can commit various forms of corporate fraud, including embezzlement, data theft, and unauthorized financial transactions. These attacks highlight the importance of comprehensive cybersecurity training and awareness programs within organizations.

Insider Threats and Data Breaches

Insider threats represent a significant risk to companies, as they involve individuals within the organization who misuse their access to commit corporate fraud. These insiders may be motivated by financial gain, revenge, or coercion. Data breaches caused by insiders can be particularly damaging, as they often involve the unauthorized access and distribution of sensitive corporate information.

Insider threats can manifest in several ways:

- Data Theft: Employees with access to critical data, such as customer information or intellectual property, may steal and sell this information to competitors or use it for personal gain.

- Sabotage: Disgruntled employees may intentionally damage systems or data, causing operational disruptions and financial loss.

- Unauthorized Access: Insiders may abuse their access privileges to commit fraud, such as altering financial records or creating fake transactions.

Mitigating insider threats requires a combination of strong access controls, continuous monitoring, and a culture of security awareness within the organization.

Financial Fraud Through Cyber Attacks

Financial fraud is a significant concern for businesses, and cyber attacks have provided fraudsters with new tools to carry out these crimes. Cybercriminals can exploit vulnerabilities in a company’s financial systems to steal money, manipulate transactions, or gain unauthorized access to financial records.

Some common methods of financial fraud through cyber attacks include:

- Ransomware Attacks: Cybercriminals use ransomware to encrypt a company’s financial data, demanding payment for its release. This can cause severe financial and operational disruptions, especially if critical financial records are inaccessible.

- Business Email Compromise (BEC): In BEC attacks, fraudsters impersonate executives or vendors to trick employees into transferring funds to fraudulent accounts. These attacks are often highly sophisticated, involving detailed knowledge of the company’s internal processes.

- Payment Diversion: Hackers may intercept and alter payment instructions, redirecting funds to their accounts instead of the intended recipients. This form of corporate fraud can lead to substantial financial losses and damage relationships with suppliers and customers.

Protecting against financial fraud requires robust cybersecurity measures, including secure payment processing systems, multi-factor authentication, and regular financial audits.

and perform with SearchInform DLP:

Supply Chain Fraud and Cybersecurity Weaknesses

Supply chain fraud is another growing concern for businesses, particularly as supply chains become increasingly digital and interconnected. Cybersecurity weaknesses in the supply chain can be exploited by fraudsters to introduce counterfeit goods, manipulate orders, or divert shipments.

Supply chain fraud can occur in various forms:

- Counterfeit Products: Fraudsters may infiltrate the supply chain to introduce counterfeit goods, which can harm a company’s reputation and result in financial losses.

- Order Manipulation: Cybercriminals may gain access to ordering systems to manipulate orders, such as inflating quantities or redirecting shipments to unauthorized locations.

- Payment Fraud: Fraudsters may target the financial transactions within the supply chain, altering payment details to divert funds or create false invoices.

Addressing supply chain fraud requires a comprehensive approach to cybersecurity, including vetting suppliers, implementing secure communication channels, and conducting regular audits of supply chain processes.

Corporate fraud is a multifaceted threat that continues to evolve with advancements in technology. By understanding the various types of corporate fraud that exploit cybersecurity vulnerabilities, organizations can implement effective strategies to protect themselves and maintain their financial and operational integrity.

Impact of Corporate Fraud on Businesses

Corporate fraud is more than just a legal issue—it’s a threat that can have profound and far-reaching consequences for businesses. From financial devastation to the erosion of customer trust, the impact of corporate fraud can cripple a company's operations and long-term viability. Understanding these impacts is essential for businesses to develop effective strategies to safeguard their assets and reputation.

Financial Losses and Economic Impact

One of the most immediate and tangible effects of corporate fraud is the significant financial loss it can cause. Corporate fraud drains resources, disrupts cash flow, and can even lead to bankruptcy. For instance, when a company falls victim to embezzlement or financial statement fraud, the direct loss of funds is only the beginning. The economic impact often extends far beyond the initial fraud, leading to higher operational costs, reduced investment, and a potential decrease in shareholder value.

Moreover, the financial fallout from corporate fraud can ripple through the broader economy. Large-scale fraud cases, such as the Enron scandal, not only devastate the company involved but also have a chilling effect on market confidence. Investors may become wary, leading to a decrease in stock prices, higher borrowing costs, and a reluctance to invest in new ventures. The overall economic impact can be profound, affecting not just the fraudulent company but also its partners, employees, and the wider business community.

Reputational Damage and Customer Trust

Corporate fraud doesn't just empty the coffers; it also tarnishes a company’s reputation. Once a company is associated with fraud, it can be incredibly difficult to regain the trust of customers, partners, and the public. Reputational damage is often one of the most challenging aspects to recover from after a corporate fraud incident.

When customers lose trust in a company, they may choose to take their business elsewhere, leading to a loss in revenue and market share. In today's digital age, news of corporate fraud spreads rapidly, and the negative publicity can linger for years. This damage can be exacerbated if the fraud involved the mishandling of customer data or breaches of confidentiality, leading to a perception that the company cannot be trusted to protect its clients.

Additionally, the reputational impact of corporate fraud can lead to strained relationships with business partners and suppliers. Companies may find it difficult to form new alliances or maintain existing ones if they are perceived as high-risk. This erosion of trust can create a vicious cycle, where the inability to secure reliable partnerships further hampers a company’s ability to recover from the fraud.

Legal Consequences and Compliance Issues

The legal ramifications of corporate fraud can be severe, with companies facing hefty fines, sanctions, and even criminal charges. Regulatory bodies are increasingly vigilant in monitoring corporate activities, and when fraud is detected, the penalties can be crippling. Beyond financial penalties, companies involved in corporate fraud may be subjected to increased scrutiny, mandatory compliance programs, and ongoing monitoring by regulatory authorities.

Compliance issues also become a major concern in the aftermath of corporate fraud. Companies may be required to overhaul their internal controls and governance structures to prevent future incidents. This can involve significant investment in new technologies, processes, and training programs to ensure compliance with legal and regulatory standards. The costs associated with these measures can be substantial, further compounding the financial impact of the fraud.

Moreover, legal consequences are not limited to the organization itself. Executives and other individuals involved in corporate fraud may face personal liability, including criminal prosecution, fines, and imprisonment. The prospect of legal action adds an additional layer of risk for companies, as legal battles can be lengthy, costly, and damaging to a company’s reputation.

Corporate fraud is a multifaceted issue that can wreak havoc on a business in numerous ways. From the immediate financial losses to the long-term damage to reputation and the burden of legal consequences, the impact of corporate fraud is profound. Businesses must take proactive steps to prevent fraud, protect their assets, and maintain the trust of their stakeholders.

Cybersecurity Measures to Prevent Corporate Fraud

In the digital age, corporate fraud has become a sophisticated threat that demands equally sophisticated defenses. Cybersecurity plays a pivotal role in safeguarding organizations against the ever-evolving tactics of fraudsters. By implementing comprehensive cybersecurity measures, businesses can significantly reduce the risk of corporate fraud, protecting their financial assets and preserving their reputation.

Implementing Strong Authentication and Access Controls

One of the most effective ways to prevent corporate fraud is by ensuring that only authorized individuals have access to sensitive information and systems. Strong authentication mechanisms and access controls are fundamental in achieving this goal. These measures help to restrict access to critical resources, ensuring that only those with the necessary credentials can interact with sensitive data.

Multi-factor authentication (MFA) is a key component of strong authentication. MFA requires users to verify their identity through multiple methods, such as a password, a fingerprint, or a one-time code sent to a mobile device. This added layer of security makes it much more difficult for fraudsters to gain unauthorized access, even if they manage to obtain a user’s password.

Access controls should also be granular, meaning that users are granted the minimum level of access necessary to perform their job functions. By following the principle of least privilege, organizations can limit the potential damage that can occur if an account is compromised. Regular reviews and updates of access permissions are essential to maintaining security and preventing potential avenues for corporate fraud.

The Role of Encryption in Protecting Sensitive Data

Encryption is another critical cybersecurity measure that can greatly reduce the risk of corporate fraud. By converting sensitive data into an unreadable format, encryption ensures that even if information is intercepted, it cannot be easily accessed or used by unauthorized parties.

End-to-end encryption is particularly effective, as it protects data at all stages of transmission—from the point of origin to the final destination. This type of encryption is essential for safeguarding sensitive communications, financial transactions, and personal information from prying eyes.

Furthermore, encryption is not limited to data in transit; it should also be applied to data at rest. Encrypting stored data ensures that even if physical storage devices are stolen or compromised, the information they contain remains secure. In the context of corporate fraud, encryption acts as a formidable barrier, preventing fraudsters from exploiting intercepted or stolen data for malicious purposes.

Importance of Regular Security Audits and Assessments

To effectively prevent corporate fraud, organizations must maintain a proactive approach to cybersecurity. Regular security audits and assessments are crucial in identifying vulnerabilities and ensuring that security measures are functioning as intended. These audits help to uncover weaknesses in an organization’s defenses that could be exploited by fraudsters.

During a security audit, experts assess the organization’s infrastructure, policies, and procedures, identifying areas that require improvement. This may include outdated software, insufficient access controls, or unpatched vulnerabilities. Addressing these issues promptly can prevent potential breaches and reduce the risk of corporate fraud.

Additionally, penetration testing—a simulated cyber attack—can be a valuable tool in assessing the effectiveness of existing security measures. By attempting to exploit vulnerabilities in the same way a fraudster might, penetration testing provides a real-world evaluation of an organization’s defenses, highlighting areas that need strengthening.

Utilizing Artificial Intelligence and Machine Learning for Fraud Detection

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the way organizations detect and respond to corporate fraud. These advanced technologies have the ability to analyze vast amounts of data, identifying patterns and anomalies that may indicate fraudulent activity.

AI and ML can be used to monitor transactions in real time, flagging any unusual behavior for further investigation. For example, if a transaction deviates significantly from a user’s typical behavior, AI systems can trigger an alert, allowing the organization to take immediate action. This proactive approach helps to stop corporate fraud before it can cause significant damage.

Furthermore, AI and ML can continuously learn and adapt to new fraud tactics, making them invaluable tools in the fight against corporate fraud. As fraudsters develop new strategies, AI-powered systems can evolve to detect these emerging threats, providing a dynamic and responsive defense.

Preventing corporate fraud requires a multifaceted approach, leveraging strong authentication, encryption, regular audits, and advanced technologies like AI and ML. By implementing these cybersecurity measures, organizations can protect themselves from the growing threat of corporate fraud, ensuring the security of their assets and the trust of their stakeholders.

Future Trends in Corporate Fraud and Cybersecurity

As technology continues to advance, so do the tactics and strategies employed by fraudsters. The future of corporate fraud is poised to be shaped by emerging cyber threats, evolving regulations, and cutting-edge fraud prevention technologies. Businesses must stay ahead of these trends to protect themselves from the increasingly sophisticated threats that lie ahead.

Emerging Cyber Threats Targeting Corporations

In the coming years, the landscape of corporate fraud is expected to be dominated by new and evolving cyber threats. As digital transformation accelerates across industries, cybercriminals are likely to exploit the vulnerabilities that arise from the adoption of new technologies. One such threat is deepfake technology, which uses artificial intelligence to create convincing but fake audio and video content. Fraudsters could use deepfakes to impersonate executives, authorizing fraudulent transactions or leaking false information to manipulate stock prices.

Another emerging threat is ransomware-as-a-service (RaaS), where sophisticated ransomware tools are rented out to less technically skilled criminals. This democratization of cybercrime could lead to an increase in ransomware attacks targeting corporations, with potentially devastating consequences. These attacks not only disrupt business operations but can also result in the theft of sensitive data, which can be leveraged for corporate fraud.

Moreover, as businesses continue to adopt Internet of Things (IoT) devices, the potential attack surface for cybercriminals expands. IoT devices, often less secure than traditional IT infrastructure, can be exploited to gain access to corporate networks, leading to data breaches, espionage, and other forms of corporate fraud. The interconnectedness of IoT devices means that a breach in one area can quickly spread, compromising the entire network.

The Evolving Landscape of Cybersecurity Regulations

As corporate fraud becomes more sophisticated, regulatory bodies are increasingly focusing on strengthening cybersecurity standards to protect businesses and consumers. The future will likely see the introduction of more stringent regulations designed to combat corporate fraud by ensuring that companies implement robust cybersecurity measures.

One significant development in this area is the growing emphasis on data privacy regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have set new standards for how companies must protect personal data. As more regions adopt similar regulations, businesses will need to enhance their cybersecurity practices to avoid penalties and mitigate the risk of corporate fraud.

Additionally, regulatory bodies are likely to require greater transparency and accountability from corporations regarding their cybersecurity practices. This could include mandatory reporting of data breaches and other cyber incidents, as well as regular third-party audits to ensure compliance. The focus on accountability will drive companies to adopt more rigorous internal controls and governance frameworks, reducing the opportunities for corporate fraud.

Furthermore, the rise of cybersecurity certification standards is expected to play a crucial role in the future. Businesses that achieve these certifications will be able to demonstrate their commitment to cybersecurity, potentially gaining a competitive edge. However, failure to comply with evolving standards could result in reputational damage, legal penalties, and increased vulnerability to corporate fraud.

Predictions for the Future of Fraud Prevention Technologies

As corporate fraud evolves, so too must the technologies used to prevent it. The future of fraud prevention will be characterized by the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain, all of which offer promising solutions to the challenges posed by corporate fraud.

AI and ML will continue to revolutionize fraud detection by enabling businesses to analyze vast amounts of data in real-time. These technologies can identify patterns and anomalies that may indicate fraudulent activity, allowing companies to respond swiftly and effectively. As AI and ML algorithms become more sophisticated, they will be better equipped to predict and prevent emerging forms of corporate fraud, making them indispensable tools for businesses.

Blockchain technology is also expected to play a significant role in fraud prevention. The decentralized and immutable nature of blockchain makes it an ideal solution for securing transactions and verifying identities. By using blockchain, businesses can create transparent and tamper-proof records, reducing the risk of fraudulent activities such as identity theft and financial fraud. Moreover, blockchain can enhance supply chain security, ensuring that all transactions are authentic and traceable.

Another emerging trend is the use of biometric authentication to prevent unauthorized access to corporate systems. Biometric technologies, such as fingerprint scanning, facial recognition, and voice authentication, offer a higher level of security than traditional passwords. As these technologies become more widespread, they will help to prevent corporate fraud by making it more difficult for fraudsters to impersonate legitimate users.

Future of corporate fraud and cybersecurity will be shaped by emerging threats, evolving regulations, and innovative technologies. Businesses must stay vigilant and proactive in adopting the latest cybersecurity measures to protect themselves from the ever-changing landscape of corporate fraud. By embracing these trends, organizations can safeguard their assets, maintain their reputation, and ensure their long-term success in an increasingly digital world.

Protect your organization from the growing threat of corporate fraud by leveraging SearchInform's advanced cybersecurity solutions. Strengthen your defenses, monitor for potential risks, and ensure swift responses to safeguard your business's integrity and reputation. Take the next step in securing your company's future today.

Extend the range of addressed challenges with minimum effort

Company news

SearchInform uses four types of cookies as described below. You can decide which categories of cookies you wish to accept to improve your experience on our website. To learn more about the cookies we use on our site, please read our Cookie Policy.

Necessary Cookies

Always active. These cookies are essential to our website working effectively.

Cookies does not collect personal information. You can disable the cookie files

record

on the Internet Settings tab in your browser.

Functional Cookies

These cookies allow SearchInform to provide enhanced functionality and personalization, such as remembering the language you choose to interact with the website.

Performance Cookies

These cookies enable SearchInform to understand what information is the most valuable to you, so we can improve our services and website.

Third-party Cookies

These cookies are created by other resources to allow our website to embed content from other websites, for example, images, ads, and text.

Please enable Functional Cookies

You have disabled the Functional Cookies.

To complete the form and get in touch with us, you need to enable Functional Cookies.

Otherwise the form cannot be sent to us.

Subscribe to our newsletter and receive a bright and useful tutorial Explaining Information Security in 4 steps!

Subscribe to our newsletter and receive case studies in comics!